August 5, 2011 - Here is Where to Watch for the Turn

Featured Trades: (HERE'S WHERE TO WATCH FOR THE TURN),

(GLD), (FXF), (FXY), (TLT)

1) Here is Where to Watch for the Turn. What to say about Thursday's market? The 'RISK OFF' trade had its finest hour. The Dow average WAS down 512 points, NASDAQ (QQQ) cratered by 135 points, oil (USO) was off $6, and copper (CU) got smacked for 34 cents. Emerging markets (EEM) quickly morphed into submerging markets. Gold (GLD) provided no refuge today, dropping $45 in hours, and silver (SLV) gave back $4 in the blink of an eye.

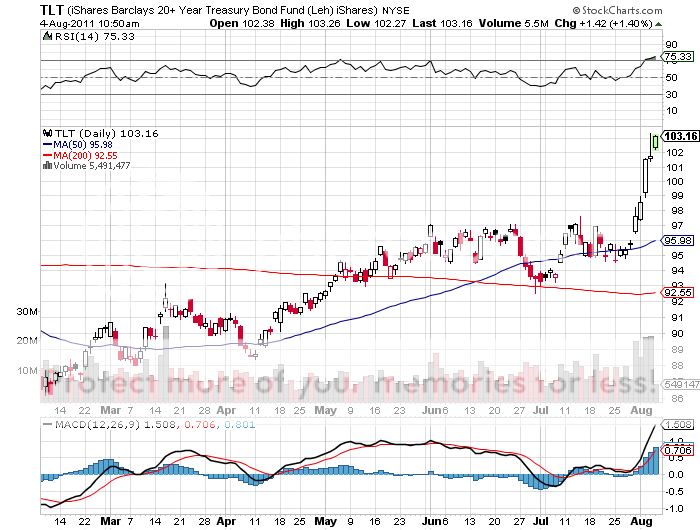

Only Treasury securities provided a safe haven, with overnight paper briefly showing negative interest rates. The yield on ten year Treasury bonds plummeted to 2.42%, nearly matching its 30 year low set last year.

Global contagion was back on the table, with credit default swaps for France blasting through to all-time highs. The European Central Bank's folly of raising interest rates in the face of a weak economy is now bearing its bitter fruit.

The confirmation of the 'head and shoulders' formation on the charts has triggered a an entire new round of selling by technically driven programs, clearly putting the 1,160 target on the downside in play. Margin clerks on Wall Street and the futures markets in Chicago were having a field day.

US stocks have lost $1.3 trillion in market cap in two weeks. This is on the coattails of the government sucking $2.4 trillion out of the global economy in the debt ceiling compromise. Gee, do you think there is a connection?

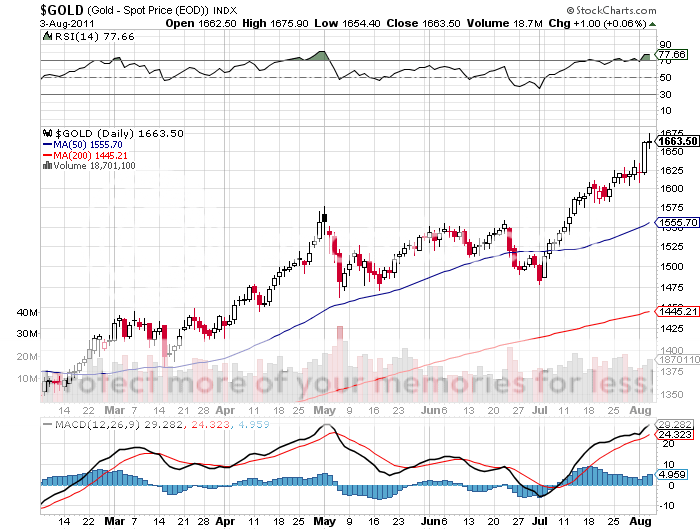

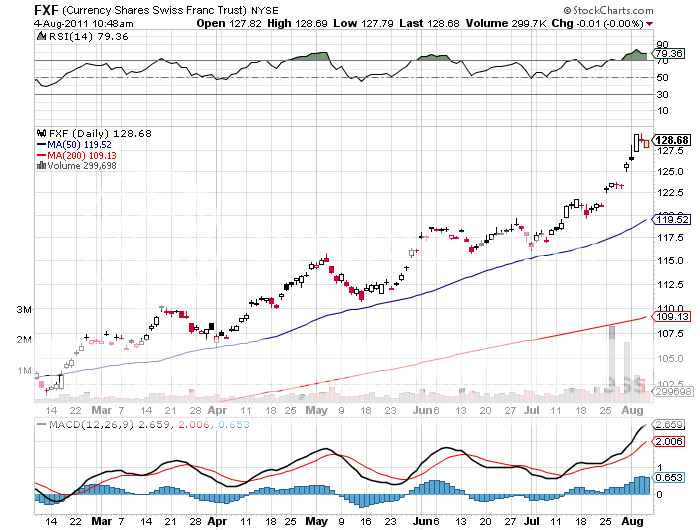

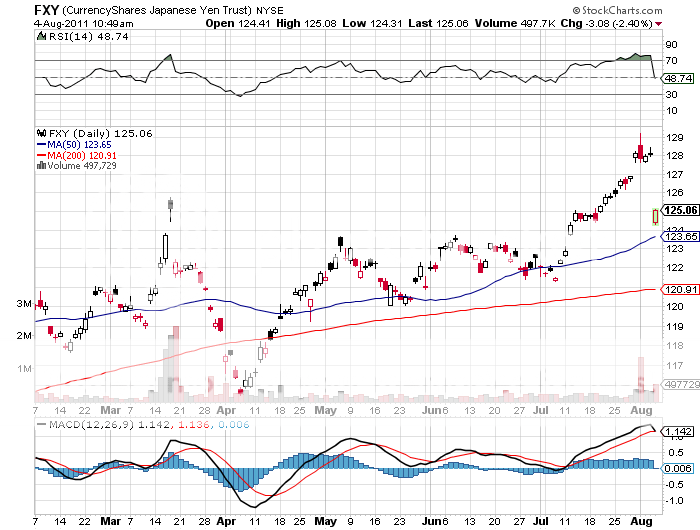

Here is where to watch for the next major turn in the markets. The traditional safe havens of gold, the Swiss franc, the yen, and Treasury bonds, have all posted hyperbolic moves to the upside over the past two weeks.

Now gold is making topping noises, the yen has seen a major reversal, and the Swiss franc has stalled. The fact that this is all happening in August makes all of these big moves suspect.

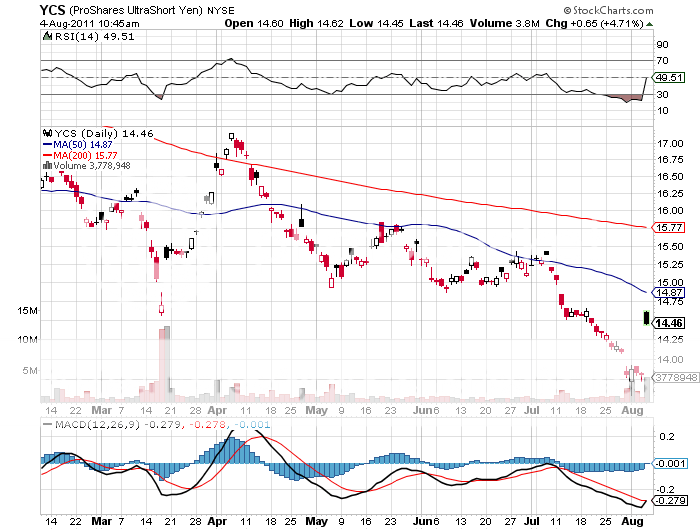

We may be seeing the first cracks in this monolithic 'RISK OFF' trade in the Japanese yen today. The Bank of Japan finally awoke from its long slumber, moving into the foreign exchange markets with a major intervention, gapping the yen down three and a half handles against the dollar. The leveraged short yen ETF (YCS) soared.

Further hope was engendered by the weekly jobless claims, which showed a loss of only 1,000. This is the second week in a row at the 400,000 level. Talk about being stuck on the 50 yard line.

JP Morgan dramatically ratcheted down its forecast for Q3 from 2.50% to 1.50%. Q4 was chopped from 3% to 2.5%. It now believes that we can expect no more than 2% growth in the first half of next year. Unemployment will stay at 9% through the end of 2012. It expects no movement by the Federal Reserves on interest rates until 2013.

I can't tell you how many people tried to get me to buy today. The fact that I ignored them is the only reason I still have ten fingers, as catching a falling knife did not appeal. If you believe that this is just a correction in a bull market, then this is a fantastic place to buy, and the rout will be over in a few days.

If, in fact, the next recession has already begun, then we have just seen the first 12% of a 50% move down that will last three years. That is because there will be no safety net in the next crash in the form of TARP, supplementary budgets, or QE3. The Tea Party wouldn't hear of it. I thought this worst case scenario wouldn't start until next year, but I could be wrong.

-

-

-

-