April 15, 2011 - Something is Bubbling in Natural Gas

Featured Trades: (NATURAL GAS), (UNG), (DVN), (CHK)

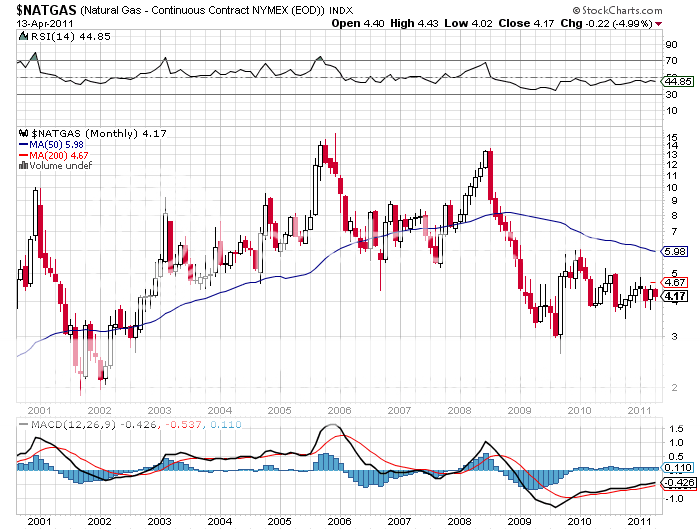

2) Something is Bubbling in Natural Gas. Today's surprise release of figures showing a shocking draw down in natural gas supplies throws a great spotlight on what has undoubtedly been the red headed step child of the energy space for the last three years. While oil prices have been soaring to near all-time highs, gas prices have plummeted from a high of $18 per million BTU's to as low as $2. Gas is now selling for one fifth of the cost of crude on an adjusted BTU basis.

You would think that people would be in love with natural gas already. This simple molecule, CH4, produces only half the greenhouse gas emissions of oil, and is easily available in large quantities in the US though a web of interstate pipelines. The byproducts of its combustion are only water and carbon dioxide, not the noxious sulfur and nitrous oxides that diesel fuel spews off. Half the electric power plants in California already burned the stuff. I was part of a team in college that built a car that ran on natural gas, and it was so cleaning burning that it didn't need a tune up for its first 100,000 miles.

The problem is one of simple supply and demand. Thanks to the new 'fracking' process, large swaths of the country once thought tapped out of oil and bearing coal of a grade considered too poor to mine have been found to be sitting on Saudi Arabia sized natural gas supplies. New horizontal drilling technologies have also been a big help. As a result, the US is now sitting on top of a giant 100 year supply of untapped natural gas, and there is probably a second century's worth there if people bothered to look. Areas of the world with similar geology, like Europe and China, can expect to find the same. These staggering discoveries have led to the greatest reassessment in global energy supplies in since the massive Saudi discoveries of the 1930's.

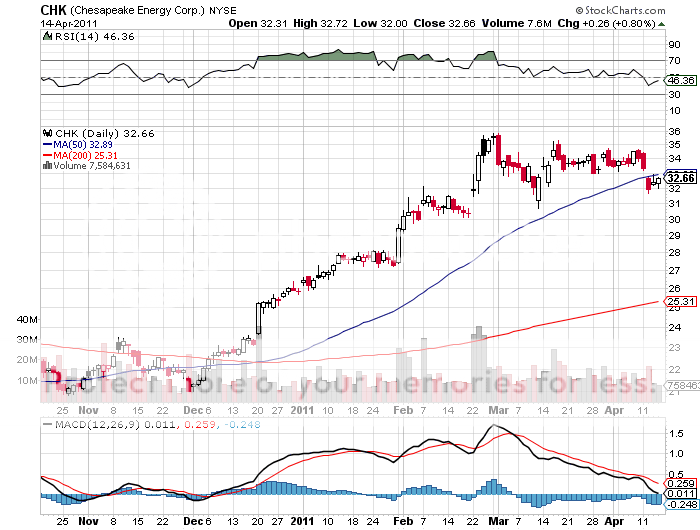

The problem is one of basic supply and demand. So much gas has been discovered so fast that the price collapse has decimated the existing industry. Storage facilities around the country are filled to capacity. Unlike crude, the excess can't be exported because there is no global market and very expensive liquefaction and re-liquifaction plants and specialized tankers are unavailable. Not only did industry leaders like Chesapeake Energy (CHK) have to fight off bankruptcy, a few major hedge funds, like Amaranth, blew up as well. While gas looks great on paper, it will require a $1 trillion investment and a decade of deregulation to create the infrastructure such enormous new supplies demand.

All of this may be about to change. After a Herculean three year, $100 million lobbying effort, legendary oil man T. Boone Pickens, an old friend of mine, is close to gaining passage in the House of HR 1830, which promises to greatly speed up the natural gas conversion process with a whole raft of government subsidies. At the top of the list are incentives to build a nationwide network of natural gas stations to fuel the nation's 18,000 heavy long distance trucks. Weaning these off oil with cut America's oil imports by 2 million barrels a day, the amount we currently bring in from the Middle East. That would save us the cost of the now three wars we are fighting there.

I smell a trade here, and not a scalp but a ten bagger, even though natural gas is odorless and colorless. For a start, to bring gas prices in line with oil at $110/barrel for Cushing, gas has to rise 500% to around $20/MBTU. There are large scale liquifaction plants now under construction or on the drawing board to deliver large scale gas exports to ever energy hungry China.

This is all happening when Japan's 40 year contracts to buy LNG from Asia, which are tied to high oil prices, are expiring, and the country's nuclear industry has been unexpectedly pushed into the back seat. This could enable the US to become a net energy exporter within a decade. Higher oil prices also make all alternatives, including gas, much more attractive.

The great question the entire energy industry is now grappling with is when supply and demand will come back into balance. No one knows. It could be as early as this summer or a few years off. The only certainty is that it is coming. When it does, every trader in the country will flip from selling rallies in gas to buying dips, for a long time.

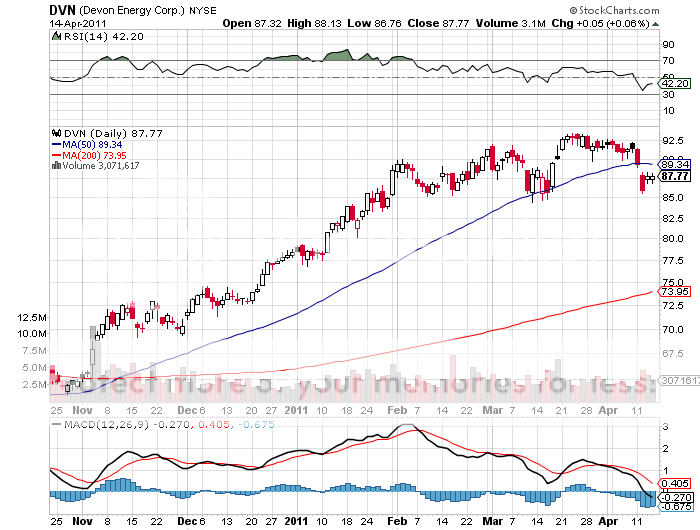

When the sea changes does come, whatever you do, don't rush out and buy the natural gas ETF (UNG), which thanks to a contango in the futures markets, has the worst tracking error in the industry. Instead, buy industry leaders like (CHK) and Devon Energy (DVN) and the pipeline companies. I'll keep you informed of more interesting gas plays as I come across them.

-

-

-

-

Natural Gas: The Worst May Be Over