Last week, the bull move continued with the S & P 500 closing 9.27 points to the upside, at 2,182.87.

You no doubt recognize that it is now within 3 points of the 2,187.50 objective.? And pre open this morning, the S & P is trading 2.50 points to the upside, so it certainly appears that the objective will be hit.

Friday ended up trading almost 19 points to the upside after the release of the non farm payroll. We had expected a range expansion after two days of contractions.

All eyes will continue to be on earnings releases this week to determine if this move is sustainable.

This week we will hear from a number of retailers, including BABA on Thursday.

Here are the key levels for the markets.

VIX:

Minor level - 17.96

Major level - 15.63

Minor level - 14.85

Minor level - 13.28 *

Major level - 12.50 *

Minor level - 11.72 *

Minor level - 10.15

Major level - 9.38

Watch the 11.72 level today.? A close today under 11.72 and the downside objective should be to 9.38.

Resistance should be at 12.50.? Minor support at 10.16.

S & P 500 Cash Index:?

Major level - 2,250.00

Minor level - 2,234.38

Minor level - 2,203.12 *

Major level - 2,187.50 **

Minor level - 2,171.88 *

Minor level - 2,140.62

Major level - 2,125.00

Minor level - 2,109.38

Minor level - 2,078.12

Major level - 2,062.50

The S & P 500 is within 3 points of the 2,187.50 objective.

To move up to 2,250, it will need two closes above 2,203.12.

Minor support is at 2,171.90.

Nasd 100 (QQQ):?

Major level - 121.88

Minor level - 120.31

Minor level - 117.19

Major level - 118.75 *

Minor level - 117.97

Minor level - 116.41

Major level - 115.63

Minor level - 114.85

Minor level - 113.28

Major level - 112.50

The next level for the QQQ is 117.19.? Two closes above 117.19 and the QQQ should try and reach 121.88.? The QQQ closed Friday just under that level, at 116.78.

Minor support is at 116.41.? Minor resistance at 117.97.

TLT:?

Major level - 143.75

Minor level - 142.96

Minor level - 141.41

Major level - 140.63

Minor level - 139.85

Minor level - 138.28 *

Major level - 137.50

Minor level - 136.72

Major level - 134.38

Watch to see if the 137.50 level holds as support.

If it takes it out, expect a move down to 134.

136.72 should offer support.

GLD:

Major level - 131.25 **

Minor level - 130.46

Minor level - 128.91 *

Major level - 128.13 *

Minor level - 127.35

Minor level - 125.78

Major level - 125.00

Minor level - 124.22

The GLD took out the 128.13 objective Friday.

Two closes under 127.35 and the GLD should drop to 125.

Minor support is at 126.95.

XLE:

Major level - 71.88

Minor level - 71.10

Minor level - 69.53

Major level - 68.75

Minor level - 67.96

Minor level - 66.41 *

Major level - 65.63 *

Minor level - 64.85

Minor level - 63.28

Major level - 62.50

The XLE is inching up to the 68.75 objective.

67.19 should be minor support.? 67.97 should also offer minor resistance.

Apple:

Major levels for Apple are 112.50, 106.25, 100, 93.75, and 87.50.

Apple closed at 107.48 on Friday.? Two closes above 107.81 and the objective should be to 112.50.

106.25 should act as support.

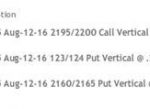

Watch list:

Bullish Stocks: PCLN, AMZN, ULTA, AVGO, RTN, ZBH, FFIV, CMI, FB, SWK, MON, JACK, CME, JACK, ALGN

Bearish Stocks:? ATHN, SRCL, WDC, HIG, CF, VGR, FLO

?

Be sure to check earnings release dates.