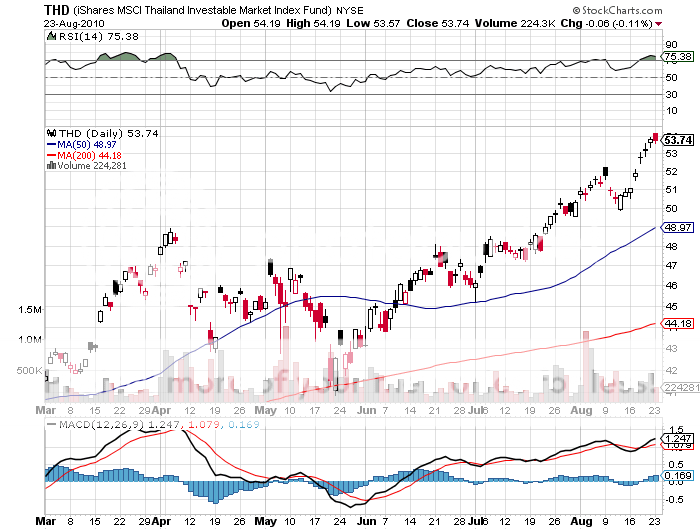

August 25, 2010 - Thailand Punches Through to New Highs

Featured Trades: (THD), (TF), (F), (NSANY), (TM)

iShares MSCI Thailand Investable Market Index ETF

Thai Capital Fund

3) Thailand Punches Through to New Highs. With hotel occupancy in the dumps at 20%-30%, and parts of downtown Bangkok still in ruins from the May riots, you would think the call to buy Thailand (THD), (TF) two months ago was a complete bust (click here for the piece).

You would be wrong. Since then, the Thai ETF has tacked on an amazing 20%, the Thai Capital Fund is up 24%, and the Thai Baht has strengthened, making it one of the top performing stock markets of 2010. Even with the collapse of tourism, GDP is expected to come in at a healthy 6% this year, a figure American economists would kill for.

The country's robust manufacturing sector, which accounts for 66% of Thai GDP, versus only 6% for tourism, continues to drive the country onward and upward. Think of Thailand as China, with the infrastructure already built out. Ford Motors (F) has announced the construction of a $450 million plant to build the Focus, while Nissan (NSANY) says it will assemble its compact. Toyota (TM) and GM are expected to follow suit with the expansion of existing facilities.

Carl Van Horne, then the chief investment officer of JP Morgan, once taught me a rule that I have found incredibly useful: follow the direct investment; the stocks markets always play catch up. Thailand continues to be a place where international investors want to be. Buy on dips, if we get any.