April 28, 2023

(THE U.S. IS FACING AN INCREASING STAGFLATION THREAT)

April 28, 2023

Hello everyone,

Stagflation could be knocking on your door for quite a lengthy visit soon. Thursday’s gross domestic product reading for the first quarter showed lackluster economic growth and high inflation.

First quarter growth came in at a 1.1% annualized pace, much slower than the 2% growth expected by economists polled by Dow Jones. Data inside the report showed the personal consumption expenditures price index, an inflation measure that the Federal Reserve closely follows, increased by 4.2%, higher than estimates.

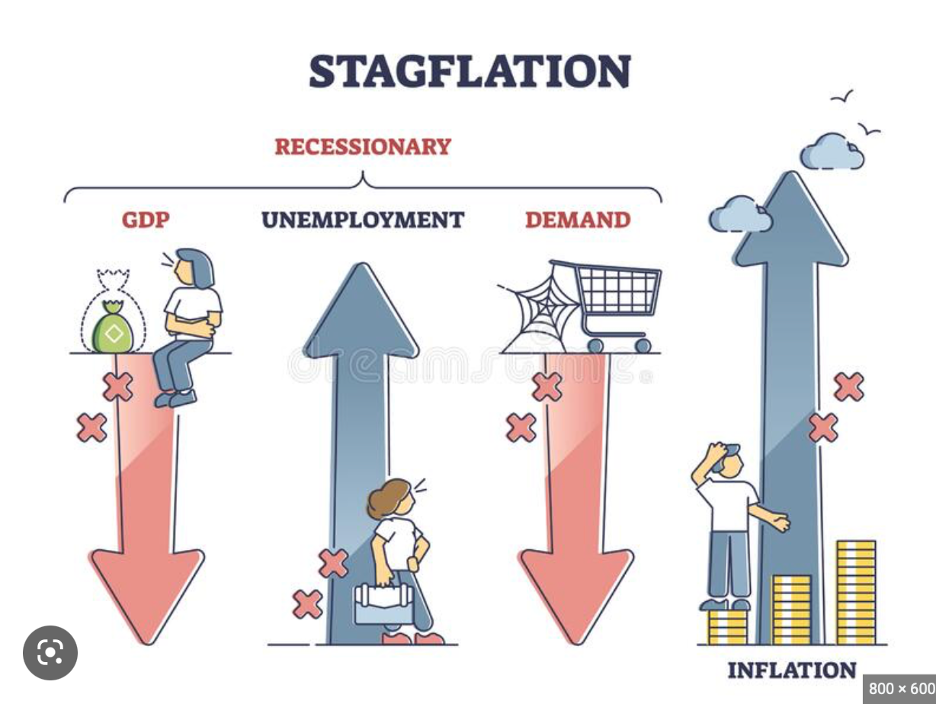

So, you might be scratching your head, wondering what Stagflation is.

Let me enlighten you.

Stagflation is an economic condition the U.S. experienced in the 1070s, characterized by slow economic growth and elevated inflation, along with high unemployment. The one ingredient missing today is the high unemployment, but mounting layoffs are raising fears that will change soon too. Cases in point, Lyft has just announced it will lay off 26% of its workforce and Dropbox also has announced it will lay off 16% of its workforce.

With most economists expecting the economic picture to darken further in the second half, what can you do as an investor?

It’s reasonable to assume that certain stocks with pricing power and resilient revenue sources could outperform in this kind of environment.

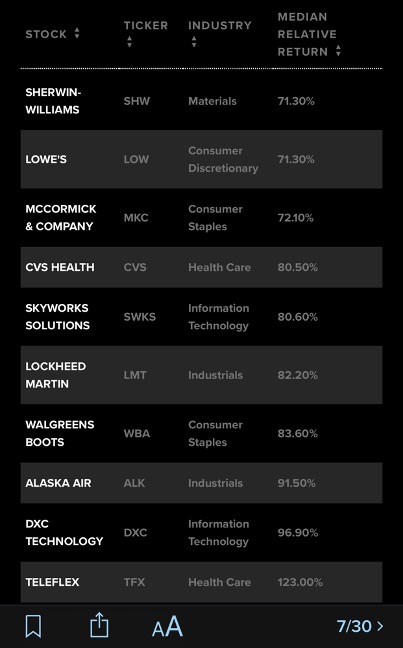

Bank of America ran a screen earlier this year to find stagflation beneficiaries. The firm looked for S&P 500 companies with the best relative performance during periods of “below-trend growth with above-trend but decelerating inflation, an environment that we will likely be in this year.”

Here are the top 10 stocks from that screen of the past 50 years.

STAGFLATION SCREEN

On that cheery note, I will wish you all a wonderful weekend.

Cheers,

Jacque