August 12, 2011 - Jobless Claims Send Bears Fleeing

Featured Trades: (JOBLESS CLAIMS SEND BEARS FLEEING)

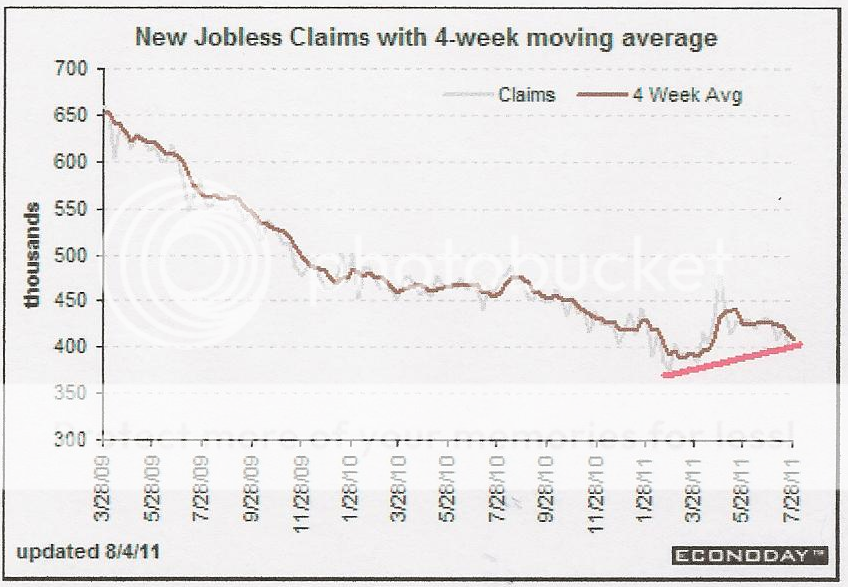

1) Jobless Claims Send Bears Fleeing. The single most important coincident indicator you can follow, the weekly jobless claims, showed a modest improvement, sending bears fleeing.

The figures released at 8:30 am EST every Thursday had claims fall by 7,000 to 395,000. This is the third consecutive week that claims have been at or below the crucial 400,000 level. The four week moving average moved down by 3,250.

The data reflects new hiring by the auto industry, which now seems on tracks to reach a healthy 13.5 million units this calendar year. The rapid recovery in Japan is also having a positive pull on the numbers. It is further evidence that the world economy is better than the stock market is indicating. The daily 600 point swings are starting to look more like a market 'accident' than an indicator of the future earning power of US corporations.

The improving trend is likely to spur some portfolio managers to move off the bench where they have been frozen in dropped jaw amazement and into 'BUY' mode. Interest rates are now pegged at zero for two more years, the year Treasury bond yield is hovering above 2.0%, and PE Multiples have just crashed from 15 to 11, the bottom of a multiyear range. At the worst of the 2008-2009 crash, earnings multiples spent only a few nanoseconds at the 9 level. Not to do so requires them to take all of their time-tested investment models and toss them out the window.

-

There Goes My Model