August 3, 2010 - China's PMI Sets Market a Flutter

Featured Trades: (CHINA), (FXI)

1) China's PMI Sets Market a Flutter. Several decades ago, a kid selling greeting cards door to door (yes, that's how old I am) stopped by my office. When I said no, he suddenly burst into tears and threw a handful of samples up in the air, which then wafted back down into the adjoining cubicles. That's how I felt this morning.

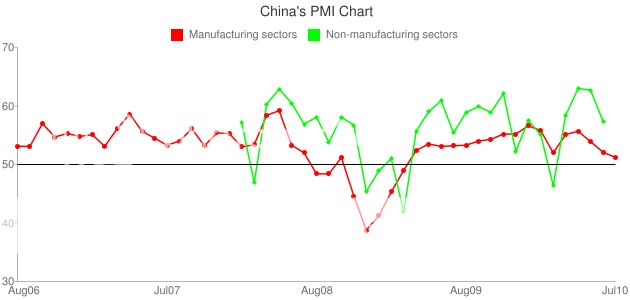

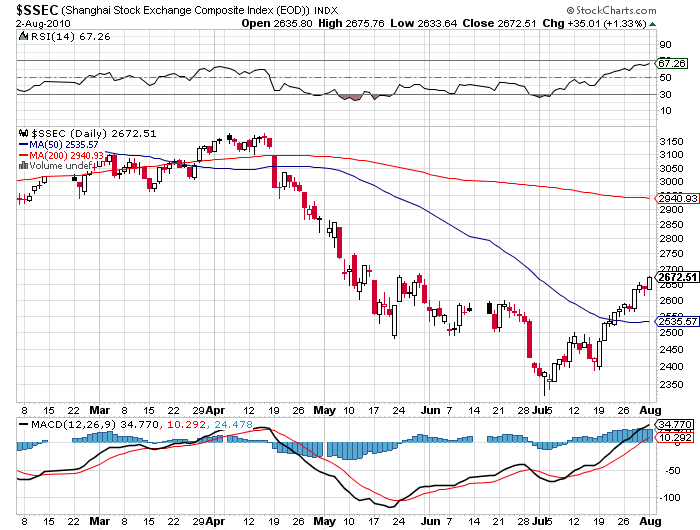

On hearing that China's (FXI) purchasing managers index dropped from 52.1 to 51.2, the lowest reading since February 2009, your first guess would not be that that the Shanghai market would jump 1.2% or that the Dow would pop 1.9%.

Perhaps traders took the new data as proof that the Chinese central bank's tightening measures were working, and that no more would be needed? Maybe strength in commodities and food prices is spilling over into the rest of the economy? How about a first day of the month buying binge by long term global investors? Maybe it's just random short term noise?

All of this is happening with ten year Treasury bond yields, which by far have been the most accurate leading indicator of the economy, straining their way back down to 2.95%. IBM raised three year money today at a staggeringly low non-yield of 1.13%, locking in an upside potential for investors of nothing! Is the double dip recession, once off, then on, now off again? Go figure.

What happened to the kid? The secretaries from the adjoining office (yes, that how old I am) scurried over, helped him pick up his cards, bought a couple of boxes, and looked at me like I was some kind of monster. The kid strolled out of the place with a smirk on his face. Sometimes you just have to throw up your hands and cry.

Is China Trumpeting a Recovery?