April 1, 2011 - Vietnam is a Paradise for Demographic Investors

Featured Trades:? (VNM)

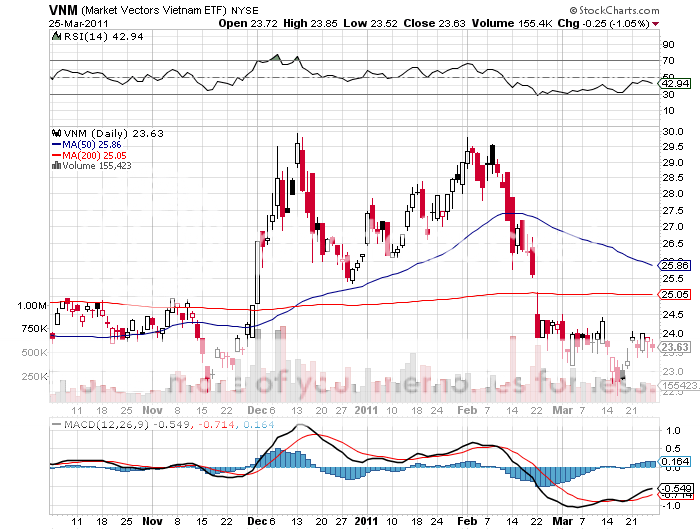

Market Vectors Vietnam ETF

4) Vietnam is a Paradise for Demographic Investors. Now that we have figured out that Vietnam is a great place to invest, take a look at the Van Eck Groups Vietnam Index Fund (VNM). The venture will invest in companies that get 50% or more of their earnings from that country, with an anticipated 37% exposure in finance, and 19% in energy. This will get you easily tradable exposure in the country where China does its offshoring.

Vietnam was one of the top performing stock markets in 2009. It was a real basket case in 2008, when zero growth and a 25% inflation rate took it down 78% from 1,160 to 250. This is definitely your E-ticket ride. Vietnam is a classic emerging market play with a turbocharger. It offers lower labor costs than China, a growing middle class, and has been the target of large scale foreign direct investment. General Electric (GE) recently built a wind turbine factory there. You always want to follow the big, smart money. Its new membership in the World Trade Organization is definitely going to be a help.

I still set off metal detectors and my scars itch at night when the weather is turning, thanks to my last encounter with the Vietnamese, so it is with some trepidation that I revisit this enigmatic country. Throw this one into the hopper of ten year long plays you only buy on big dips, and go there on a long vacation. If you are looking for a laggard emerging market that has not participated in this year's meteoric move up, this one fits the bill nicely. Their green shoots are real. But watch out for the old land mines.

-

Pass Me a 'BUY' Ticket Please