August 4, 2011 - The Head and Shoulders Is In

Featured Trades: (THE HEAD AND SHOULDERS IS IN), (SPX), (VIX),

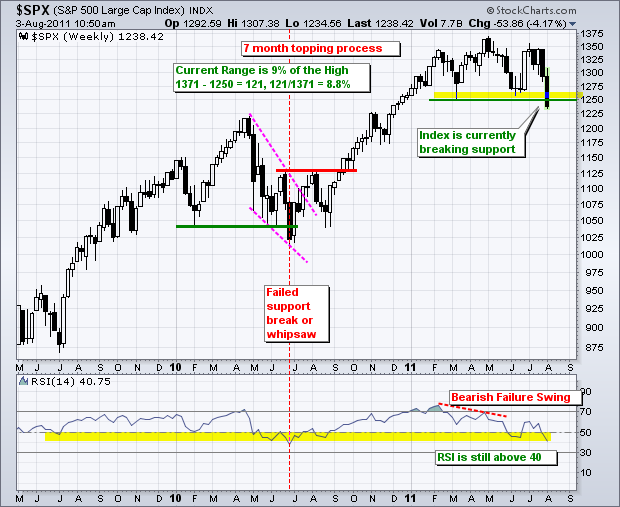

1) The Head and Shoulders Is In. Much of the selling that took the Dow down 265 points on Tuesday was generated by a clear 'head and shoulders top' pattern setting up on the charts. This occurs when you see three consecutive peaks on a chart, with the middle 'head' higher than the two 'shoulders'. This formation often presages more substantial movement on the downside. The number most mentioned by technicians today is 1160 in the S&P 500.

This has been a stunning move, barely escaping the nine consecutive down days not seen since 1978. What amazed everyone was the way the selling drove the indexes through 200 day moving averages like a hot knife through butter. Usually you see a battle fought between bulls and bears around these levels that can last days or weeks. In (SPX)'s case, this happened at 1284. The McClellan oscillator became more oversold than it was at the March, 2009 lows.

The day was saved by a mishmash of data on the jobs front that was just positive enough to cause the selling to abate and permit a 28 point rally in the (SPX). Virtually all the buying was short covering.

The Challenger Report showed job cuts up 60% to 66,414, continuing 16 months of continuous rises. The pharmaceuticals shed the most workers (13,493), followed by retail (11,245), and government (9,389). The greatest losses were in the East. Cisco announced enormous cuts, followed by Merck, and Borders went out of business completely. But ADP private sector employment in July was up 114,000, with 56,000 job gains in small business.

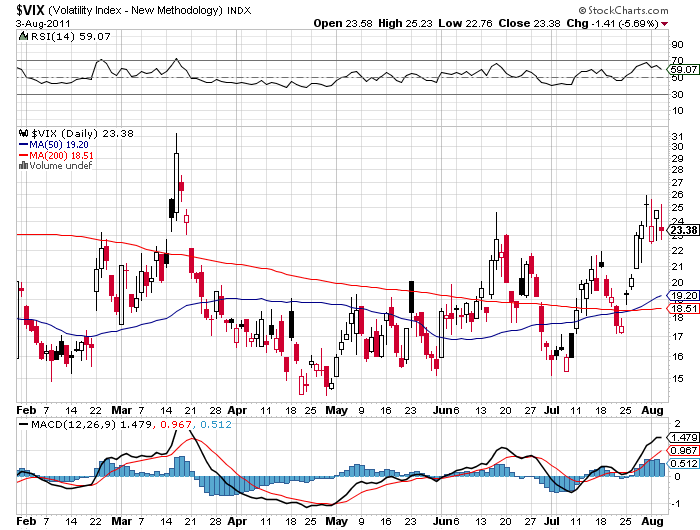

The great mystery in all this is the volatility index (VIX). With a 120 point drop in nine days, you would expect it to rocket well into the $40's. Instead it struggled to top $25 and is now falling. This means that few are buying insurance for further downside moves. There are two possible explanations. The market bottomed today after a good capitulation sell off, sending (VIX) traders into profit taking mode. Or, the big down move is ahead of us, like the next 90 points down to 1160, and the insurance has yet to be bought. I'll let you know which one it is when I figure it out.

One thing I know for sure. Great fortunes are not made selling markets down eight days in a row. We may get the answer when the big enchilada- the July nonfarm payroll figure- comes out on Friday. The consensus now is for a gain of 90,000. Any better than that and the market could surprise to the upside.

-