Will the Ark Innovation Fund Crash?

Michael Burry, the audacious hedge-fund icon who is famous for being represented in the movie “The Big Short,” is aggressively taking the other side of Cathy Woods, a name synonymous with tech growth.

Such prominent names at loggerheads with each other signals a divergence in interest rate expectations and the fallout, or lack of it, for tech growth stocks.

That is fundamentally the crux of the issue, with the stock market levered so heavily that even a quarter rate rise would undermine it.

Woods seems to minimize any ill-effects that broader volatile behavior will have on her niche area of the tech market.

Statistically speaking, growth tech outperforms the broader market when already low-interest rates are expected to trend lower.

The inverse holds true when interest rates are expected to rise, then tech growth stocks will underperform the broader market and even non-growth tech.

This is precisely why in 2020, elevated growth names rode the wave of the pandemic and shelter-at-home trade as the Fed lowered rates to fuel the stock appreciation.

The party is somewhat over now; or at least the low-hanging fruit has been plucked.

Burry disclosed that his firm, Scion Asset Management, held bearish put options against 235,500 shares of Woods’ actively managed ARK Innovation exchange-traded fund (ARKK) at the end of the second quarter.

The new position was valued at almost $31 million, according to the quarterly filing, which is required for hedge funds above a certain size.

Burry also has a growing put position worth $731 million in Tesla (TSLA), which remains Wood's highest conviction stock.

Woods responded saying, “I do not believe that he understands the fundamentals that are creating explosive growth and investment opportunities in the innovation space.”

Woods doesn’t understand that this isn’t a call based on a long-term forecast of growth tech outperforming the broader market but more of a short-term call that even slightly rising interest rates will penalize high beta names more than the rest.

No doubt that Burry has a clearly defined entry and exit point while Woods seems to be in the business of blanket statements disregarding idiosyncratic particulars which is a dangerous game.

There is the premise out there that a slightly rising interest rate will rotate money back into FANG names who can, by and large, stomach the ensuing bond rise opposed to loss-making growth stocks that depend on cheap money to fuel unproven business models.

Last year was sensational for ARK Invest, there is no point to play this down, it raked in billions of new assets from spectacular performances by Wood’s active ETFs focused on high-growth innovation-driven stocks. Several were among 2020’s best-performing funds, with returns of more than 100%.

But the funds have struggled to maintain that momentum this year. Many of their stock holdings are trading at frothy valuations that are betting on outperforming expected growth in the future.

As inflation flares up and interest rates rise, the current value of the growth companies’ future cash flow diminishes.

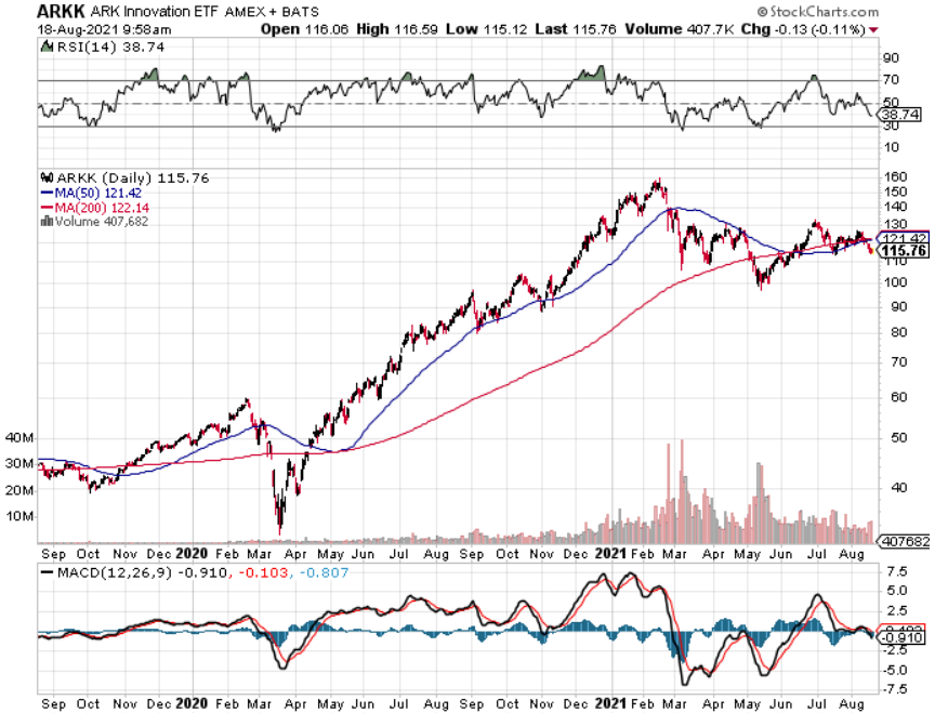

The ARK Innovation ETF is now 6% down for the year, with $500 million asset outflows in the past month.

Burry hasn’t been always right such as pulling out of GameStop (GME) in 2020 before the frenzied buying, which left a 2,000% surge on the table.

Wood also told us that Burry may not understand the current growth environment, as inflationary pressures are likely to be short-term in nature.

"Most bears seem to believe that inflation will continue to accelerate, shortening investment time horizons and destroying valuations," Wood explained. But Wood thinks supply-chain-related issues will be resolved, helping relieve inflationary pressures.

Wood pointed to a sharp drop in certain commodity prices in recent weeks (including lumber, copper, and oil) in regards to explaining why inflation may not linger for as long as some think. Used-car prices are also beginning to fall after an extraordinary rise, and a strengthening US dollar has also put pressure on commodity prices, according to Wood.

Nevertheless, Woods fails to chime in on China closing one of its biggest ports or Southeast Asian manufacturing hubs like Vietnam, Thailand effectively being shutdown from the delta virus.

Ultimately, Woods offers an overly blasé attitude towards an extremely niche problem. It is almost as if she would say the same thing no matter what condition the broader market is in.

And while cheerleading the stocks you are invested in is not a criminal act, to completely miss that Burry most likely has a different timeline than Woods shows that she has tunnel vision in terms of the phase of the economic cycle we are in.

I would say with conviction that it’s normal for Tesla to retrace after a 600% move up in 2020. There is nothing wrong with it and I see it as healthy market behavior.

Burry is essentially betting on a revision to the mean, which is high risk, ostensibly, Tesla most likely won’t rise another 600% in 2021 as well which is where Burry comes in.

I won’t sit here and advocate to market time mean revisions of tech growth stocks as we are not in that business, but this little skirmish screams to jump back into best-of-breed tech stocks to protect ourselves at frothy levels.