August 12, 2010 - Time for Platinum to Play Catch Up

Featured Trades: (PLATINUM), (PPLT)

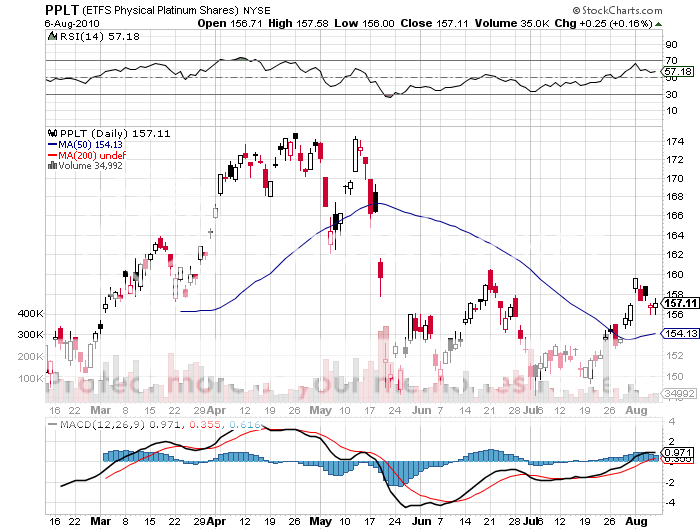

ETFS Physical Platinum ETF

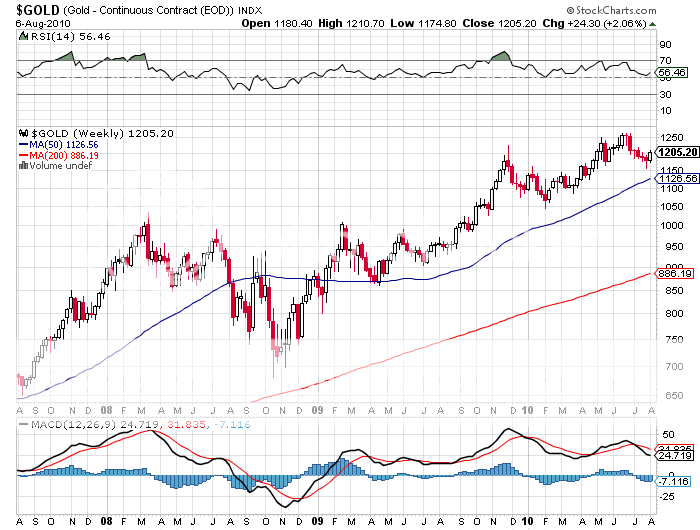

2) Time for Platinum to Play Catch Up. Since you've recently been romancing gold, you should check out platinum, her younger, racier, and better looking sister, who wears the low riders. The white metal historically has more volatility than gold, but this year has risen by only 6.2%, compared to a 9.5% gain for the barbaric relic. No doubt the 'double dip' threat to the economy is having an impact.

While gold is just shy of its all time high, Pt has to rise a further 50% from here just to match its 2008 high of $2,200, suggesting that some catch up play is in order. I have always been puzzled by the fact that platinum is 30 times more rare than gold, but at $1,572 an ounce, trades at a mere 30.4% premium to the barbaric metal. And unlike gold, platinum has actual uses.

You have to refine a staggering 10 tons of ore to come up with a single ounce of platinum. The bulk of the world's 210 tons in annual production comes from only four large mines, 80% of it in South Africa, and another 10% in the old Soviet Union. All of these mines peaked in the seventies and eighties, and have been on a downward slide since then.

That overdependence could lead to sudden and dramatic price spikes if any of these are taken out by unexpected floods, strikes, or political unrest. While no gold is consumed, 50% of platinum production is soaked up by industrial demand, mostly by the auto industry for catalytic converters. Recently, no lesser authority than Jim Lentz, the CEO of Toyota Motors Sales, USA, told me he expects the American car market to recover from the current 12 million units to 15-16 million units by 2015. That's a lot of catalytic converters. That assumes that 14.5 million cars a year are scrapped, requiring almost no new net demand. Surprises will be to the upside.

Jewelry demand for platinum, 95% of which comes from Japan, is also strong, as the global pandemic of gold fever spreads to other precious metals. You can trade Platinum futures on the New York Mercantile Exchange, where a margin requirement of only $6,075 for one contract gets you exposure to 50 ounces of platinum worth $78,600, giving you 12:1 leverage. For those who like to get physical, the US mint issued Platinum eagles from 1997-2008 in nominal denominations of $100 (one ounce), $50 (? ounce), $25 (1/4 ounce) and $10 (1/10th ounce) denominations. Stock traders should look at the ETF (PPLT).