April 19, 2011 - What Relative Sector Performance is Trying to Tell Us

Featured Trades: (WHAT RELATIVE SECTOR PERFORMANCE IS TRYING TO TELL US),

(XLF), (XLK), (XLV), (XLP), (AAPL), (SWY), (KFT)

3) What Relative Sector Performance is Trying to Tell Us. Get ready to reach for that barf bag in the seat pocket in front of you. The relative performance of industrial sectors in the S&P 500 is shouting 'Mayday, Mayday, Mayday!'

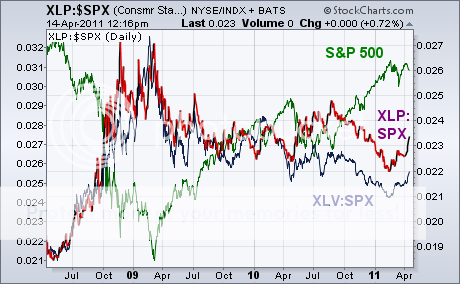

During times of market strength, financials (XLF) and technology stocks (XLK) outperform on the upside. This is because during healthy stock markets, investors are happy to increase their trading volumes and use the profits to buy new IPods, Mac Books, and Xbox 360's. During weak markets, investors flee to the imagined safety of consumer staples (XLP) and health care stocks (XLV). After all, regardless of market conditions, people still get sick and need to eat and take a bath.

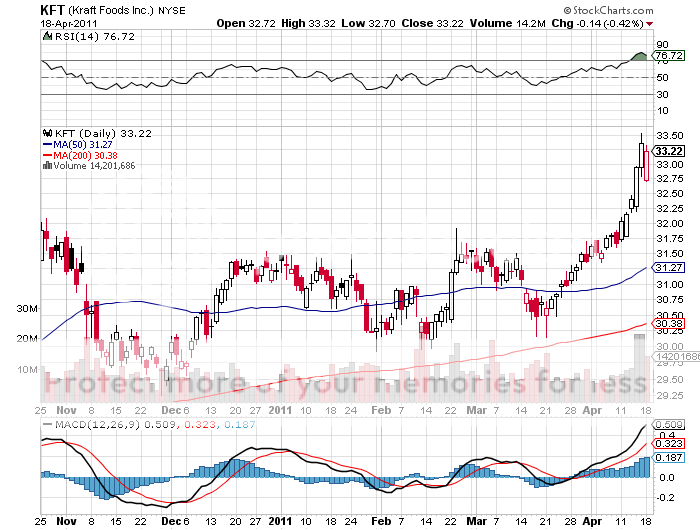

Take a look at the revealing charts below provided by my friends at www.StockCharts.com. Defensive sectors started a definite upturn from the beginning of April, while leading sectors have moved into the dog house. You can clearly see this in the individual stock charts for Kraft (KFT), Safeway (SWY), and Apple (AAPL).

These charts suggest that the love fest we have been partaking in for the past seven months are about to end, and that troubled times are at hand. Did I hear someone say 'Sell in May and Go Away?'

-

-

-

-

You Are About to Experience Some Moderate Turbulence