August 2, 2011 - Be Careful What You Wish For

Featured Trades: (BE CAREFUL WHAT YOU WISH FOR)

1) Be Careful What You Wish For. Politicians are popping champagne bottles and celebrating the end of cantankerous negotiations over the debt ceiling. I say be careful what you wish for. Let me give you my quickie, back of the envelope analysis of the debt ceiling deal in Washington.

The compromise calls for $2.4 trillion in spending cuts over ten years. That amounts to 16.6% of GDP, or 1.6% per year. If the Federal Reserve's 3.0% forecast comes true, that means our economic growth rate is about to fall to 1.4% a year. If my prediction comes true, and we grow at a 2.5% rate, that plunges to 0.9%.

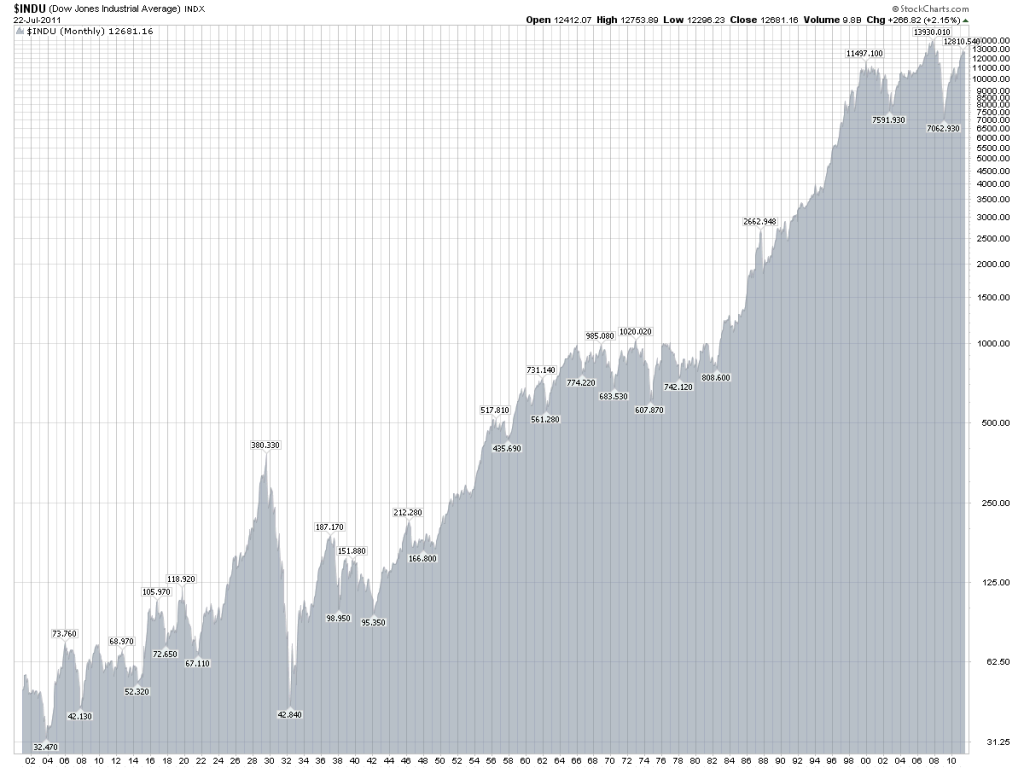

There is another country where GDP growth is measured in mere basis points: Japan. Congress has just voted for ten years of austerity. To do this at this stage of the economic cycle, when growth is feeble at best, and we have just seen two back to back quarters of growth at the 1% handle, is to guarantee us a second lost decade of zero stock market returns.

Sure, the spending cuts are back end loaded. But you know what? Investors will front end load the discounts in asset prices this slow growth scenario demands. This is not good news for long term holders of risk assets of any description, be they stocks, commodities, or homes.

This may be the riot act that financial markets are reading us today. Instead of getting the short covering rally that many of us expected, we were given a cascading series of flash crashes. The (SPX) cratered 35 points, oil cracked by $5, the Euro plunged 3 cents against the dollar, copper gave back 20 cents, and even gold pared $15. In the meantime, a flight to safety bid took bonds up two points to an incredibly low yield of 2.72%.

Armchair historians out there have to be recognizing the similarity of 2011to 1937. That is when a republican congress forced Franklin D. Roosevelt to throttle back government spending too soon, throwing the country back into round two of the Great Depression. That triggered a 49% plunge in the stock market. The downturn continued until WWII delivered the greatest stimulus package of all time and ignited a 25 year bull market.

To a large extent, there is not much anyone can do to repair the economy. Possibly as much as half of the economic growth of the past 30 years was borrowed from the future. This is because it was fueled by the $3 trillion that Ronald Reagan borrowed largely from the Japanese during 1980 to 1988, and the $5.5 trillion George W. Bush borrowed from the Chinese from 2000 to 2008.

The bill is now due, but the piggy bank is empty. Decades of minimal growth will be the consequence. I doubt that there is a single business out there that can point to a new customer coming to them as a result of the debt deal. There will be tens of thousands that will moan about lost business. The republicans now own the economy. That may be something they come to regret.

See Any Similarities?