August 21, 2009

Global Market Comments

August 21, 2009

Featured Trades: (NATURAL GAS), (UNG),

(LITHIUM), (OPTT), (HANG SENG), ($HSI)

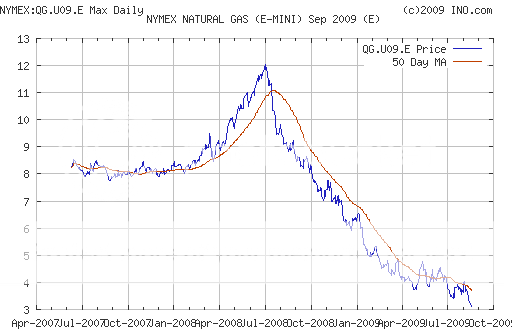

1) Many traders are staring at their screens with rapt attention to see if natural gas can hold the new seven year low of $3. If it does, you can expect an explosive rally back to $3.50. If it doesn?t, the mother of all stop loss selling will ensue, as day traders and chartists, ignorant of the fundamentals of CH4, bail on positions that technically looked sooooo attractive. Seeing this terrible price action with a hurricane barreling in on the East coast is nothing less than amazing. NG owners have to be thinking that if you throw good news on a market, and it can?t go up, then get the Hell out of there. You could see $2/MCF in a heartbeat, and the washout could set up one of the great long plays of the decade. Buying on the back of others? distress is always a great play. Please see my call on June 2 to sell NG at $4.30 by clicking here . Remember the $13.50 we saw last year, or better, the $17 that printed after hurricane Katrina? They don?t call this contract the widow maker for nothing. For an excellent update on this clean burning fuel, go to the opinion page of the August 17 issue of the Wall Street Journal and read the piece entitled ?New Priorities for Our Energy Future,? written by none other than two sons of the South, T. Boone Pickens and Ted Turner. (To read the full article, click here). They argue that the gigantic pool of NG recently discovered under the US exceeds the energy reserves of Saudi Arabia and should be used to transform our economy. But that isn?t going to help nervous traders decide if they should puke their long NG positions first thing tomorrow morning.

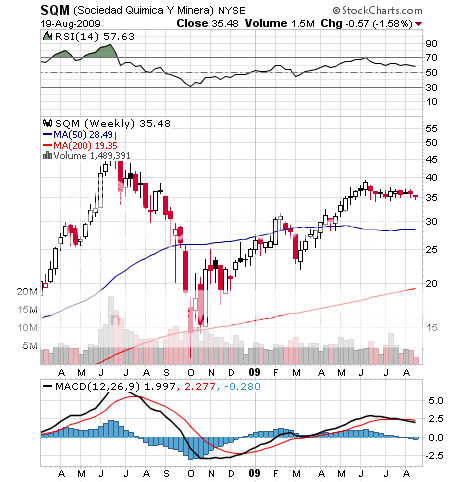

2) If we do move from a carbon to a lithium based economy, what are the implications? Will we all become mellow? Politicians, industrialists, and environmentalists who see battery powered vehicles as the wave of the future are overlooking the fact that 50% of the world reserves of lithium are found in impoverished, landlocked Bolivia. This is a country that, until now, was best known for killing off famous foreigners (Che Guevara, Butch Cassidy, and the Sundance Kid), and being the source of a new form of venereal disease. Lithium ion batteries are four times more efficient than the current generation of nickel cadmium ones, and are essential for electric cars to finally become economically viable. But now that the country finally has something the world wants, nationalism is rearing its ugly head. Local politicians see their country as the Saudi Arabia of the highly corrosive, toxic, reactive metal, and are already discussing ways to restrict access. Will La Paz become the headquarters of OLEC, the Organization of Lithium Exporting Countries? The only other supplies are to be found in Chile, Argentina, Australia, China, and Nevada. Should the US invade to insure supplies? Iraq worked didn?t it? The safer way for opportunistic investors to play this is to look at Sociedad Quimica Y Minera (SQM), Chile?s largest producer of lithium, which has already seen its shares nearly triple this year.

3) Wave power has been the orphan of the alternative energy world, the allure of infinite supplies of energy offset by the highest cost of extraction. Every time it looks like someone has cracked this nut, a storm comes along and washes away all of their high tech buoys. However, we may finally be seeing this technology come to fruition. New Jersey based Ocean Power Technologies (OPTT) has been working on the problem since 1994, went public in 2007, and seeks to convert the mechanical motion of ocean waves into electricity with their PowerBuoys. Their engineers have created a 150 KW buoy that generates power at a relatively rich ten cents per KW. The energy available in waves is truly immense. A small harbor of these could generate enough electricity to power a medium sized city. The Navy has been their biggest customer until now, accounting for 58% of sales, driven by a directive to obtain half of their renewable energy generation from renewable sources. Commercial projects are operating or under consideration for the Jersey shore, Spain, Scotland, Western Australia, Hawaii, and Oregon, where local utilities are operating under similar mandates. The cash rich, well funded company says if they can mass produce their next generation 500 KW PowerBuoy, which will be operable in 2010, the cost of electricity will drop from 10 cents to 5 cents per kilowatt, making it cost competitive with fossil fuels, wind, and solar. Throw government subsidies into the mix and this could be an interesting play. The stock cratered with those of other green companies, dropping from $20 to $4. With crude now having moved from $32 to $75 on its way back up to $150 this could become an interesting cheap call on energy prices. Check out their website at http://www.oceanpowertechnologies.com/

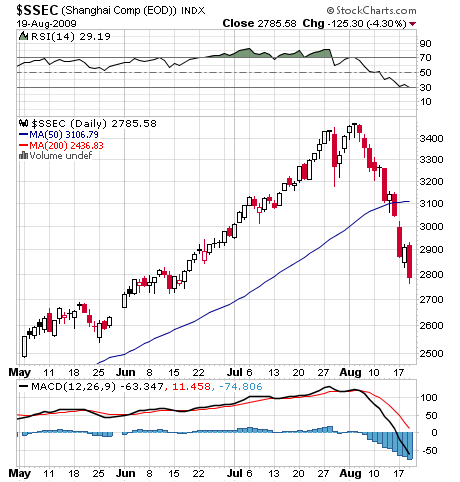

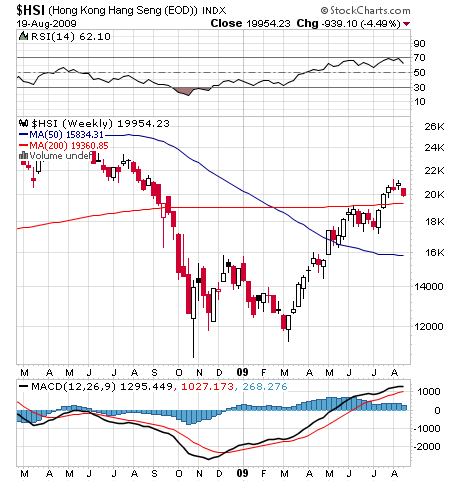

4) All eyes are riveted on Shanghai, where the index has gone from up 110% on the year to only 53% in less than three weeks. Talk about taking the rice wine away from the party! I know from my own hard earned trading experience that the Middle Kingdom is the home of the one way move, a tendency exacerbated by the 53% retail participation in the daily trading volume. Analysts are looking for the 150 day moving average to hold at 2,700, which could set up a range of 2,700 to 3,500 for the rest of the year. Use the sell off to get a position in an economy that will see growth accelerate from the current 9% rate to possibly 12% by next year. With Shanghai closed to foreign direct investors, the best way to do this with decent leverage is through the Hong Kong based Hang Seng futures. The mini contract has only recently been cleared by US regulators, and is now available to US based traders. One contract? gives you an exposure of? US$26,000, with a margin requirement of?? US$2,000, giving you leverage of 13 times. Catch a 10% move and you earn a handy 130% return. The only drawback is you have to stay up from 9:45 pm to 4:30 am New York time to watch the intraday moves, which can be utterly breathtaking. If you don?t mind the No Doze and want to know how to get set up on this, email me at madhedgefundtrader@yahoo.com.

5) Note to subscribers: I will be off for a week, first to attend the San Francisco Money show, then to drink the pristine, ultra pure waters of Lake Tahoe. Great news for the kids, bad news for the fish. It?s time to accumulate some grit on my teeth instead of stock positions, and watch burning marshmallows drip from my coat hanger into the fire instead of diminishing investment opportunities. Paid subscribers will have these days added to the end of their run. Thanks for all of the wonderful suggestions for poison oak remedies after my last trip. Does anyone know any good tricks to keep the mosquitoes at bay?

QUOTE OF THE DAY

?Recession-Plagued Nation Demands New Bubble to Invest In,? says a headline in The Onion, a satirical publication.