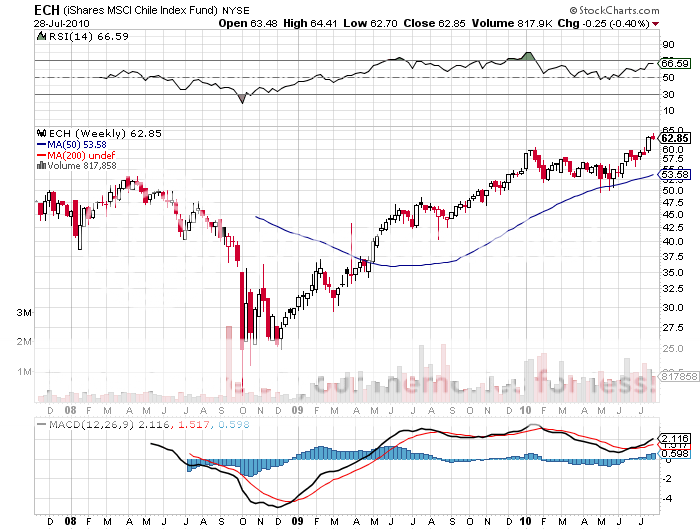

August 2, 2010 - Chile is Looking Hot

Featured Trades: (CHILE), (ECH)

iShares MSCI Chile Fund ETF

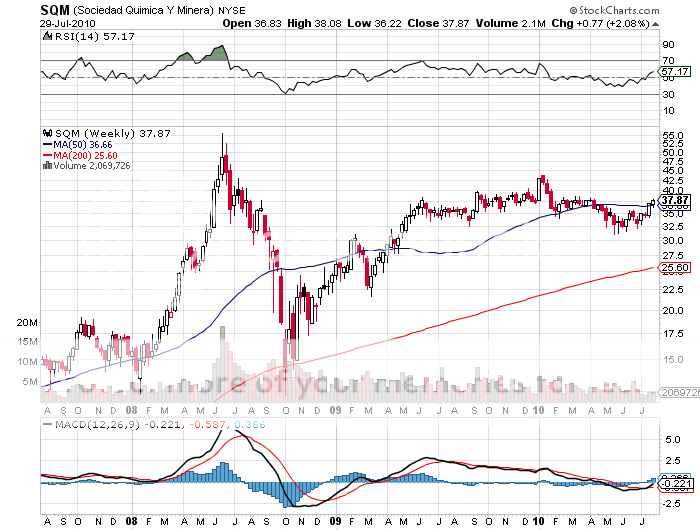

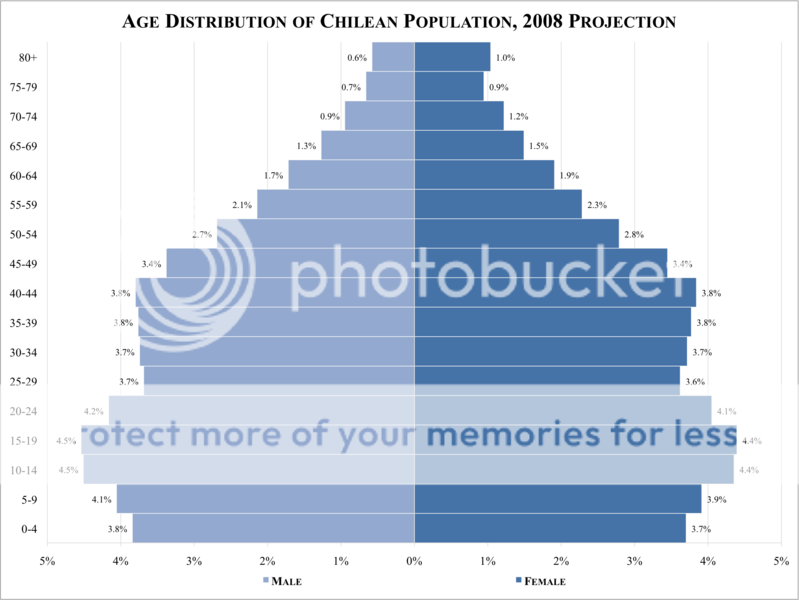

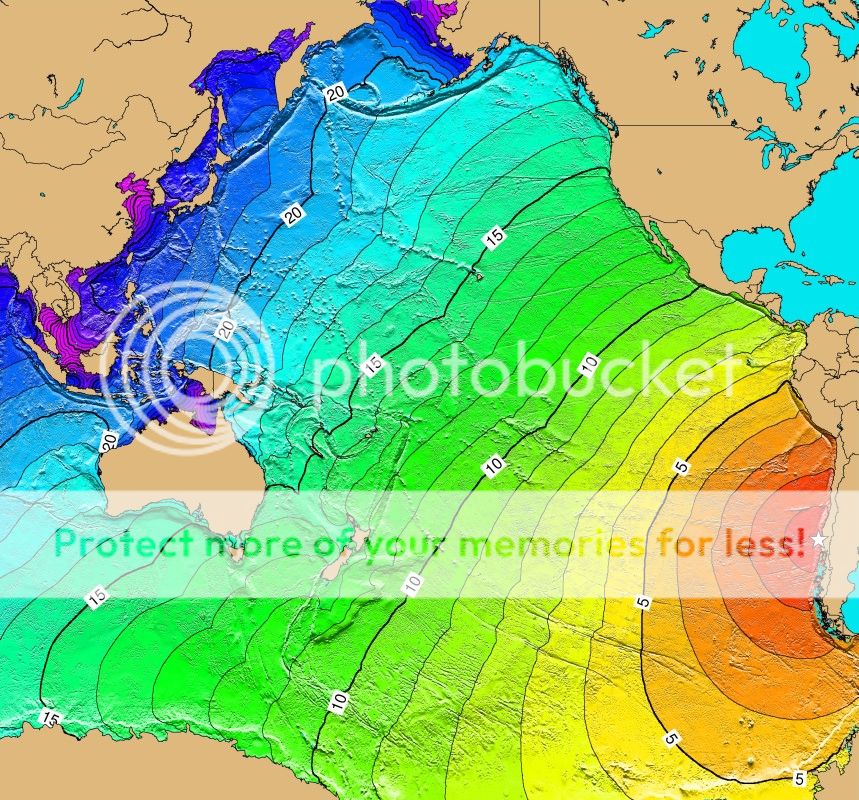

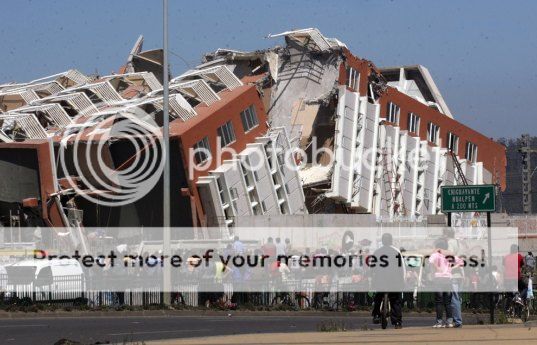

1) Chile is Looking Hot. Want to invest in an extremely well managed country with almost no debt, budget surpluses, an appreciating currency, and the price for its dominant export commodity going through the roof? Then, Chile is the place for you. It is an old trading adage that if you throw bad news on a market and it doesn't go down, you buy it. That has happened in spades in this prosperous Latin American country, when the ETF barely backed off a peso after it was devastated by a massive 8.8 magnitude earthquake in February that caused $32 billion worth of damage. While I have seen too many emerging nations blow their mineral wealth on ornate palaces, fast cars, and faster women, and stash the rest in secret Swiss bank accounts, that is not the case with Chile. Looking at the country's finances is a breath of fresh air. Of course, the 800 pound gorilla in the room is copper, for which it is the world's largest supplier, and generates one third of its GDP. Chile has had the good luck to be run by a government that took windfall prices from copper's meteoric price rise over the last decade and poured it into development projects and debt reduction. It runs a debt to GDP of only 6%, compared to 60% in the US, and 140% in troubled Greece. While corruption is rampant in much of the continent, the newly elected president, Sebastin Pinera, is already a self made billionaire, having made a fortune introducing credit cards to the country during the seventies. So what's the point? You don't get a more pro business leader than that. The country's demographic pyramid looks good until 2017, when a rapid shrinking of its fertility rate starts to bite (click here for why this is important). It is already approaching US fertility levels of 2.1, barely the replacement rate. Prior to the earthquake, GDP growth for the previous two quarters came in at an explosive 11.3% and 13.7% annualized rates. Many analysts believe the full year rate will come in as high as 5.5%. With reconstruction now getting underway, the central bank is expected to raise interest rates to keep the economy from overheating, likely leading to a stronger Chilean peso. Rising revenues and an appreciating currency give investors a 'hockey stick' effect that I am always looking for in international trading profits. Think Canada, Singapore, and Australia. And get this: even though the government is running a budget surplus, it raised taxes to pay for the rebuild. Perish the thought!? I recommended Sociedad Quimica Y Minera (SQM) last year, the country's largest lithium producer for batteries (click here for the call), with spectacular results. Ironically, Chile's ETF (ECH) is dominated by utilities and has no direct mining exposure, as they are all government owned, such as the giant CODELCO. That will change if privatizations begin. But Dr. Copper's footprint in the country is so big, you can't help but participate, even if indirectly. With China on a tear to accumulate more of the red metal for its own infrastructure build out, that looks like a good bet.

A Missed Buying Opportunity in Chile?