August 11, 2009

Global Market Comments

August 11, 2009

Featured Trades: (NATURAL GAS), (UNG), (BYD)

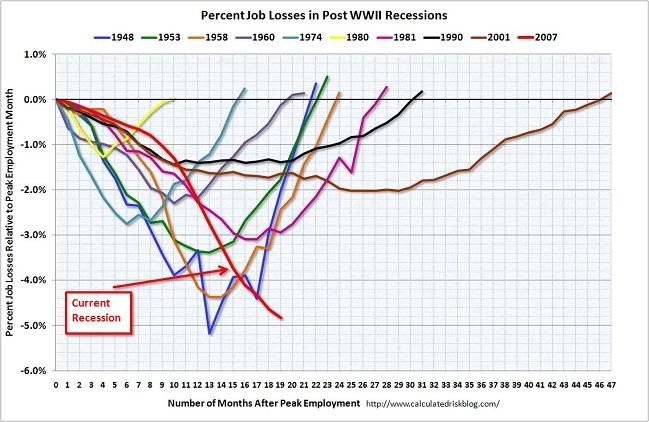

1) Welcome to the ?square root? shaped recovery. That is the likely shape of the recovery curve we can expect over the coming years. If you back out what I call the ?2000?s fluff? of excess car production, liar loans, using the home ATM for serial, annual refinancings, excess consumption, unneeded home construction to account for the new frugality, US GDP growth drops by 1%. Chop off another 1% for deleveraging in all its forms, including lower leverage ratios, the end of the collaterized debt markets and credit default swaps, ultra high junk yields, bond ratings for sale, and the new conservatism of CFO?s and auditors. That leaves you with the 1% growth rate that Japan has seen for the last 20 years. That means falling standard of livings, an unemployment rate permanently stuck at German style double digits, endemic deflation, a collapsing dollar, a comatose real estate market, and moribund stock markets. Where are the 37 million jobs going to come from that American needs over the next decade? If your kid is going to graduate from college soon, or cash out from the army, he better start learning Mandarin.

3% Average US GDP growth rate 2002-2007

-1% Bank deleveraging

-1% 2000?s fluff-liar loans, excess home construction, excess car production

-1% real GDP growth 2010-2020

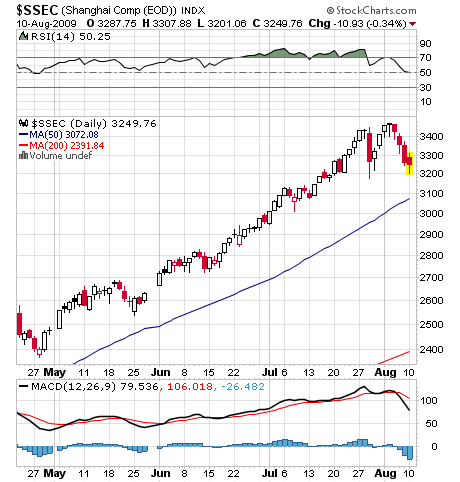

2) Car sales are soaring by 48% to a 12 million unit annual rate. Consumer spending is exploding. Property is going crazy, with prices and volumes back to all time highs. The bubble is back. No, I?m not talking about the US, dummy, it?s China. I?m amazed that the Middle Kingdom?s?? car sales have exceed those of the US for the first time in history without a peep from the press, a feat that Germany and Japan were never able to pull off. It just shows how much time we are wasting gazing at our own navel. Too bad they don?t have enough roads to drive them on. The big question is how long until China take over the world market? See my earlier piece on BYD Motors here. That?s what happens when your stimulus package gets spent on stimulus, and not on a 12 year backlog of pork.

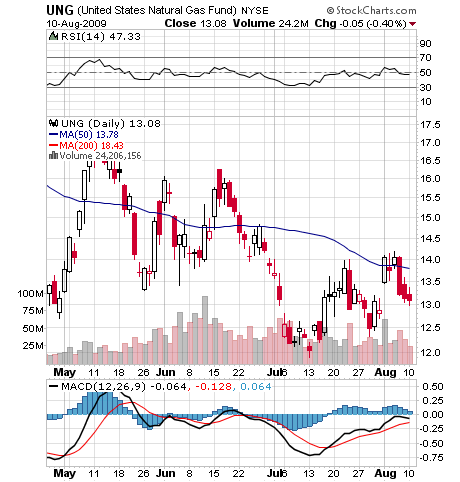

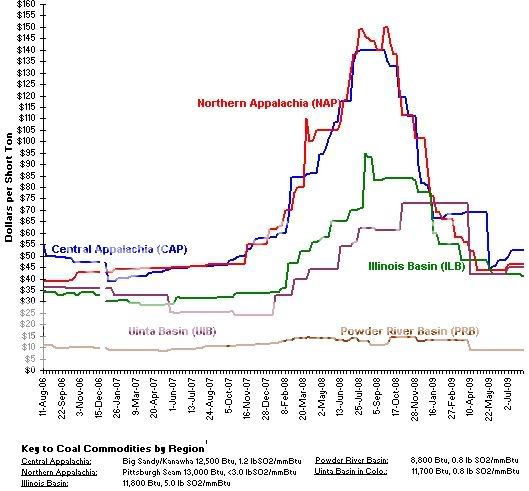

3) I ran some numbers today and came to the staggering conclusion that at $3.60/BTU, natural gas is now cheaper than coal in some markets. One ton of high grade Pennsylvania anthracite costs $65/ton. Some 18 million BTU?s of natural gas, the energy equivalent, costs $66, and doesn?t give you black lung, asthma, lung cancer, polluted air, and mountains of ash. The BTU equivalent of crude comes in at $210, and high test gasoline at an extortionate $420. The crude/NG ratio is at 19:1, an all time high, and an entire generation of ratio traders has been wiped out. It?s just another one of those six standard deviation events which seem to be happening constantly. And like a rubbernecker driving past a gory accident where the human organs?? are draped over the detailing, I am always interested in wipe outs. Yes, I saw the movie Crash. Don?t ask. Why aren?t the power companies jumping in and burning gas instead of coal? There is the minor issue in that the industry needs $500 billion and ten years to build the plants to take advantage of the enormous new supply. So only frenetic production cuts will support the price until then, which are accelerating as you read this. Or a major hurricane.?? Better keep UNG on your screen and buy the next wash out.

4) The US Postal Service, the largest civilian government employer in the country, is getting flayed by a pack of feral dogs. After cutting $6 billion in costs this year by shortening hours, layoffs, and closing branches, it still looks to lose $7 billion. The General Accounting Office says that first class mail volumes have had their greatest fall since the Great Depression I, dropping by half,?? and few send out junk mail in a recession. Next on the chopping block is Saturday deliveries to save another $3 billion. Naysayers argue that hard times for the service is proof the government can?t manage anything, including health care. Hellooooo! Have these people heard of e-mail? If the Boston Globe, the Rocky Mountain News, and the San Francisco Chronicle are getting gutted by the Internet, why not the post office? My investment advice? Load up on nondenominated first class postage stamps, which have already increased in value from 42 to 44 cents since December, a gain of 5%. The last time I checked, it cost $8.25 to send a letter via Fedex. Postage rates are going up large.

QUOTE OF THE DAY

?Without exception, no one I know is long term bullish,? said Michael Steinhart, one of the founders of the hedge fund industry, and an early backer of the Wisdom Tree family of ETF?s.