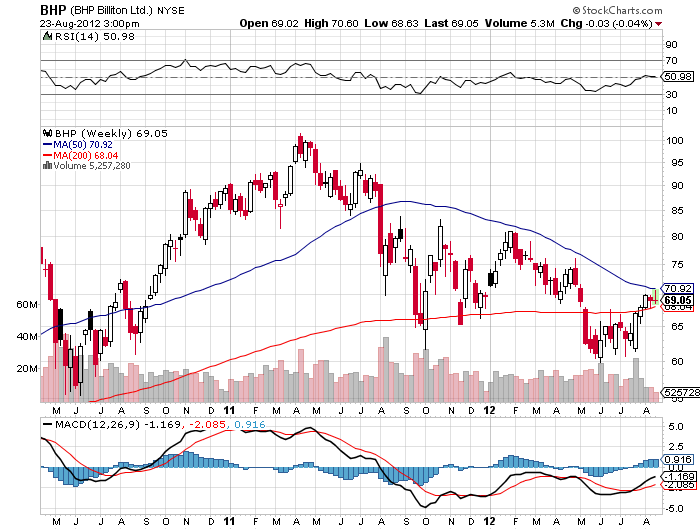

BHP Cut Bodes Ill for the Global Economy

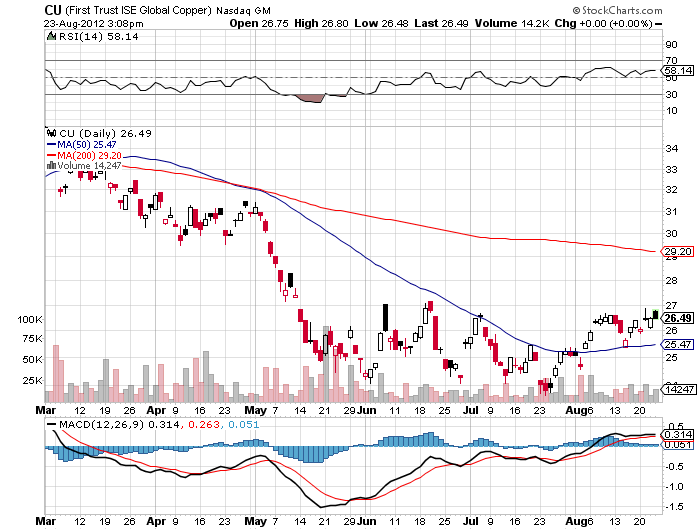

The decision by BHP Billiton, one of the world?s largest producers of copper, to postpone its planned $20 billion expansion of its Olympic Dam mine is sounding alarms about the near term state of the global economy. It is telling us that China is slowing faster than we thought, that demand for base metals is shriveling, and that we are anything but close to exiting out current market malaise. This is not good for risk assets anywhere.

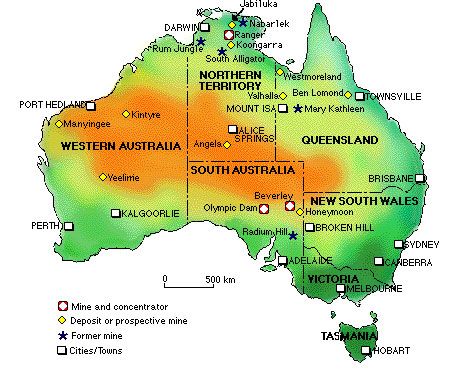

The news comes on the heels of a company announcement that earnings would fall from $21.7 billion to $17.1 billion this year. The weakest demand from China in a decade was a major factor. So was the Fukushima nuclear disaster, which dropped prices for uranium, another product of the Olympic Dam mine. Piling on the headaches was a strong Australian dollar, which escalated capital costs. BHP CEO, Marius Kloppers, has said that there will be no new expansion of the company?s capacity approved before mid-2013.

Olympic Dam is the world?s fourth largest copper source and the largest uranium supply. The upgrade was going to involve digging a massive open pit in South Australia that would generate 750,000 tonnes of copper and 19,000 tonnes of uranium a year. Almost the entire output was slated to be shipped to the Middle Kingdom. When Chinese real estate flipped from a ?BUY? to a ?SELL? last year, the days for this expansion were numbered.

I have been following BHP for 40 years, and a number of family members have worked there over the years. So I know it well, and can tell you that their pay and benefits are great. I have used it as a de facto leading indicator and call option on the future of the world economy. When the share price delivers a prolonged multiyear downturn as it has recently done, it is a warning to be cautious and limit your risk.

Hey, I Saw That Parking Place First!