August 29, 2011 - Time to Dump the Swiss Franc

Featured Trades: (TIME TO GO SHORT THE MATTERHORN), (FXF)

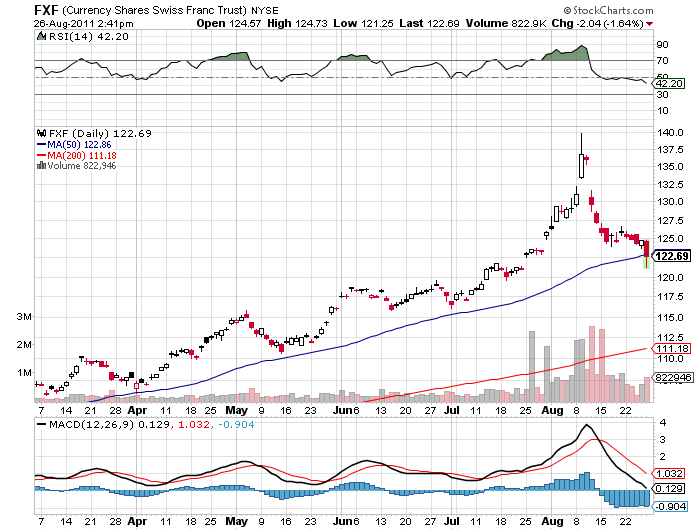

2) Time to Dump the Swiss Franc. This will be my first post Bernanke speech trade. The Swiss franc (FXF) has been driven up to absurd levels by a safe haven bid. It is about to suffer a fate similar to its safe haven cousin in the metals market, gold, which plunged an incredible 11% in two days. This is the next 'short gold' trade. If the barbarous relic can fall that far, that fast, so can the Swiss franc.

The Swiss National Bank has undertaken massive efforts to weaken its hopelessly overvalued currency before it completely wrecks the country's economy. For a more detailed report on the travails of the Swiss economy, please click here for 'My Big Miss of the Year'. I love Swiss chocolate, especially Toblerone, but it's not that good. $20 for a cup of coffee? Puleese!

The Swiss National Bank is flooding the domestic money markets with liquidity at an unprecedented rate and intervening in the foreign exchange markets. Harsher measures are rumored to come shortly. This is all fresh red meat for hedge fund traders.

Adding the fat to the fire, on Friday, a rumor swept the foreign exchange market that UBS, the largest bank in Switzerland, would start charging negative interest rates of short term Swiss franc deposits. A similar move during the late seventies heralded the peak of speculation in the Swiss currency. The Swiss franc immediately crashed 3.5 cents. Many stop loss liquidation orders were triggered along the way, causing one of the sharpest declines in the history of the Swiss franc market.

My experience is that, while these measures initially fail and are 'poo pooed' by the market, at the end of the day, they succeed. After all, central banks can print all the money they want. It is far easier to weaken a currency than to strengthen them. We are about to see that with the Swiss currency.

-

Time to Go Short the Matterhorn