Your Source For Winning Trade Alerts, Real Market Wisdom, and Global Economic Insights For Free!

"*" indicates required fields

Sign up for free! and get my free research today!

"*" indicates required fields

Some asset classes are reflecting the fact that we are already in a full-blown recession, while others are not. In case I am wrong and we DO go into a recession, knowing how to sell short stocks will be a handy skill to have. It will become essential to be knowledgeable about all the different ways

Thank John for his ceaseless banter. I enjoy this service so much. Great stories!!!! I hope our paths cross soon. Thank you. Bill North Carolina

Just a quick note of appreciation for your helping me decide to get my clients into (GLD) with a 15% allocation early this year. It sure has helped me to be more of a hero to my clients this year than a goat... Best wishes to you and yours! Keep 'em coming. Brad Bakersfield, CA.

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting in Orlando, Florida at 12:00 PM on Thursday, January 8, 2026. A three-course lunch is included. I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to

Ingenious writing John in your Monday morning strategy letter. I forwarded it to all my family and kids, and made my 16-year old read it out loud to my wife. I made sure he understood what he was reading. I got choked up by the whole article. Go Ukraine! Best regards, Greg Las Vegas, NV

Trade Alert - (AAPL) – BUY BUY the Apple (AAPL) December 2026 $230-$240 at-the-money vertical Bull Call spread LEAPS at $5.50 or best Opening Trade 9-5-2025 expiration date: December 18, 2026 Number of Contracts = 1 contract With Apple about to announce its next-generation iPhone 17 on Sunday, which is AI-enabled, this is a

Lately, I have spent my free time trolling the worst slums of Oakland, CA. No, I’m not trying to score a drug deal, hook up with some ladies of ill repute, or get myself killed. I was looking for the best-performing investment for the next 30 years. Yup, I was looking for new homes to

I received a call from a friend the other day. He said he bought Goldman Sachs last summer, a great move, since it has since risen by 86%. That is, until last week, when he got a margin call from Goldman Sachs. It turns out that he didn’t actually BUY (GS); he sold it short,

Come join me for dinner at the Mad Hedge Fund Trader’s Global Strategy Dinner, which I will be conducting in Incline Village, Nevada, on Friday, August 22. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period. I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious

At some point in 2024, we are going to need to SELL. Maybe there will be an economic slowdown, a surprise election outcome, or a flock of black swans. However, there is selling and then there is selling. I have a new training video on how to execute a vertical bear put debit spread. You

There is only us, there is no them, said director Ken Burns when speaking about the American people.

Occasionally, I get a call from Concierge members asking what to do when their short positions in options were assigned or called away. The answer was very simple: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly. We have the good fortune

When I was in Ukraine, the air raid sirens used to go off every night exactly at 2:00 AM. The Russian goal was to deprive the civilian population of sleep and to make their lives miserable. It was also when the country was least able to defend itself. You knew the missiles were on the

If demographics are destiny, then America’s future looks bleak. You see, they’re just not making Americans anymore. At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture. I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call

We certainly are having to work hard for our crust of bread in the stock market this year. April brought us the fastest downturn in stocks in 16 years, immediately followed by the sharpest upturn in 21 years. It's like running for a treadmill heart test, but a sadistic doctor keeps raising the angle of

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV. Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies? A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When

A significant proportion of my Mad Hedge subscribers are either retired or are about to do so. I have therefore gained from them a lot of valuable information about how retirees can best manage their financial resources, as well as the worst mistakes they commit, which I thought I might pass on. I have also

I like to start out my day by calling readers on the US east coast and Europe, asking how they like the service, are there any ways I can improve the service, and what topics would they like me to write about. After all, at 5:00 AM Pacific time, they are the only ones around.

A huge new buyer may eventually enter the gold market. That could be a year off, maybe two, or three at the most. I’ll give you a hint who: your taxes will pay for it. If true, it could send the price of the barbarous relic soaring above $5,000, or even $50,000 an ounce, a

Last week, a concierge customer asked me an excellent question. Having correctly called the top in this market to the hour, what would it take for me to go all in on the long side and get maximum bullish? With everyone now laser-focused on downside risks, which was really a last February game, I thought

Gosh darn it, you nailed it again! Trump stopped firing Powell. Banks are on fire. Netflix hit a new high. Score John Thomas 100, everyone else zero. Well done, John AND let's keep it going. You're the Savant of the time at the moment. Talk to you soon, bye. Bill Florida

Today is when you get off the fence and join!

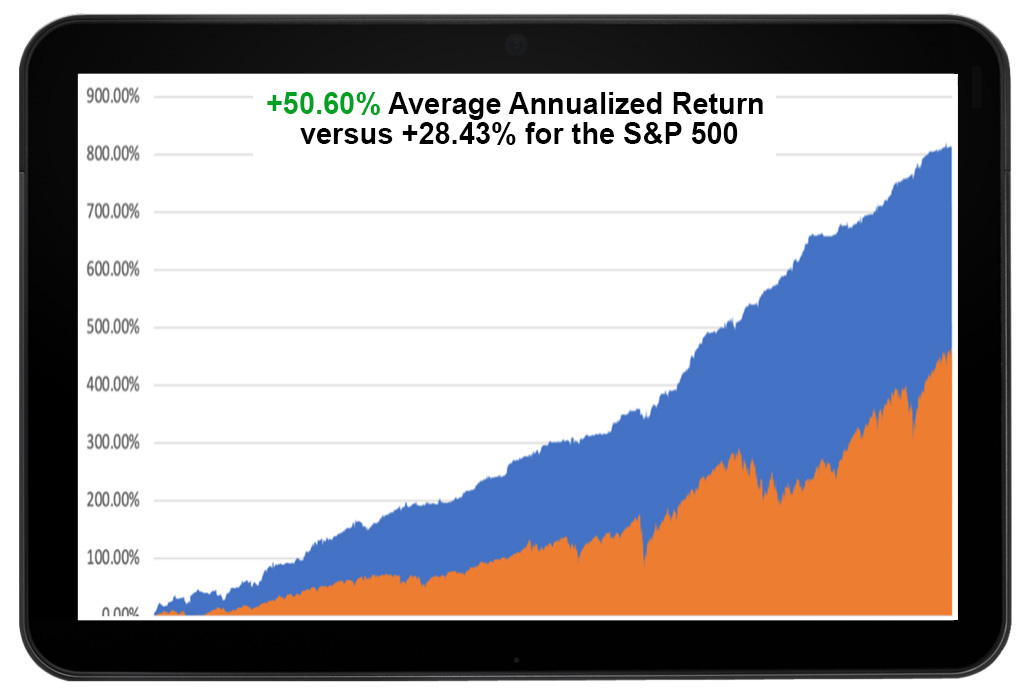

To make this offer utterly irresistible I will throw in a free copy of my best-selling book, Stocks to Buy for the Coming Roaring Twenties. Read it now before the companies I recommended double in value again!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.