August 31, 2011 - Rare Earths Are Heating Up Again

Featured Trades: (RARE EARTHS ARE HEATING UP AGAIN)

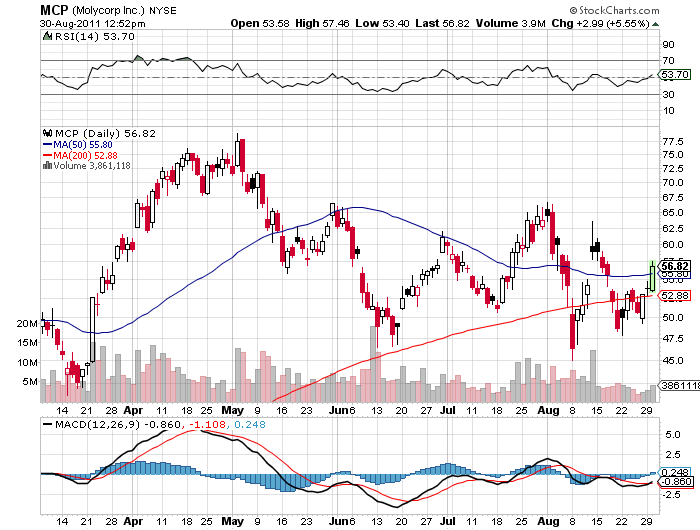

3) Rare Earths Are Heating Up Again. Long time readers remember fondly my 2010 play in the rare earth sector, where stocks like Molycorp (MCP), Avalon (AVARF), and Lynas Corp (LYSCF) clocked gains of over 400%, and the call options went ballistic (click here for 'Rare Earths Are About to Become a Lot More Rare'). After a somewhat dead 2011, this sector could be in for another shot of adrenalin.

Chinese authorities are enforcing one of the most aggressive clamp downs in history in an effort to close down illegal rare earth mines in China's southern Jiangxi province, it is said, for environmental reasons. ??The Middle Kingdom now accounts for 97% of the world's rare earth supplies, much of it produced by unlicensed rural farmers and organized crime.

The environmental damage caused by these small operators is enormous, with small leaching pits dotting the countryside in rare earth rich areas, seriously polluting local drinking supplies.

China's goal is to consolidate all production into three state owned giants, Baogang, Chinalco, and Minmetals, which, it is hoped, will act more responsibly. Authorities have been burning refineries, arresting offenders, and offering out rewards for others.

So named because they were hard to get in the 18th and 19th century, these once obscure elements have suddenly become the focus of several converging trends in the global economy. They are the key ingredient of magnets. There are 17 in all, divided into light (cerium, Ce, lanthanum, La, and neodymium, Nd) and heavy (dysprosium, Dy, terbium, Tb, and europium, Eu).

It turns out that you can't build a hybrid or electric car, a wind turbine, thin film solar, LED's, high performance batteries, or a cell phone without these elements. One Prius uses 25 kilograms of the stuff. You also can't fight a modern war without rare earths, being essential for radar, missile guidance systems, navigation, and night vision goggles. That's where things get interesting.

Rare earths were never really rare. What is scarce is the cheap labor and scant regulation that enabled them to be produced cheaply. This, China had in abundance. By the early 1990's , most western producers of rare earths had been undercut by low Chinese prices and driven out of business.

Last year, the increasing application of rare earths in modern electronics combined with tightening Chinese export prices drove the prices of some of the more valuable, heavier rare earths up tenfold. Since 2009, China's export quota for rare earths has been pared back from 50,145 tonnes to 30,184 tonnes this year.

This has prompted a scramble to develop new mines, notably in the US and Australia. But these mines take years to bring into operation, and certainly not in time to head off any short squeeze in supplies triggered by the Chinese clean up.?? Molycorp was brought back online after a 20 year hiatus with its IPO last year, but has yet to produce a single ounce. Therein lays the play.

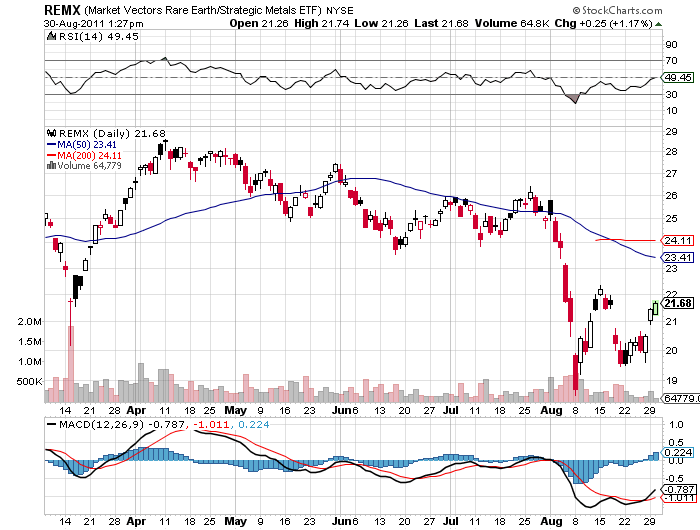

Going back into California's Molycorp at this level is probably not a bad idea. You can also look at the new ETF, Market Vector's Rare Earth/Strategic Metals (REMX), the product of the last bubble in this sector, which fell 36% from its April peak. It we get a return of the global 'RISK ON' trade in September, as I expect, this could be a great place to focus.

-

-

-