April 29, 2024

(WHAT WILL KEEP THE AMERICAN ECONOMY HUMMING ALONG IN 2024?)

April 29, 2024

Hello everyone.

Welcome to an eventful week.

Week ahead calendar

Monday, April 29

10:30 a.m. Dallas Fed Index (April)

Germany Inflation Rate

Previous: 2.2%

Time: 8:00 a.m. ET

Earnings: Paramount Global, ON Semiconductor, Domino’s Pizza

Tuesday, April 30

9 a.m. FHFA Home Price Index (February)

9 a.m. S&P/Case-Shiller comp. 20 HPI (February)

9:45 a.m. Chicago PMI (April)

10 a.m. Consumer Confidence (April)

Euro Area Inflation Rate

Previous: 2.4%

Time: 5:00a.m. ET

Earnings: Prudential Financial, Clorox, Advanced Micro Devices, Amazon, Super Micro Computer, Starbucks, Public Storage, Diamondback Energy, Extra Space Storage, Caesars Entertainment, Corning, McDonalds, Archer-Daniels-Midland, Molson Coors Beverage, Coco-Cola, Marathon Petroleum, 3M, Eli Lilly, GE Healthcare Technologies, PayPal.

Wednesday, May 1

8:15 a.m. ADP Employment Survey (April)

9:45 a.m. S&P Global Manufacturing (Final) (April)

10 a.m. ISM Manufacturing (April)

10 a.m. JOLTS Job Openings (March)

2:00 p.m. FOMC Meeting

Previous: 5.5%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: Marathon Oil, MGM Resorts International, Allstate, Etsy, eBay, Qualcomm, MetLife, First Solar, Devon Energy, Albemarle, Norwegian Cruise Line Holdings, Yum! Brands, Marriott International, Kraft Heinz, Pfizer, Estee Lauder Companies, CVS Health, Generac, Mastercard

Thursday, May 2

8:30 a.m. Continuing Jobless Claims (04/20)

8:30 a.m. Initial Claims (04/27)

8:30 a.m. Unit Labour Costs preliminary (Q1)

8:30 a.m. Productivity preliminary (Q1)

8:30 a.m. Trade Balance (March)

10 a.m. Durable Orders final (March)

10 a.m. Factory Orders (March)

Switzerland Inflation Rate

Previous: 1.0%

Time: 2:30 a.m. ET

Earnings: Apple, Live Nation Entertainment, Fortinet, Booking Holdings, Pioneer Natural Resources, Motorola Solutions, Ingersoll Rand, Expedia Group, EOG Resources, Coterra Energy, Dominion Energy, Howmet Aerospace, ConocoPhillips, Moderna, Stanley Black and Decker.

Friday, May 3

8:30 a.m. April Jobs Report

Previous: 303k

Expected: 250k

9:45 a.m. PMI Composite final (April)

9:45 a.m. Markit PMI Services final (April)

10 a.m. ISM Services PMI (April)

Earnings: Hershey

The Fed is set to convene for their third meeting of the year this Wednesday with market consensus anticipating no adjustments in interest rates this month. Amid increasing signs of an economic slowdown paired with sticky inflation, the focus will pivot if Fed Chair Powell intends to adjust their interest rate outlook.

Meanwhile, it’s become a guessing game as to when the Fed might be likely to deliver the first rate cut. September has now come in at good odds as the first likely date, but there has now been a noticeable uptick in the probability (19.6%) of interest rates remaining at 5.25 – 5.5 % throughout 2024.

The latest U.S. jobs market report will be released on Friday.

Additionally, it will be a mega-packed week of earnings reports.

Despite a challenging economic backdrop, the American economy is showing remarkable strength, thus far. But, as the effect of higher rates become fully felt throughout the economy, it would not be surprising to see growth cooling. Above-target inflation and fears of slower growth can lead to stagflation – which no-one wants to see. However, America seems to be equipped with elements that are mitigating the effect of higher rates and helping the economy steer clear of a contraction.

Jose Rasco, chief investment officer of the Americas at HSBC’s wealth division, sees four themes which will insulate the U.S. economy from a downturn. Firstly, he sees growth staying above 1.7% and the unemployment rate pushing moderately higher.

Advancement in technologies is curbing inflation.

Rasco argues that technological disruptions have historically put downward pressure on prices given the potential to streamline inefficiencies and cut back on labour. (We can see this well illustrated in many companies adopting blockchain technology, which cuts out intermediaries, increases efficiency and cuts cost). This can help the path of inflation as the Fed struggles to return price growth to no more than 2%, the central’s banks preferred rate.

Technological health care innovation

Advancements in technology are boosting patient care and health administration. Revolutionary technologies are providing more options for surgery that provide better outcomes and can be cheaper. As I have already pointed out above the use of blockchain can reduce costs as it cuts out the middleman and this is particularly applicable to both billing and insurance costs in the health sector.

On-shoring

Moving production back to or closer to the U.S. spells good news as it is bringing money and investment to the U.S. and to Mexico.

Re-industrialization of the U.S.

A record amount is being spent on research and development in the U.S. Coupled with legislation such as the CHIPS Act, it is not hard to see that an industrial boom is taking place which can boost the entire U.S. economy. Many American companies are spending large amounts investing in technology to become more productive and profitable.

Presidential Election Year

U.S. stocks tend to outperform in presidential election years. As far back as 1926, BlackRock found an average gain of 11.6% in election years, or 1.3 points better than the average 10.3% return in all years.

Rasco notes that HSBC Asset Management oversaw $707 billion in client assets as of the end of 2023.

Brief Market Update

S&P 500 is undergoing a 4th wave correction. Whilst resistance around 5125/5150 contains strength, there is risk of a final sell -off toward the low/mid 4800’s before the uptrend is ready to resume.

Brent Crude is still expected to rally towards $100 over the short to medium term.

Bitcoin chart formation cautions the eventual formation of a Head and Shoulders reversal pattern. From an Elliott Wave perspective this could mean that Bitcoin will correct back to the prior span of support (4th wave) which sits around $49,000 - $38,000.

Resistance $65 - $67,000.

Gold is undergoing a correction and may fall towards $2,260 area before the uptrend resumes.

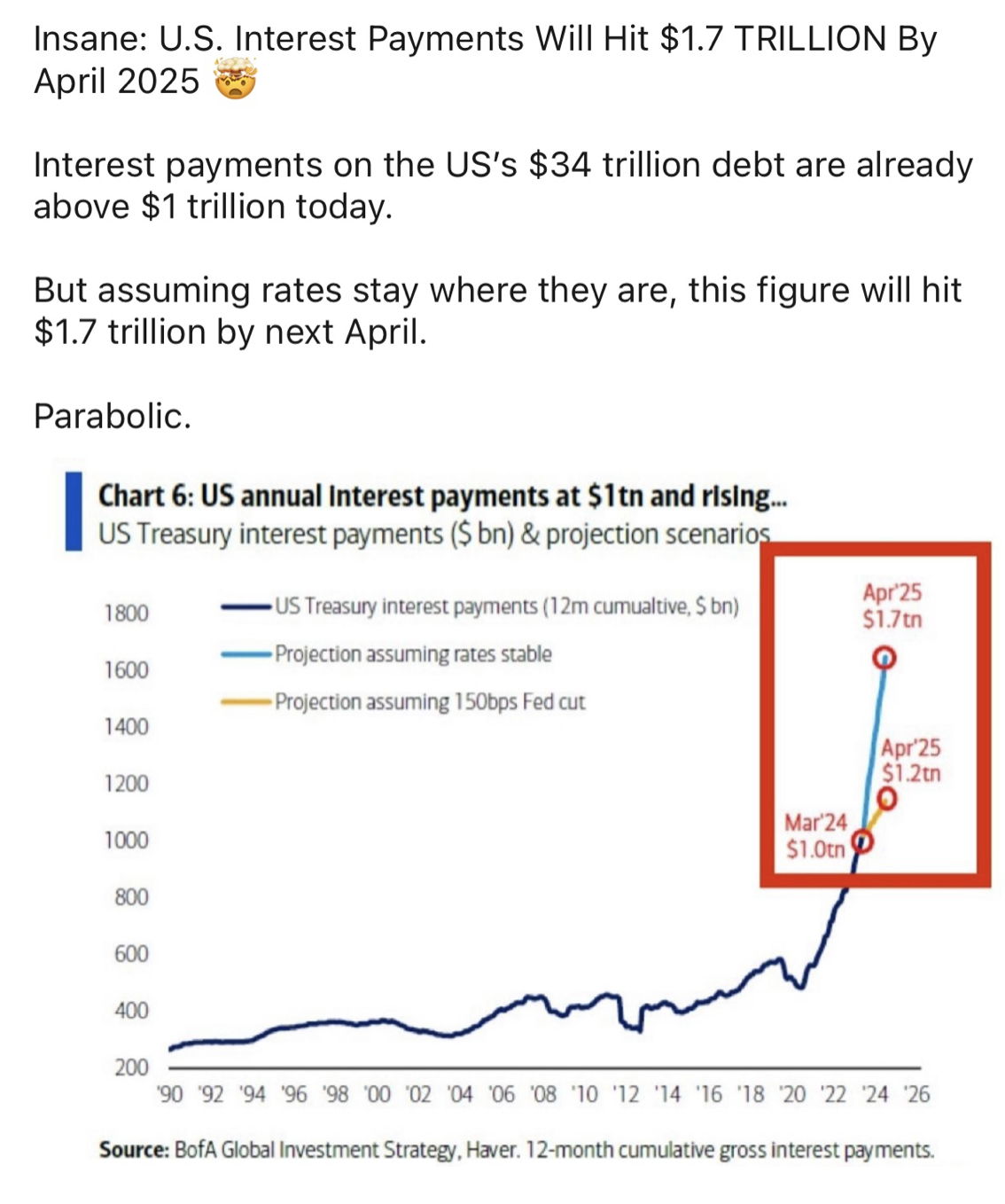

QI Corner (or should I say QA – quite alarming?)

Cheers

Jacquie