Below please find subscribers’ Q&A for the April 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Key West, Florida.

Q: If Elon Musk died, would you sell Tesla (TSLA)?

A: Yes. A lot of Tesla’s success is because Elon Musk alone can push people to do the impossible, only because he’s the largest shareholder and therefore is in complete control of all of the dozen or so Tesla major operations. Certainly, nobody else would be crazy enough to invest in so many businesses at once, like SpaceX, like the storage business, SolarCity, Nueralink, and AI, and get away with it. But then, very few people are willing to work 24 hours/day, 7 days/week either. Musk is also the world’s greatest risk-taker with his own money. So Elon Musk is a large part of the Tesla added value; if you take him away, it just becomes another General Electric (GE) (or worse, General Motors (GM)).

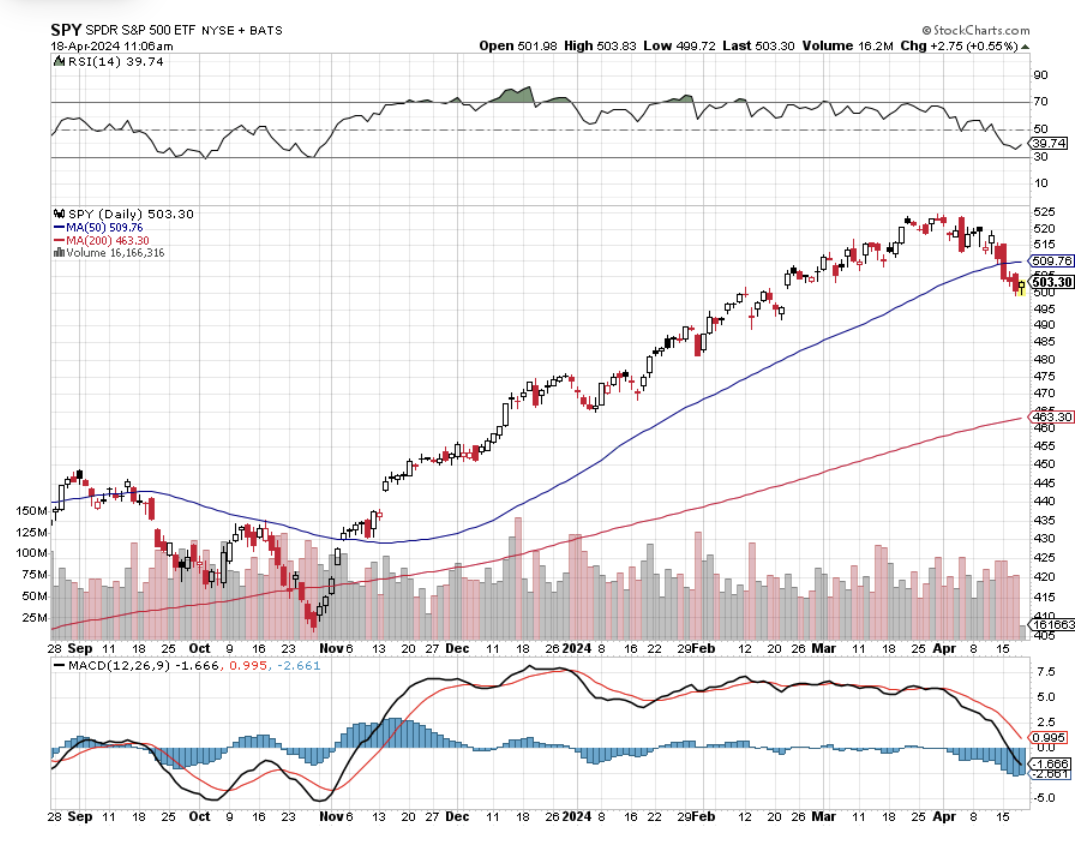

Q: Are geopolitical risks in the Middle East a threat to the stock market?

A: No. Several people commented in my Monday morning letter that I didn’t even mention the Middle East, and that’s because it has no market impact beyond a day. Nobody could care less. All we can do is feel sorry for all the civilians who are dying on both sides. In my lifetime, every geopolitical crisis has been a “BUY” in the stock markets, and in all risk assets. In the old days, it used to take them a month or two to figure it out, now it takes a few hours, so you just get one down day, everybody buys into that low, and markets continue up. Far more impact on the market these days is the inflation rate because that's what the Fed is looking at and they’re the ones who have their hands on the interest rate throttle. And even if inflation does stay where it is now, they’ll still have to eventually cut rates because otherwise the half of the economy that is dependent on interest rates will be destroyed. The other technology half doesn’t really care because they’re all positive cash flow, so they benefit from high interest rates.

Q: How do you select your spread prices?

A: I look at the bid-offer spread in the market, I send you a screenshot of that bid-offer spread, and then I move 5 or 10 cents off the bid side of the market. Normally, if you tighten the spread at the bid side, you will get filled on that order, and if you don’t, just leave it in there, and the second the market trends down you’ll get filled, or if you leave it the next day you’ll get filled. Remember that the second I put out a trade alert, algorithms take it up to the offered side of the market, but algorithms have to go 100% cash by the end of the day and dump all their positions, so if you leave an order in until the end of the day, often you get filled unless there’s been a major market move.

Q: Will gold continue higher?

A: Yes it will. For a start, it isn’t selling off with other risk assets in the recent correction. (GLD) only dropped $10 from an intra-day high of $225, and even though the Fed may not be cutting interest rates today, their next move will be a cut, even if that's in 3, 6, or 9 months. So, people are buying gold for that reason. Also, historically, it’s cheap relative to other asset classes such as stocks and bonds. On top of that, you have China and Russia buying record amounts of gold to bypass the Western financial system. They’ve done that for many years and it’s finally created a big short position on the market. Oh, and they’re not making gold anymore—the amount of gold being mined has been declining now a decade as the costs of mining gold rise.

Q: Why is inflation staying so high?

A: One of the reasons is that there were huge gaps in the supply/demand system due to COVID-19 still being addressed three years after the fact. That created price spikes and all kinds of unexpected consequences. Also, a lot of the government stimulus, or “COVID money,” hasn’t been spent yet; it’s still out there at the contract level and is still being committed. Even if you signed a contract two years ago, it can take two years to get a major construction project started with the planning, design, etc. Rule of thumb in dealing with all governments: everything happens slowly. All over the country, there are construction projects starting using the Federal stimulus money, so that also creates inflation when you have $3 trillion in new spending. That’s what your local traffic jam is all about. Here in Key West, they are rebuilding the Atlantic side waterfront, and that has to cost billions of dollars, far beyond what the locals could afford. But the major component of inflation, which is labor, is flatlining now. We are seeing a lot of one-time-only increases in pay going through, and then there won’t be any after that for a long time. Rising rents are a big problem now.

Q: Can you explain the market timing index?

A: The profit predictor updates itself every time we do a mouse click for all the different algorithms to kick in and generate a new number, and every piece of research we send out has an updated market timing index in it. So, if you get all of our services with Mad Hedge Hot Tips, the Global Trading Dispatch, the Trade Alerts, etc., we’re sending out at least ten updates a day for the market timing index. Suffice it to say, the more services you buy, the more updates you get on the market timing index.

Q: Will (USO) oil sell off on peace in the Middle East?

A: Well actually we’re seeing that today—we’re getting a selloff on the highs after Israel did not launch a tit-for-tat retaliation on the missile attacks from Iran. On the day they do, you will see prices go back up again. But the goal here is to dial back responses. The rule of thumb in defense for the US is: when somebody attacks you, you attack back with twice the force. That way you discourage any further retaliation from the enemy. That certainly is how our nuclear response is designed, and it’s pretty successful because only the US has the ability to execute unlimited increases in military response.

Q: Is Starlink a Tesla company?

A: Starlink is owned by SpaceX, which is an independent company owned by Elon Musk and several venture capitalists, but of course, Elon Musk is the largest shareholder. Space X is worth about $180 billion these days with several large government contracts. It’s why Elon Musk became a US citizen (foreigners are not allowed to launch our top-secret military satellites).

Q: How far-in-the-money do you go in your spread purchases?

A: It’s totally driven by the volatility of the individual stock. If you have a boring stock, you only go 5% in the money in order to earn enough money to make it worth it. If you have high volatility stocks like Tesla (TSLA) or Nvidia (NVDA) which both have options implied in the mid-40%s, you can get away with 20% in-the-money and still make a decent profit one month out. As you can tell, I tend to gravitate towards the highest volatility stocks in the market that are liquid.

Q: Will the 10% staff cut at Tesla hurt the stock?

A: Staff cuts mean bigger profits because you’re reducing the overhead by 10%. Staff cuts in almost every other technology company have been positive for the stocks for this reason. So I would say no, and Tesla has bigger problems than staff cuts like the nuclear winter going on in EV sales.

Q: Why won’t Nvidia (NVDA) go down?

A: Well, it’s because it has such a lead against all competitors. And, you know, in any other industry you’d just go hire the staff or buy the division in order to get it to hold in the market—you can’t do that with Nvidia because they’re all rich and have stock options priced at the $1 or $2 level to lock them in for life. The CEO Jensen Huang is now the sixth richest man in the world.

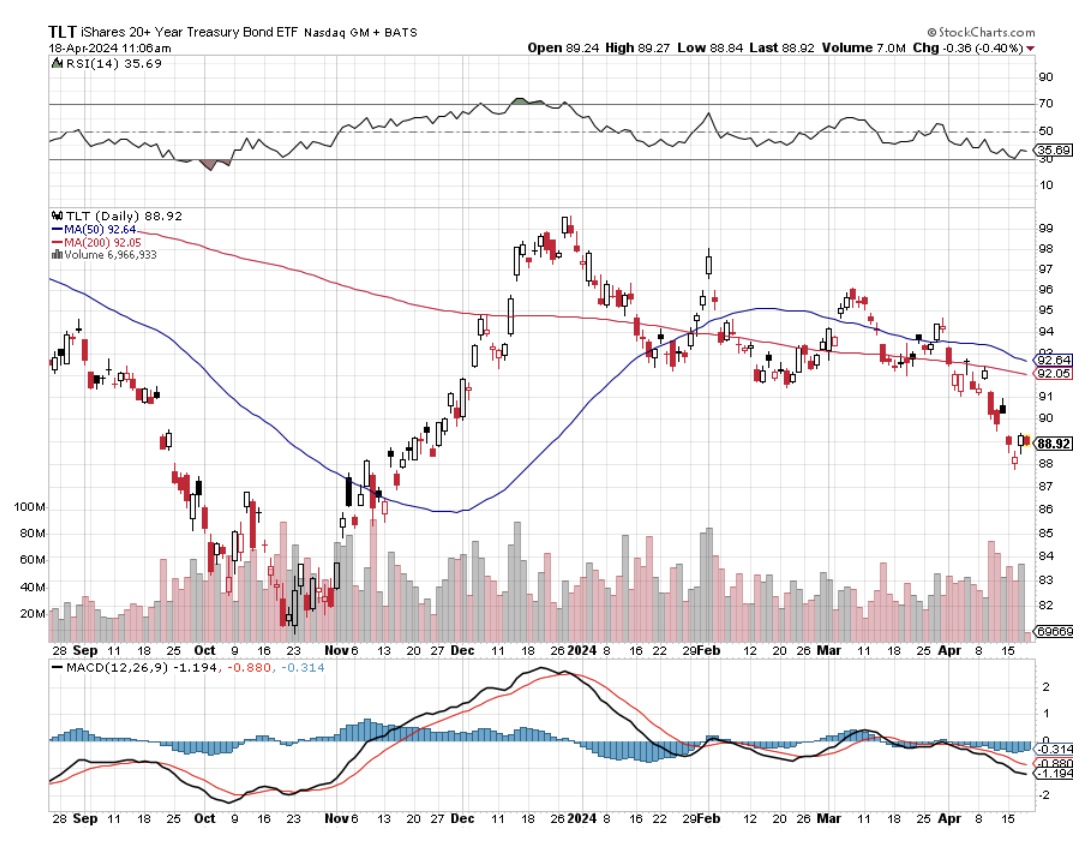

Q: Why have bonds failed to rally with the rest of the market?

A: Because the Fed isn’t cutting interest rates any time soon and bonds are dependent on the level of interest rates, which means they will rise once the Fed does cut.

Q: Should I buy Goldman Sachs Group (GS) on their great earnings report?

A: Yes, trading volumes look good for the rest of the year and that is how brokerage houses make their crust of bread. Buy Morgan Stanley (MS) too. It’s a better quality company with less dependence on trading revenues and more on fee income. After all, they hired me!

Q: Should I buy Cathie Woods’s Ark Innovation ETF (ARKK) fund here?

A: Absolutely not. Highly leveraged funds and the most leveraged stocks are the last thing you buy on market tops. That is a market bottom play, and the last real market bottom we had was in October.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2024 Key West Thinking of the Next Trade Alert