August 17, 2010 - Pick Up Shipping Stocks for the Dividend

Featured Trades: (SHIPPING), (TK), (NAT), (OSG), (FRO)

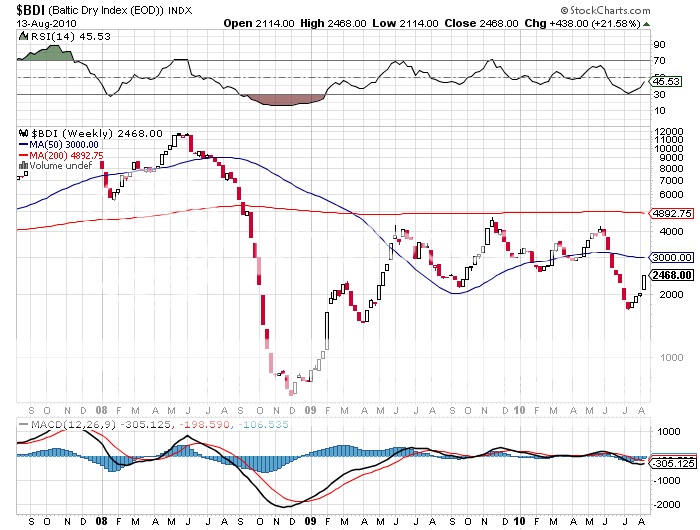

3) Pick Up Shipping Stocks for the Dividend. The markets are currently stampeding for yield of any description, damn the risk. That's why shipping stocks have suddenly come into focus, which offer some of the highest dividend yields on the board. Nordic American Tanker (NAT) has a bounteous 8.30% dividend, while Frontline Ltd. (FRO) is offering positively stratospheric 10.20% yield. It would be a vast understatement to say this is an industry that is not without problems. When commodity prices collapsed and international finance froze up, charter rates cratered. Overbuilding from the days when obtaining financing was as easy as, well, falling overboard, left a glut of hundreds of ships in mothballs in Singapore. Unpredictable fuel prices also have profitability bouncing up and down like a yoyo.? Just take a look at the Baltic Dry Index ($BDI), a measure of spot rate for bulk carriers, whose chart looks like that of a lifeboat in a typhoon. Still interested? I think the way to do this is not to reach for yield, and stay with companies that are more modest payers, but have firm contracts for bottoms for the foreseeable future. That gives you a modest haircut on returns for a lot less risk, a better risk/reward ratio that I am always looking for. Shippers that meet these specs include Overseas Shipholding Group (OSG), with a still healthy 5.10% dividend yield, and Teekay Shipping (TK), with a 4.80% return. And I never thought I'd say this, but to avoid your single company risk you might consider buying calls on the BDI itself, as continuous Chinese buying of iron ore is expected to keep rates strong there for the rest of the year.