August 22, 2014 - MDT Pro Tips A.M.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Current Positions

Long IWM ?????????????????????

.......................................................................................

Today's Working Orders

Sell IWM 114.35 Stop Close

.......................................................................................

Stocks...

Spu's....2000 is a natural big level # where it would be imprudent to over trade. It is more a psychological level than a technical boundary.

Depending upon where you like to take your swing counts from the 2020's is an achievable 1st objective.

1956 is support.

Russell 2000 Futures... (TFU) just missed putting in an ORH day, however, like the IWM, the pattern is friendly as long as it remains above yesterday's low @ the 200 DMA.

DAX... sell stops are @ 9276 today's daily ORL #. Support and the closing downside pivot is 9230.

Bonds...

30 Yr....last Friday saw me pull my sell orders @ 140.14 only to see a much higher level assaulted near 142.00.

Given it's the end of the week and we're still in an uptrend, I'd rather be patient and see what develops.

Sell stops are @ 139.12, with a close under 139.00 needed for the Bonds to change direction and start selling the rallies again for something more than a point or two.

FX...

USD/JPY...near term Dollar buy stops are over 104.12 (Futures sell stops @ 96.04)

The Yen has been in an almost 8 month range. While I'm looking for a higher USD/JPY (Lower Yen) 40 years of trading it make me reticent to chase weakness or strength.

The daily, or short term time frame, is trading Yen oversold although the longer term time frames show there is more room for the Yen to move lower.

This just means I'd prefer to sell a rally vs. a break.

AUD/JPY...as long as this cross is above 96.00 I'm friendly to buying the breaks. 96.56 is the monthly ORH#

Commodities...

OIL...94.80-95.00 will remain a low risk sell zone.

General Comments orValuable Insight

Yellen is scheduled to speak @ 9:00 A.M. CDT

Draghi is scheduled to speak @ 1:30 P.M. CDT

Needless to say both speeches have the potential to be market moving events for the Equity Indices, Currencies and Bonds.

The day will be all about how and where the Equity Indices hold after the speeches.

Russell 2000 Futures

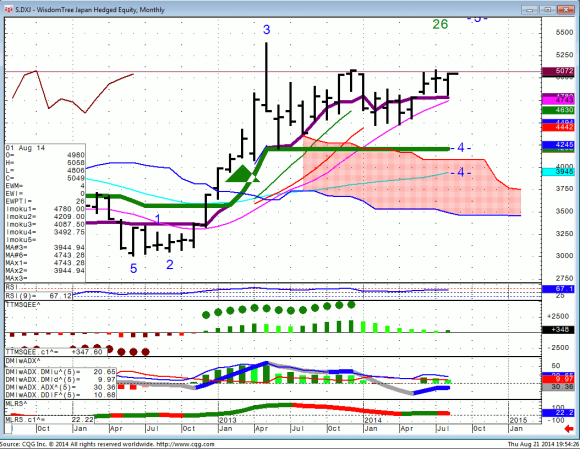

DXJ

For Medium Term Outlook click here.

For Glossary of terms and abbreviations click here.