Bear Trap Sprung

The coming bear trap that I warned about last week sprung this morning on the non-subscribing unwary, triggering panic buying by short sellers in all ?RISK ON? assets. Oil (USO), gold (GLD), silver (SLV), copper (CU), and foreign currencies all moved in lockstep to the upside. The trigger was news that leaked out over the weekend that the International Monetary Fund would make available several hundred billion dollars to bail out the beleaguered European ?PIIGS?.

Never mind that the IMF immediately denied any such moves from multiple offices around the world. The tipoff that something big was coming was the strong performance during Friday?s stock market opening, ostensibly off the back of healthy ?Black Friday? figures, which rapidly faded at the close. I suppose the big money was too busy fighting turkey indigestion to maintain the ephemeral gains. Once the buying started during the Sunday Asian market hours, it was all over but the crying.

With many managers poo-pooing today's move, one has to ask if this is a one day wonder, a much needed 24 hour holiday from the deluge of bad news from the Continent?

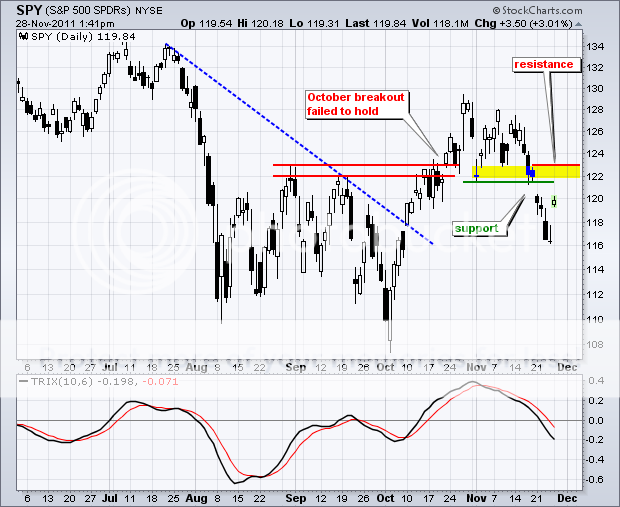

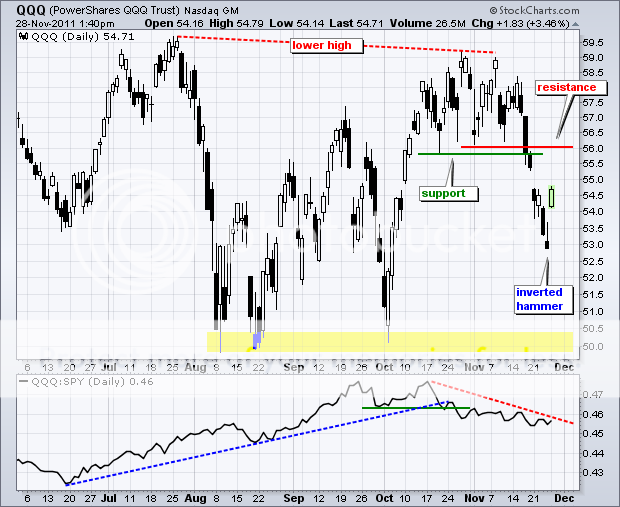

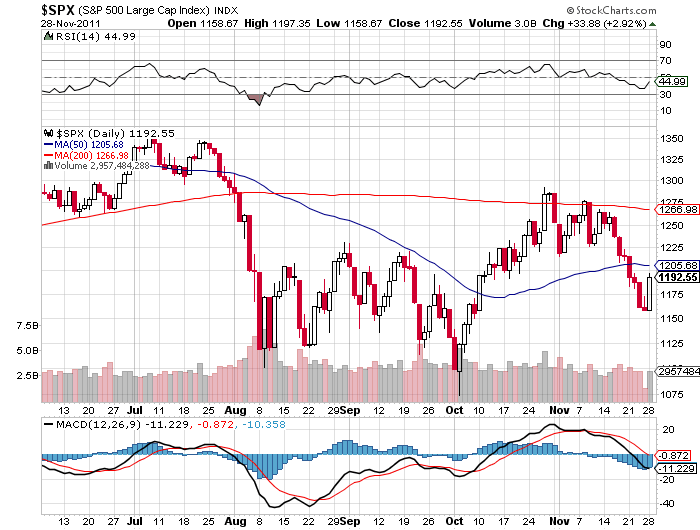

The charts below suggest that this is more than a one day wonder and that there is more juice to go. Certainly breaking the 50 day moving average at 1,205 would be a positive development. At the very least, we should take a run to the old S&P 500 support level at 1,230, which should now pose substantial resistance. Break that, and the 200 day moving average at 1,266 comes into play, close to the three month highs we saw two weeks ago.

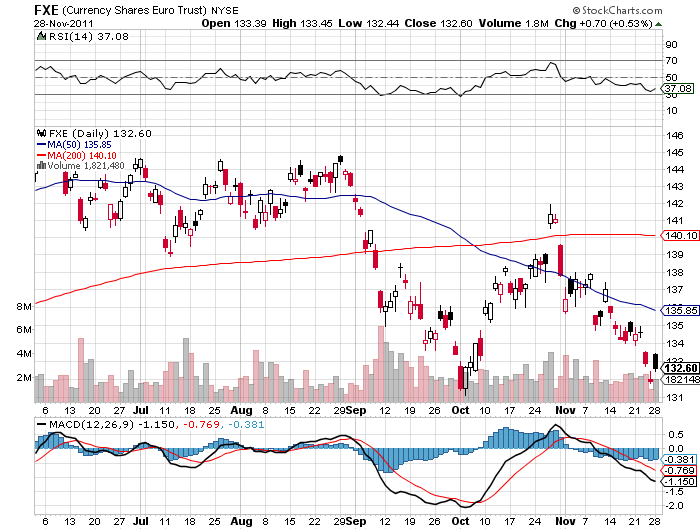

The interesting mover today was the Euro, which hardly moved at all, the ETF (FXE) gained a scant 0.53%. You would think that the troubled European currency would be the primary beneficiary of any rescue attempts. It wasn?t. This feeble response tells me that the Euro is fundamentally flawed, is still the currency that everyone loves to hate, and is looking at more downside than upside. That is why I didn?t join the lemmings this morning scrambling to cover shorts.

Cover Those Shorts!