August 2, 2010 - Pick Up Big Oil While it is Still Cheap

Featured Trades: (XOM), (USO)

United States Oil Fund ETF

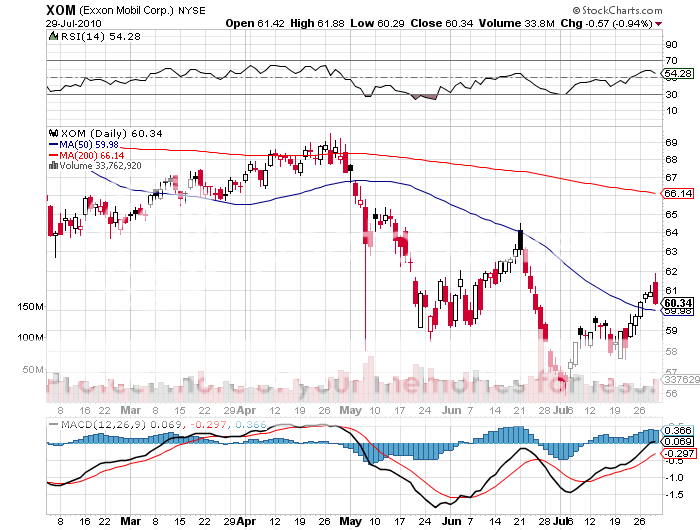

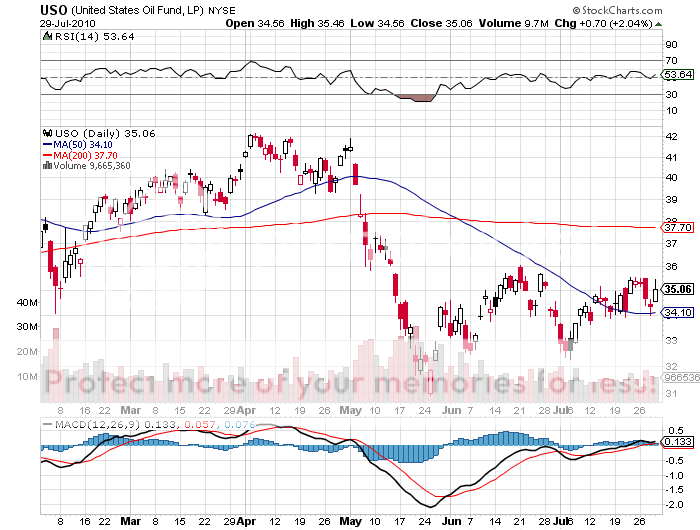

3) Pick Up Big Oil While it is Still Cheap. I have always been an unfashionable person. I was still wearing my bell bottoms and mutton chop sideburns well into the eighties, and even today people laugh at my yellow power ties which are 30 years old. It's all part of my living antique image. To be consistent, I am remaining unpopular in my fascination with oil companies, which are now trading at multi generational lows, thanks to the errant ways of BP. ExxonMobil (XOM) has stoked my interest further, announcing a blowout of a different sort today, with Q2 revenues soaring 24% YOY to $92.4 billion. Higher crude realizations, a new LNG project coming online in Qatar, and sharply recovering refining margins all contributed, enabling EPS to jump from $1.46 to $1.60. I have followed this company decades before the 1999 merger with Mobile Oil, back when it was still the Standard Oil Company of New Jersey, have met various members of the founding Rockefeller family over the years, and helped guide their foundation into some early hedge fund investments. David Rockefeller, John D.'s grandson and chairman of the Chase Manhattan Bank, once told me that I was one of 70,000 names in his rolodex. This is the world's most conservative company, and there is a reason why the Gulf blowout happened to BP and not to them. I think rising oil prices (USO) are going to be a major investment theme from here on, and that we will revisit $150/barrel oil sooner than you think. I wrote about Occidental Petroleum (OXY) earlier (click here for the piece). My investment in an all electric, carbon free Nissan Leaf also anticipates this move (click here for that piece). I'm putting XOM on my 'buy on meltdowns' list.