August 31, 2010 - On Safari for Trades in South Africa

Featured Trades: (SOUTH AFRICA), (EZA)

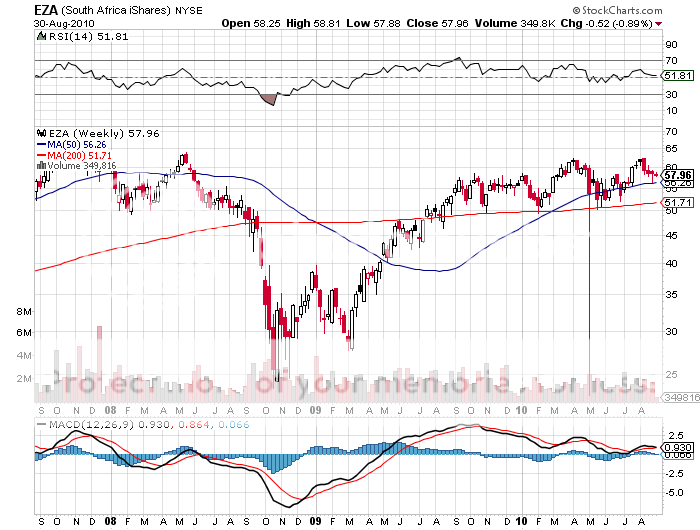

South Africa iShares ETF

2) On Safari in South Africa. When I first visited South Africa (EZA) as a journalist in 1979, I was stuffed into the trunk of a car and smuggled into Soweto, a fenced off? 'township' , so I could write about the appalling living conditions there. Six ANC bodyguards accompanied my every move, as to venture out alone amidst 100,000 oppressed blacks would have been suicidal. Bringing along my Japanese wife to the land of apartheid didn't exactly go down well with the white locals either, as there was only one hotel in the country that would accommodate us.

The bottom line: everyone hated us. We were lucky to get out alive. Is those days, when long lines of Afrikaners snaked out of coin dealers selling their krugerrands for $900/ounce, everyone was convinced the country would soon blow up in a gigantic, bloody racial war.

It never happened. The Afrikaners made peace with the ANC, an incredible reconciliation process ensued, and by 2010 the country had healed enough to host the World Cup. It's all proof that if you live long enough, you see everything.

Now, South Africa is popping up on the radars of several big hedge funds as one of a handful of frontier emerging markets ready to make the move to prime time. Of course we already know about world class companies like De Beers, Standard Bank, and Sasol, which give it enough muscle in services and industry to stand out from the rest of the Dark Continent.

But did you know about alternative energy and venture capital? Local entrepreneurs report that South Africa is among the best countries to start a new company these days, with top rate universities, a plentiful, well educated professional class, a trained work force, generous government subsidies for key industries, and a healthy local market. Despite its well earned reputation as the premier source for the world's gold and diamonds, 50% of the country's exports were manufactured goods.

This dynamic mix enabled South Africa's GDP to hold up well during the financial crisis. Analysts are expecting a 3.3% growth rate this year and acceleration to 5% or more next year.

But this all misses the really big play in EWZ, whose ticket to prosperity will get punched by selling into fast growing markets? and a rapidly rising standards of living in the rest of Africa. The entire region has enjoyed accelerating GDP growth rates since 2002. This has been partly fueled by soaring commodity prices where Africa has a lock on the market, such as for cobalt and iridium, crucial elements for advanced electronics and cell phones.

There have been a number of new oil discoveries in Nigeria and Sudan. The Chinese are pouring tens of billions of dollars there into gigantic farms in Africa to feed its own hungry masses. Mass distribution of free anti retrovirals and malaria drugs by the likes of billionaire Bill Gates and the US government has also stopped the AIDS epidemic in its tracks.

Mind you, this is not a country without challenges. The unemployment rate is stuck at a daunting 24.5%, crime is rampant, income disparities are vast, and inter racial strife still percolates under the surface. However, when the world's investors flip back to risk accumulation mode, this is a new country you should consider.

Are You a Bull or a Bear?