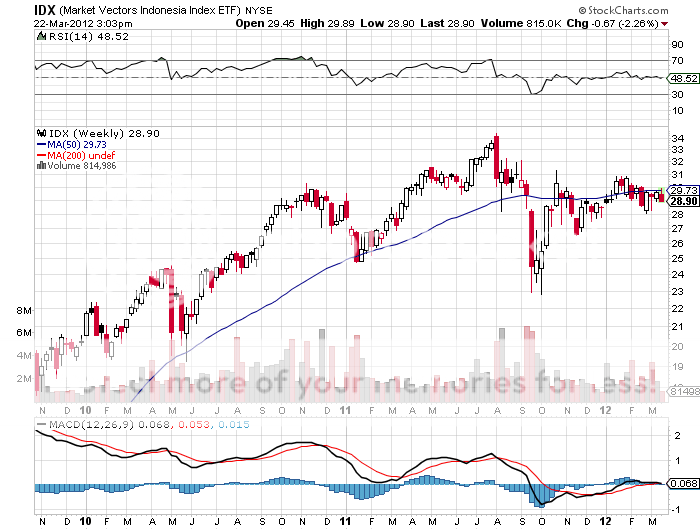

Buy Indonesia on the Dip

If you are looking for another emerging market to add to your list of things to buy on big dips, then take a look at Indonesia.

The world?s largest Muslim country offers a combination that I love, a population with great demographics that is also a major energy and commodities exporter. The archipelago is the biggest country in Southeast Asia and a huge exporter of oil and LPG to Japan on long term contracts. (An old friend of mine torched their Borneo fields at the beginning of WWII, and spent four years in a Japanese prison camp for his troubles.)

Other big exports include marvelous textiles, rubber, and increasingly rare tropical hardwoods. The global financial crisis only knocked their growth rate from 6.1% to 4.5%, and now it is back above 6%. No doubt, $63 billion of direct foreign investment into the country last year helped.

A series of tax reforms promise to keep the train moving, cutting the top corporate rate from 30% in 2008 to 28% in 2009, and 25% in 2010.? Wisdom Tree had the ?wisdom? to launch the country?s first ETF (IDX) close to a market bottom, a rare event indeed (what timing!), which became one of the best performers of 2009, rocketing over 300% from the lows to $60.

Islamic inspired terrorism is still a lingering concern. I keep Indonesia in the category of highly volatile, high risk, high return frontier markets that you only want to buy on a big dip. Keep it on your radar.