August 17, 2009

Global Market Comments

August 17, 2009

Featured Trades: (SUGAR), (CRUDE),

(NATURAL GAS), (CHK)

1) I?m sorry I?m late with my letter today, but the lady in front of me in line at MacDonald?s (MCD) with the four screaming kids maxed out all four of her credit cards buying some hamburgers and happy toys. Her new SUV with the chrome wheels baked outside in the summer heat. Sign of the times. When I got back to the office, Egg McMuffin in hand, I was surprised when someone told me that the recession in Europe was over, that Germany has reported Q2 GDP of a positive 0.3%. What immediately came to mind was that their ?Cash for Clunkers? program started much earlier and was much larger than ours, that they has fewer banks drinking the subprime Kool-Aid, and they saw a housing boom that was only a shadow of the mania that swept the US. Europe is also closer to Asia, does a lot more business there, and is being dragged up by the gangbusters Q2 growth in China. But when I looked at the figures closer, I found more fudges than one of Warren Buffet?s See?s Candies factories. The seasonal adjustment was big, there was more tweaking with the number of working days in the year, and if you strip these out, the number was still negative. The fact is, that heavily export dependent German GDP is down 5.9% YOY, with the euro zone shrinking at a 4.6% rate. It will take years to make this back. So don?t pour the schnapps just yet. I think I?ll go back to being a vegetarian.

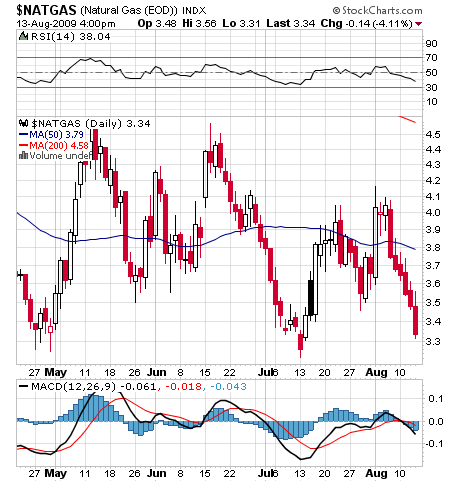

2) I love it. The fat lady is singing on natural gas. Not only did we plunge to a multi month low of $3.23/MCF, the crude/gas ratio blew out to yet another new high of an amazing 21 times, wiping out yet another generation of quant players. How many standard deviations is this? Their computers must be melting from the models that are exploding. Didn?t anyone tell them these are just tools, and not gospel? The big providers have just not been able to shut down production fast enough. It looks like Chesapeake Energy?s Aubrey McClendon (CHK) is going to have to sell more of his wine collection and artwork (click here for their website). I have been overwhelmingly negative on NG since early June, (click here for report) , suffering an Internet full of abuse in the process. But you want to buy the final washout, because market conditions are bound to improve this winter. Let?s see if you can get a $2 handle, which traders have not visited this century.

3) The seventies are about to make a comeback. No, don?t drag your leisure suits, bell bottoms, and Bee Gee?s records out of your storage facility. I mean the nuclear industry, which has been in hibernation since the accident at Three Mile Island in 1979. There is absolutely no way we can deal with our energy crunch without a huge expansion of our nuclear capacity, which sits at a lowly 20% of our power generation. France has already achieved this, getting 85% of its electric power from nuclear, followed by Sweden at 60%, and Belgium at 54%. Unless you?re a nuclear engineer, you are probably unaware that the technology has moved ahead four generations. The first one produced the aging behemoths we now see on coasts and rivers, which used high grade fuel that would melt down if someone forgot to flip a switch. Generations two, three, and four never got off the drawing board. Generation five is not your father?s nuclear power plant, relying on a new form of fuel embedded in graphite tennis balls that is just strong enough to generate electricity, but too weak to risk a disaster. This eliminates the need for four foot thick reinforced concrete containment structures, which accounted for 50% of the old design?s cost. Low grade waste can be stored on site, not shipped to Nevada or France. The permitting process is being shortened from 15 years to four by confining new construction to existing facilities instead of green fields, urged on by a less fearful public and even some CO2 conscious environmentalists. At least 30 new reactors are expected to start construction in the US over the next five years, and over 90 in China. There has got to be an equity play here. The Market Vectors Nuclear Energy ETF (NLR), which has jumped an impressive 78% to $25 since March, is the easiest way in. You can also buy its largest components, like Cameco (CCJ), the world?s largest uranium producer, or ??lectrict?? de France (EDF SA) which has the monopoly in France and is developing a major export business.

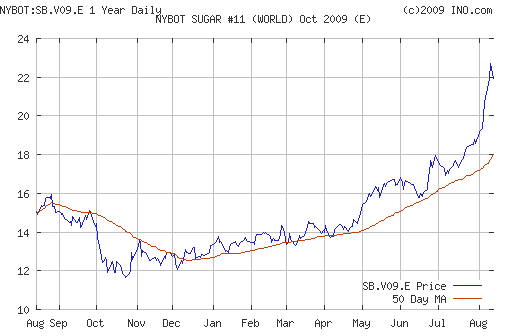

4) I have been watching with some amusement the price action in world sugar, which has exploded from 16 cents/pound to 22 cents since June, because the world?s largest consumer, India, flipped from being an exporter to an importer. Besides demolishing the budgets this year for the big sugar users here, the chocolate, soft drink, and cereal companies, (and McDonald?s), the sugar spike is a wakeup call for everyone else in the commodity space.?? When sugar last peaked at 63 cents during the seventies, the Club of Rome was in vogue, and discussion of resource shortages and imminent global starvation was rife. That is over $1.50/pound on an inflation adjusted basis today. When global supply/demand get?s out of kilter for something everyone has to have, the sky is the limit on prices. Instead of the normal 10%, 20%, and 30% moves traders expect, they will be served up with gyrations of 10X, 20X, and 30X. I expect all commodities to have major moves up in the decade ahead. Sugar was just the first in line. For more details on how to play these moves, please click here