August 14, 2009

Global Market Comments

August 14, 2009

Featured Trades: (GG), (GOLD), (BRAZIL), ($BVSP), (EWZ)

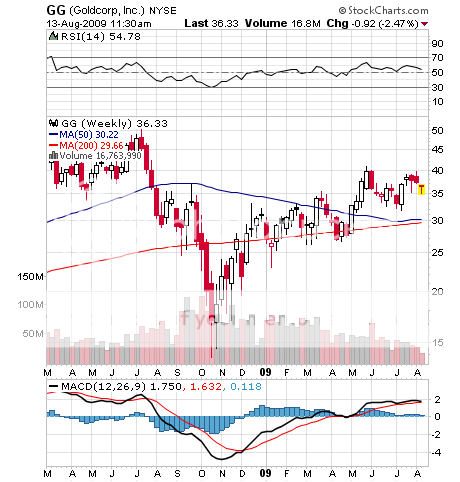

1) Charles Jeannes, CEO of Goldcorp (GG) (visit their website ) sees an all time high for the yellow metal of $1,050 by the end of the year. His Canadian company is the world's leading low cost, unhedged producer of the barbaric relic, with major assets in Guatemala, Honduras, Mexico, and Argentina. Gold production has been dropping steadily for the past five years, and this will accelerate, as there are few attractive ore deposits in the world to develop. South African production has fallen off a cliff. With the US government expected to continue flooding the financial system with debt for many more years, the universe of buyers looking for an inflation hedge is growing relentlessly. We are just entering a seasonally strong part of the year for gold demand, with the beginning of the Indian wedding season and the run up in jewelry buying for Christmas presents (GUILTY). India is the world's largest gold importer. Rising standards of living in emerging markets are also providing a long term structural increase in demand. With an average production cost of $299/ounce, the outlook for GG looks particularly golden.

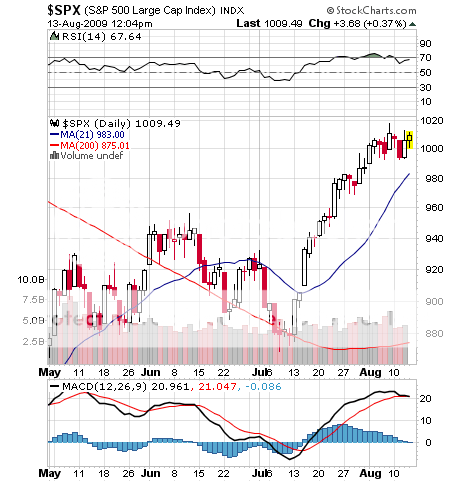

2) Has the 21 day moving average become the new 50 day moving average? With hedge funds and day traders so dominating markets, accounting for 70% of trading volumes, the world's time frame for investment decisions is shortening dramatically. It has essentially been shrunk to fit their monthly P & L's like a cheap cotton shirt. This is why we are seeing spectacular volatility at the beginning and end of each month on a settlement basis, overshadowing the once violent mid month options expirations. It also sheds some light on why there have been no significant pullbacks in the ferocious July stock market rally. It's all been a dream come true for volatility sellers and outright put sellers. The current S&P 500 21 day moving average support kicks in at 882. We'll see how real this theory is when that test happens, which I believe will be fairly soon.

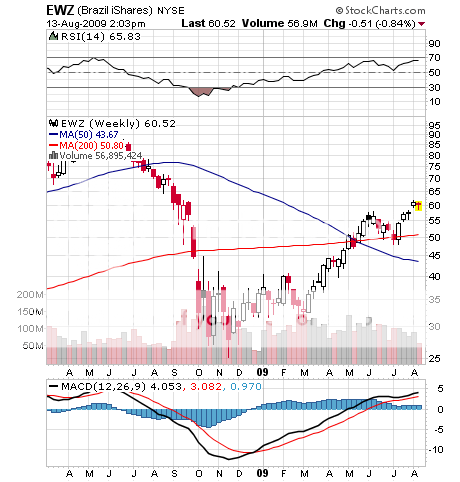

3) Analysts having been paring back their negative forecasts for the Brazilian economy faster than a salsa dancer stoked with triple espressos, taking expected 2009 GDP growth from -2.5% to as high as 5% in?? mere four months. When last year's commodity collapse knocked the stuffing out of the country's exports, many feared a return to the serial crisis that plagued the home of the string bikini and the banana thong during the eighties and nineties. Remember all those sovereign debt defaults? Remember the generals? What a bunch a incompetents! Just because you can run a platoon doesn't mean you can run a country. There is a lot more than just a commodity bounce going on here. Their banking system is now conservative and highly reserved, thanks to the draconian conditions we imposed on them 25 years ago. Too bad we didn't follow our own advice! Once the bane of Brazilian planners, inflation is now down to a comfortable 4.5%. Now the government is cutting taxes to get the country back to its merry high growth, emerging market ways. Since I recommended Brazil at the beginning of the year, the Bovespa has soared some 77% ($BVSPA). Keep the ETF (EWZ) nailed to you short list, and accumulate on any substantial dips. For a more in-depth report on this amazing country, please click here . I'll see you at the Copa.

QUOTE OF THE DAY

'The entire financial system is in receivership to the political establishment, and that's worldwide,' said George Friedman, chairman of the private intelligence company, the Stratfor Group.