August 29, 2011 - The Great Snore of 2011

Featured Trades: (THE GREAT SNORE OF 2011)

1) The Great Snore of 2011. As I expected, Ben Bernanke's long awaited Jackson Hole speech turned out to be a huge nonevent. He effectively put off any serious action to repair the sagging economy until the next Federal Open Market Committee (FOMC) meeting on September 20-21. He will look at the world then and decide if the global financial system needs any further assistance to avoid a collapse.

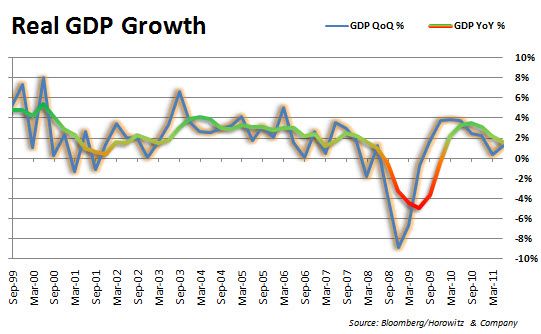

His reasoning? The economy is already humming along well enough to postpone any further stimulative action. In fact, he stated that he expects GDP to be stronger in the second half than in the first. This is in sharp contrast to the market's opinion that things are going to hell in a hand basket, and that Armageddon is near.

Who is right? Mr. Bernanke, or Mr. Market? Could 'surprise at the failure of the economy to accelerate' become the most commonly used phrase in future Fed releases?

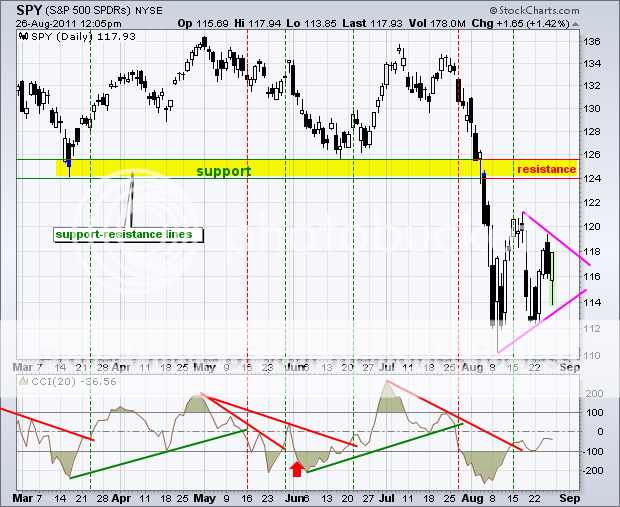

The Dow immediately tanked 200 points on news that Ben wasn't pouring another pint of 200 proof ethanol into the punch bowel. It then rallied 400 points. Gold soared by $70 in anticipation of a big 'RISK OFF' trade next week. At the end of the day, stocks and gold were rising at the same time, which never happens. I think that traders were just throwing up their hands in despair and going flat so they could board up their windows ahead of the approaching hurricane.

With Ben now out of the picture, I think we are in for a period of continued tearing your hair out type market volatility that could extend all the way into the next FOMC meeting in 3 ? weeks. Look for the S&P 500 (SPX) to continuing putting in a narrowing triangle off the 1,100 bottom that could pave the way for a more robust move to the upside in the fall. If 1,100 fails, the market will try again to find a floor just above 1,000.

I believe that there is a 50% chance that we already saw the bottom of this move at 1,100, and a 50% probability that it is at the 1,000 handle. Let me toss this silver dollar and I'll tell you where it is for sure. And the answer is'?.

-

-

-

OK, Who Forgot the Ripple?