Ben Bernanke Will Say Nothing on Thursday

All eyes will be focused on Federal Reserve Chairman, Ben Bernanke, on Thursday looking for any hints that further quantitative easing is on the way. Don?t get your hopes up. I don?t expect the esteemed former Princeton professor to conveniently tip his hand. At the most he might make a reference to ?keeping all options open,? and that is it.

The Fed?s Beige Book was released today and doesn?t by any means justify bolder action. This is the report that Ben will have in hand when he treks up to Capitol Hill for his congressional testimony.

According to the report, the economy is expanding at a moderate pace. Manufacturing, loan demand, capital spending, consumer spending are all up modestly. New York rents are rising. Auto sales are strong. Construction is up in both the residential and commercial sectors. Price inflation and wage pressures remain modest. It is all consistent with the lukewarm, flaccid 2% GDP growth that I have been arguing for all year. There isn?t a QE3 anywhere in this.

You can therefore expect market to be disappointed once again. Whether the selloff resumes mid-way through Ben?s statement, when it is over, or sometime next week, is anyone?s guess. Keep in mind that everyone and his brother is looking to sell this rally. So you will need the fastest mouse finger in the West to unload at the top. It is wiser still to start scaling in at this level here, with the S&P 500 at 1,318.

If Europe can just shut up for a few more days and quit acting like a chicken with its head cut off, then we might make it up to the 1,336 high that we saw last week. That would be an opportunity to double up your short and sell out of the money calls. If the Greek election on June 20 goes the right way, then we could make it all the way up to 1,350. That would be a textbook retracement of half of the move down that started on April 2. However, I doubt we?ll make it that high.

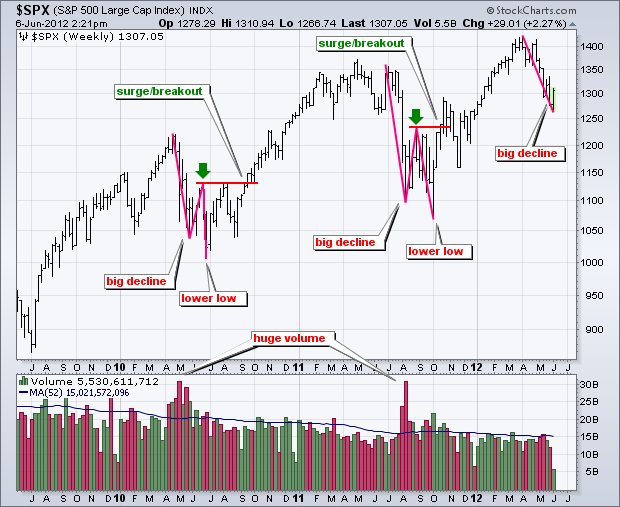

Take a look at the chart below and you?ll see that in recent years corrections have been a two-legged affair. First you see a dramatic selloff, then a dead cat bounce worth 50% of the move down, then a new marginal low. This logic also points to a final bottom at 1,250 or 1,200.

I am able to add shorts here because I covered the ones I had within one point of the 1,268 bottom on Monday. This enabled me to clock a three day, 45% gain in my short position on the S&P 500 (SPY). It gives me the dry powder I need to reload up here. That is provided I have the fastest mouse finger in the West, which my close friends assure me I do.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011, putting it among the top hedge fund managers. The average annualized return since inception is 26%. The service includes my Trade Alert Service, daily newsletter, real time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Fastest in the West?