August 26, 2010 - Why Gold Seems Unbreakable

SPECIAL BOND BUBBLE ISSUE

Featured Trades: (GOLD), (GLD), (GDX)

SPDR Gold Shares ETF

Market Vectors Gold Miners ETF

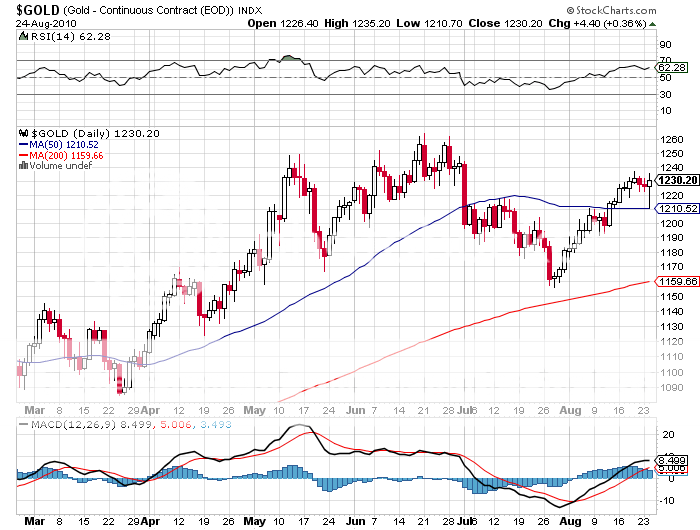

3) Why Gold Seems Unbreakable. While the rest of the world has been going to hell in a hand basket, gold (GLD), (GDX) refuses to take a serious dip, and is threatening the old $1,260 high. Today, the World Gold Council, the ultimate go-to source for figures on global supply and demand for the barbaric relic, published its 2010 Q2 assessment yesterday. The report paints a positively bullish outlook for the yellow metal (click here for the link at http://www.gold.org/).

Investment demand has been skyrocketing, causing total buying to jump 36% to 1,050 metric tonnes YOY. Purchases from the new exchange traded funds have soared 414% to 291 tonnes. Hoarding of gold bars, primarily in emerging markets, is up 29% to 96 tonnes. India and China will continue to be the new demand driver for the foreseeable future.

A flight to safety bid from Europeans desperate for a hard alternative to the Euro has been strong. A recovering economy has caused industrial electronics gold consumption, especially from Japan, to jump 14% to 107 tonnes, near all time highs. Substantially higher prices caused jewelry demand to fall 5% to 408 tonnes, driven by a pull back in buying from India.

I'm starting to wonder if my long term target of $2,300/ounce is too conservative (click here for 'What to do About Gold'). Overall, it is one of the most positive reports I can recall. Gold bugs should print it out so they can sleep with it under their pillows at night.

Sleeping Better With Gold Coins Under Your Pillow