August 14, 2014 - MDT - Midday Missive

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

JJG...38.58 is last months close. Price action and a close over 38.80 is needed to signal a short term bounce.

Corn...is oversold and is attempting to rally. (Z) could rally to 3.796 resistance. This is also the upside closing pivot #. All new price action over this level is needed to sustain a rally.

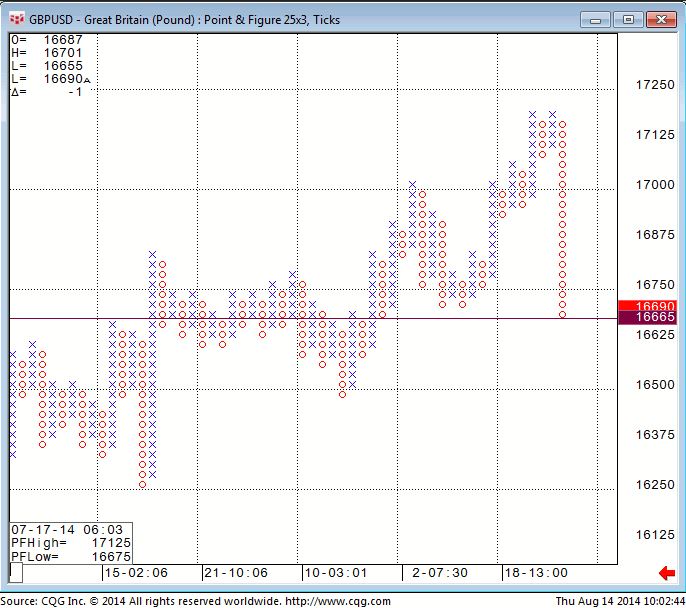

GBP/USD...I've included the Pound chart that possessed me to buy.

The point & figure has had no retrace since topping July 15th just shy of 172.00

Given we're into monthly momentum support + 200 DMA support it looked worth a go for a wiggle back up even though it looks to be the wrong way on the EUR/GBP cross.

A close below 166.45 will have me close out the trade.

?30 Yr. Bond Futures...?

?you now have a double top on the pit only Chicago session @ 140.01.

Crude...?

?has elected the pattern sell stops and has tested the 200 week DMA @ 96.12.

Brent has been the better technical trade and is the lead instrument.

British Pound

For Medium Term Outlook click here.

?For Glossary of terms and abbreviations click here.