August 28 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the August 28 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Santa Barbara, CA.

Q: What is your opinion on Supermicro (SMCI)?

A: I can tell you that all fund managers have the same reaction as I do when they hear the words “accounting irregularities” ….run. So, if you haven’t, I would get out. If you’re looking to get in, there’s probably a great opportunity somewhere, but not here. Their product isn’t that high-tech, cooling racks for artificial intelligence servers. But it did have the letters “AI” attached, so it went up 50-fold. But Hindenburg is occasionally right on their research reports, although they’re wildly exaggerated to enhance their short positions. I would stay out of the way on that one for now.

Q: Are there any startup companies worth investing in on the public market right now?

A: No, because new listings are always overhyped. They come in usually double their true value. This happened with Tesla (TSLA)—I think Tesla came out at $32, I waited for the 50% selloff and all the marketing hype to wear off and I bought it at $16, and of course, that's probably about 60 cents now on a split-adjusted basis. So, I don't play the IPO game. If an IPO really is hot, chances are your broker won’t give it to you anyway; he'll give it to his largest clients. That's probably not you. So, I don't get involved in that game, I look at the aftermath. And in hot markets, there is no aftermath, you just watch them go up. The answer to that is a firm no.

Q: Home prices just hit new all-time highs, according to the S&P Case-Shiller. How do the prices keep rising with high interest rates?

A: Because people expect interest rates to fall, and they are doing so dramatically. If you look at all the interest-sensitive sectors which I've been recommending for the last four months, they've all been on fire. So if the cost of your mortgage is about to drop by half, housing prices should double, and we are starting to see that double now.

Q: Should we buy a put on the (QQQ) based on Nvidia (NVDA) earnings?

A: Nobody knows what the Nvidia earnings are going to be, so if you're willing to make a bet on a coin toss, go ahead and do it. I don't make bets on coin tosses. I make bets when there's a 90% chance that I'm going win, and there are no 90% chance trades out there anywhere in any asset class right now. It's better to watch and wait for the next opportunity. If Nvidia sells off 10% on a weak guidance, then I would be in there with both hands buying, because Nvidia is still cheap relative to the rest of the sector and the rest and of the market. And if Nvidia goes up 20%, I might even sell it short. I have shorted Nvidia this year a couple of times this year, and made money both times, so that is the trade. But right here we're in the middle of the next likely range, so no trade there at all.

Q: Will CrowdStrike (CRWD) have a financial liability for the problem it created by crashing the world's travel computers?

A: Yes, and that will no doubt be the subject of litigation for the next 10 years, which I would rather not get involved in.

Q: The tech industry keeps cutting white-collar jobs, and they have been for some time. At which point does this subside, and won’t this crush employment in Silicon Valley?

A: Well, it’s already crushed employment by about 300,000 in Silicon Valley, but artificial intelligence is now starting to soak up those employees, and they certainly are soaking up the office space, which is why the smart money that is now pouring into San Francisco buying up office buildings for pennies on the dollar. They see an employment recovery. In the meantime, buy the Magnificent Seven stocks, because they’re creating profits by cutting the excess staff which they always used to keep.

Q: When you talk about Tesla (TSLA) losing ground in the EV market, do you see the company broadening out its technologies, and growing the company down other avenues?

A: Absolutely, yes. They have a very fast-growing solar panel business, an industrial-scale battery business, and of course, they're basically running the charging network for the entire United States and the entire world. They also have new batteries under development that have the potential to increase car ranges 20 times at zero cost. Elon always has at least a dozen or so other projects underway, many of which he keeps secret. What you have to keep track of is how many of these accrue to Tesla, and how many accrue earnings to his other companies, like SpaceX, Neuralink, and xAI. SpaceX is going gangbusters right now because guess what? They're planning an IPO in the near future and should get a big multiple. xAI just raised $6 billion in a VC round.

Q: How can Nvidia (NVDA) go higher tonight if it disappoints?

A: It won't. It will drop about 10%. I'm just saying you can go higher into next year on 50% earnings growth, but we may have to give back 10%, 20%, or in the case of August 5th, 40% before we can go forward.

Q: Whatever happened to the commercial real estate problem? How is that taken care of so tightly by private capital?

A: It's a play on falling interest rates. A lot of buildings were going for 10 cents on the dollar in Manhattan and in San Francisco, so these guys know bargains, and they're long-term players, and that's how they always make money in that business. I've been watching it for 50 years, and their market timing is excellent.

Q: What will the effects of de-dollarization mean to the long-term health of the stock market?

A: Nothing, because de-dollarization isn't going to happen. It's more or less an internet conspiracy theory. There's no serious move whatsoever to replace the US Dollar, and Bitcoin or crypto in general never got to more than 1% of the total value of US dollars out there, and plus it's had its problems. So I don't think de-dollarization is going to happen in my lifetime.

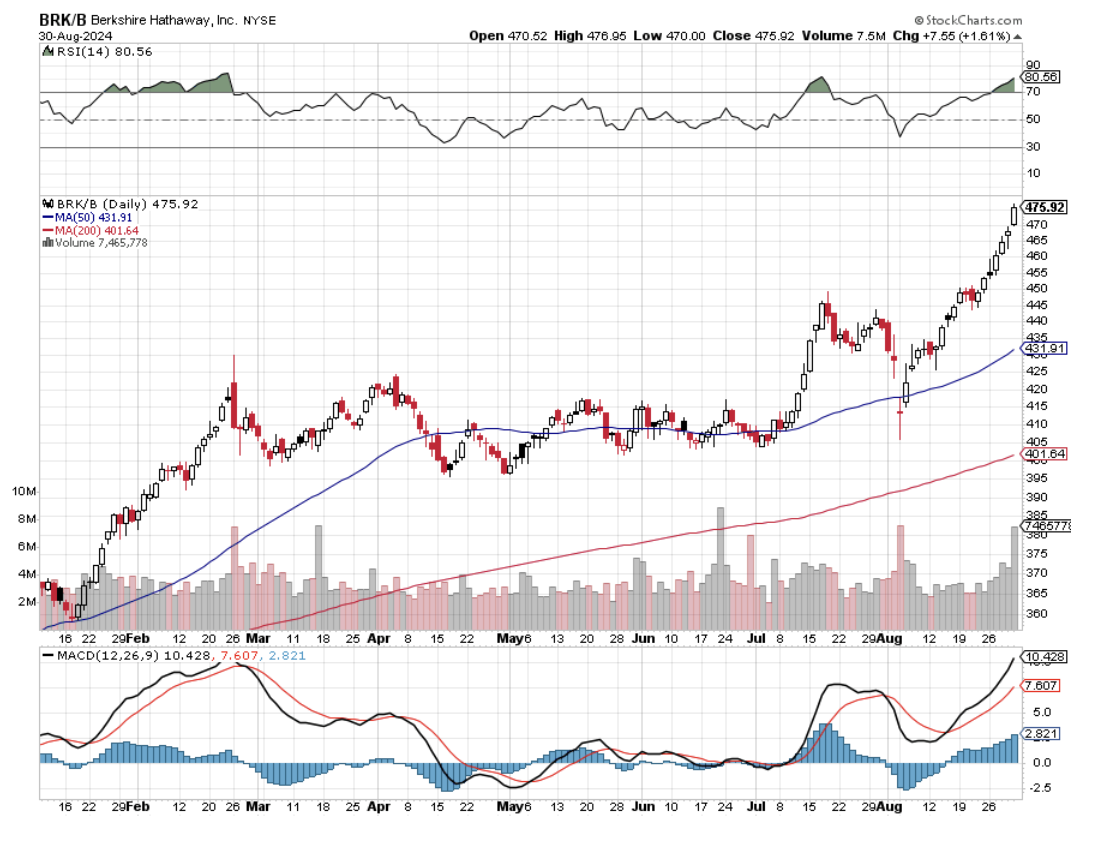

Q: Why is Warren Buffett (BRK/B) unloading shares in Apple (APPL) and Bank of America (BAC)?

A: He thinks the whole market is expensive, and I would agree with him. He likes having a lot of cash during recessions or during major market crashes, so he can swoop in and buy whole companies. So that is the answer. He's thought the market has been expensive for years now, but that doesn't seem to stop them from making money.

Q: Should we take profit on the LEAPS in Barrick Gold (GOLD) expiring in January?

A: Yes, you should take the profit here. You make maybe 20% or 30% and then wait for the next sell-off, and then go back into (GOLD), but add an extra year to the expiration date. Do a 2026 instead of a 2025, because we're getting kind of short on time on all the January 2025 expirations. So that would be the smart thing to do, is to take profits on all your January 25 LEAPS, raise cash, and go back in into an 18-month LEAP on the next sell-off, and I will be reminding you to do exactly that when it happens.

Q: Should we wait until after the election to invest?

A: No. The market will start running before the election, especially if the election outcome becomes more and more certain. So that kind of sets up an October bottom for the market, and maybe even a September one—who knows? We will just have to see how the polls go, even though they are usually wrong. So that's what I would do on that.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader