August 17, 2010 - ConocoPhillips Looks Like a Steal

Featured Trades: (COP), (BP), (OIL)

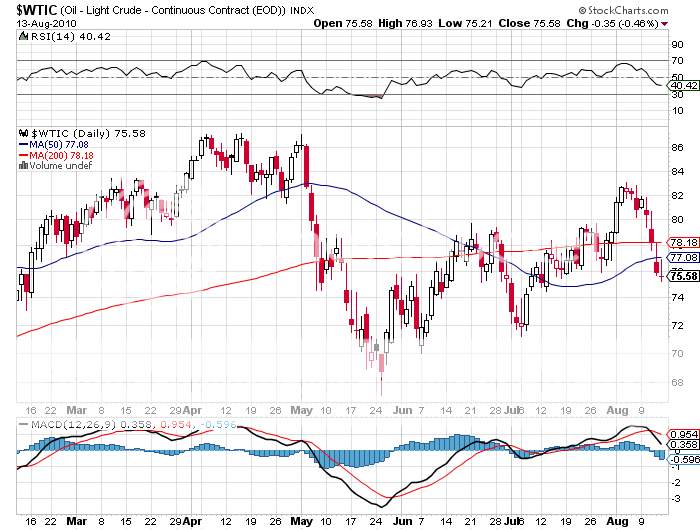

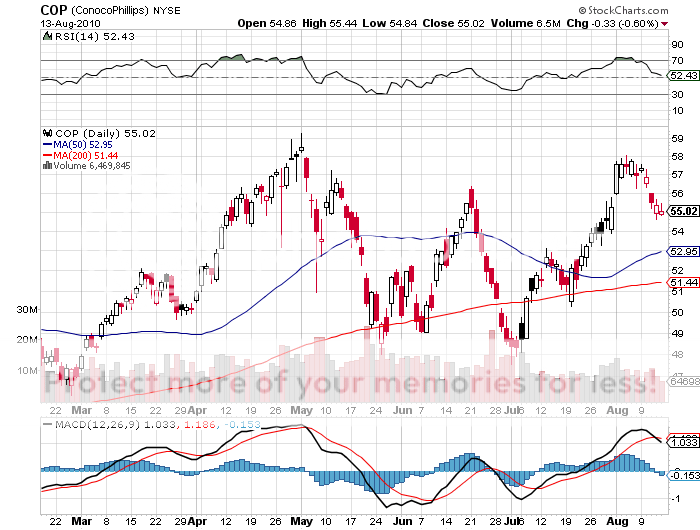

2) ConocoPhillips Looks Like a Steal. Since I am a permabull on energy of all types, I am constantly trolling the markets for cheap energy plays, and ConocoPhillips (COP) popped up on my radar. The large cap integrated oil major has announced a $20 billion restructuring that has whetted my appetite. Specifically, they are allocating $10 billion to retire debt and a further $10 billion to buy back their own stock. With a PE multiple of 8.5 X and a dividend yield of 4%, some 1.3% higher than ten year Treasury bonds, you can hardly blame them. COP has long been a favorite of Oracle of Omaha, Warren Buffet, (click here for the tip). Bring them back to their peer group valuation, and that takes the stock up to $75, some 36% higher from here. I'm not the only hedge fund manager looking for these kinds of plays, which is why I was able to grab a quick 38% profit in British Petroleum (BP) in a matter of weeks (click here for the call). Look at the chart and try to buy at the bottom end of its recent range. It's nice to have some insurance for that day you know is coming when you wake up and find oil suddenly up $10 because of some unexpected shenanigans in the Middle East.

Waking up to ConocoPhillips