August 15, 2011 - The Euro is Ready to Turn

Featured Trades: (THE EURO IS READY TO TURN)

1) The Euro is Ready to Turn. I believe that we may be about to witness a sea change in the value of the Euro versus the US dollar.

Since January, the Euro has been beating the daylights out of Uncle Buck, as European interest rates have been rising, while those for Uncle Buck have been falling. Trading 101 dictates that widening spreads produce strong currencies.

Never mind that the European Central Bank has been raising rates for all the wrong reasons. President Jean Claude Trichet kept an incredibly narrow focus on the rising price of oil, commodities, gold, and food, while ignoring the other gale force deflationary headwinds facing the global economy. This astigmatism delivered two 25 basis point interest rate hikes, while the economy was clearly heading into the dump.

You can blame the conflicting mandates of the two central banks. The Federal Reserve is required to simultaneously fight inflation and maintain full employment. The ECB need only worry about inflation. This is partially rooted in the German influence over the ECB, where memories off Weimar style hyperinflation during the 1920's is still strong. This can lead to sharply diverging policies between the two central banks that can create great opportunities for traders.

Now commodities prices are in free fall, and these decisions to tighten are not looking like such a great idea. In the meantime, interest rates for the greenback have been pegged at zero for two years as a result of the Federal Reserve's latest emergency moves. They can go no lower. Therefore, the spread is about to move in favor of the dollar, possibly dramatically so. This is dollar bullish and Euro bearish.

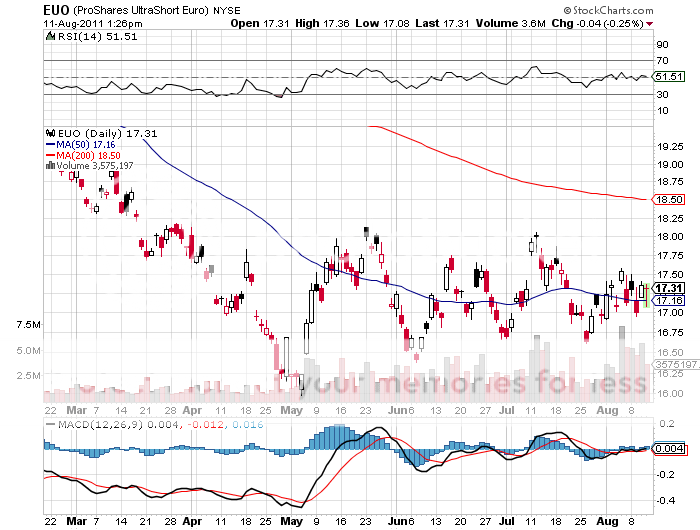

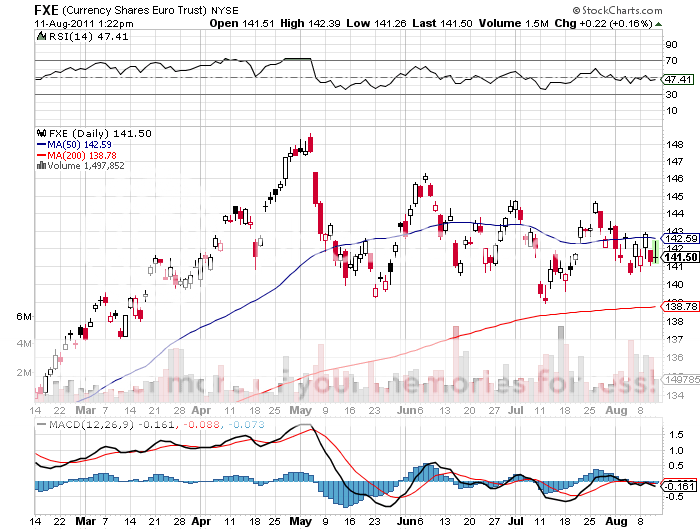

Take a look at the charts for Euro/dollar and it's clear that they have been hinting as much. There are four undeniable declining peaks from $1.49 trending downward, suggesting that worse is to come. We are already through the 50 day moving average. The no brainer target here is the 200 day moving average at $1.38.

If you get another pop up to the $1.44 handle on a wave of 'RISK ON' buying, it might be worth strapping on short Euro bets like the (EUO), a 2X leveraged ETF that profits from a falling Euro. Buying puts on the (FXE) would also work. You might be in for quite a rise.

-

-

Is Uncle Buck Ready for a Comeback?