August 10, 2010 - The Best Trade of the Year

(SPECIAL FOOD ISSUE)

Featured Trades: (CORN), (WHEAT), (SOYBEANS),

(POT), (MOS), (AGU)

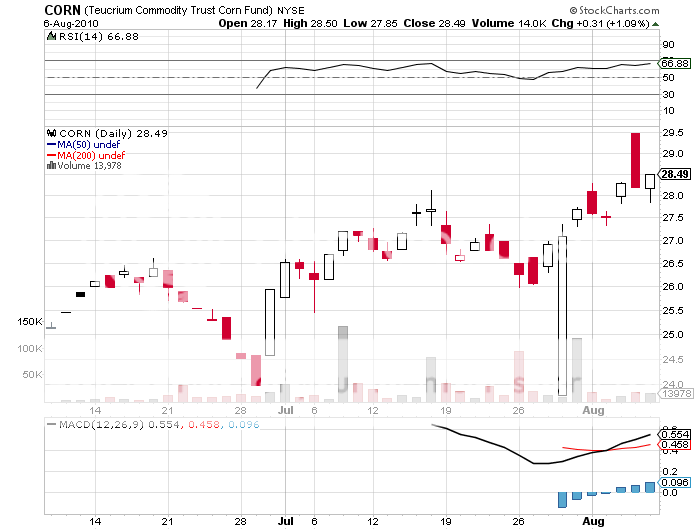

Teucrium Agricultural Trust Corn Fund

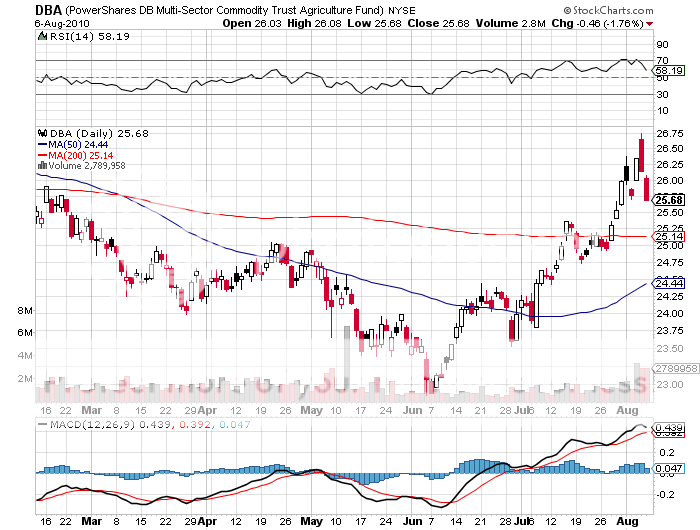

PowerShares DB Multisector Commodity Trust Agriculture ETF

1) My Best Trade of the Year. I was having a good 2010 until the grain trade came along. Now I'm have a fabulous year. Since my initial call to buy on June 24 (click here for the piece), soybean meal has risen by 15%, Corn (CORN) has jumped by 25%, and wheat has rocketed by a mind boggling 100%. The fertilizer stocks of Potash (POT), Mosaic (MOS), and Agrium (AGU) have done just as well. Even the sleepy ag ETF (DBA) has done great. Believe me, I have paid my dues in this market I probably put out more data on agricultural products than a macro newsletter, with the obvious exception of Dennis Gartman's heroic effort in The Gartman Letter. I'm sure that most of this work goes for naught, as these commodities are so far off the radar, that most readers quickly skip over it in search of the truly juicy stuff. After all, wheat does not have a PE multiple, a book value, or pay a dividend. But there are times when ags work and nothing else does. Finally, all those hours speaking to Agricultural Coop mangers in Kansas, analyzing weather models, and visits the docks in Benicia to check on grain loadings to China have paid off. The futures give you great leverage, and as we have seen in recent weeks, truckloads of volatility. A tip off from an ex-KGB friend in Russia that conditions were far worse than the media and the trade rags were hinting at also helped (click here for the piece). The truly amazing thing about this year is that domestic grain traders, seeing nothing but rows of corn, wheat, and soybeans at home as far as the eye could see, were caught totally flat-footed. Much of the buying that took us limit up in wheat the last few days was panicked short covering by desperate locals. This crop disaster was totally foreign in its original. I first spotted trouble with the canola crop in Canada. It then rippled from there to Australia, Western China, the Ukraine, and then to Russia, big time. My strategy is the same every year. Just wait for the market to price in perfection, buy it, and wait for the weather to turn bad, which it inevitably does. Who are the big winners in this mess? Not you or me, but American farmers, who stand to make a bundle selling to a starving world at prices double from when they planted. Oh, and by the way, I stopped out of my wheat on Friday, August 6th. A double is better than a poke in the eye with a sharp stick, especially when returns everywhere else are so miniscule. And, as any farmer will tell you, pigs get slaughtered.