Breakfast with Mohamed El-Erian

Passing through Los Angeles for a day, I thought I would take a walk down Nostalgia Lane and have breakfast at the historic Langham Huntington Hotel, the venue for my 1970 senior prom.

I was half way through my eggs Benedict in the Terrace Room when, who sits at the next table, but bond giant PIMCO?s brilliant former CEO and co-CIO, Mohamed El-Erian.

That?s the last time he makes that mistake. I proceeded to grill him on the long-term prospects for the global economy, in the politest way possible.

Mohamed anticipates ?a bumpy journey to a new normal.? Developed countries will see sluggish economic growth, high structural unemployment, increased regulation, and constant pressure for private sector deleveraging.

Emerging economies will maintain the breakout stage of their development phase. They will deliver high economic growth, strong currencies, and increasingly close the income gap with the developed world.

Policymakers have embraced initiatives designed to boost asset prices, divorcing them from economic fundamentals. The impact on Main Street has fallen well short of expectations. Interest rates have been repressed.

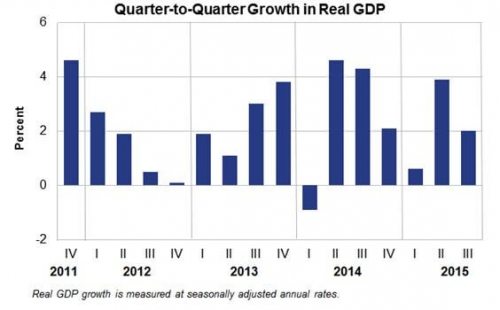

Mohamed thinks we will see an uneven and faltering economic recovery over the next five years. He is sticking with his long-term growth rate for the US of 2%. Investors face a particularly devilish challenge in that much of our past returns have already been borrowed from the future.

Inflation will return eventually. Commodity prices will rise. Yield curves will steepen. High dividend stocks will prosper. Many emerging market currencies will appreciate.

El-Erian has one of the best 90,000-foot views out there. A US citizen with an Egyptian father, he started out life at the old Salomon Smith Barney in London and went on to spend 15 years at the International Monetary Fund.

He joined PIMCO in 1999, and then moved on to manage the Harvard endowment fund. His last book, When Markets Collide, was voted by The Economist magazine as the best business book of 2008. He regularly makes the list of the world?s top thinkers. A lightweight Mohamed is not.

His final piece of advice? Engage in ?constructive paranoia? and structure your portfolio to take advantage of these changes, rather than fall victim to them.