August 8, 2014 - MDT - Midday Missive

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

I sold a couple of 30 Yr Futures this A.M. @ 140.00.

I still have a resting order at the target to sell more.

This is a big macro level.

The 30 needs under the hourly support @ 139.10 to confirm a high.

This could take a couple of days to play out.

While the equity indices had an over sold bounce and trapped some weak shorts, this doesn't mean we don't go back down and retest or put in a lower low.

We're just a headline away from another risk off swoon.

In a perfect world the Bonds would have hit the tgt zone as the Equity Indices hit my go long levels.

Time Frame trading today.

It will be a late day trade.

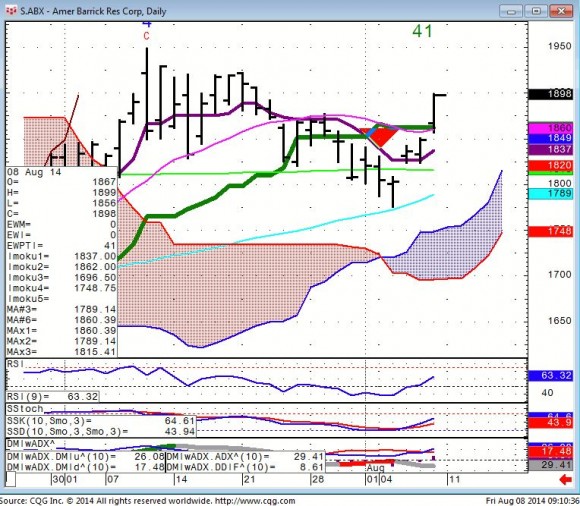

ABX...is attempting to put in a good low with a close over 18.78.

GDX...needs a close over 27.58 for a matching pattern.

Seasonally, August is a good time to look for a play in the Miners.

American Barrick

GDX

For Medium Term Outlook click here.

For Glossary of terms and abbreviations click here.