Buy What Ben?s Buying.

In view of Federal Reserve Chairman, Ben Bernanke, yesterday: ?it is time to reassess one?s investment strategy. ?The former Princeton professor didn?t give us QE3, he gave us QE3 with a turbocharger, on steroids, with an extra dose of adrenaline. ?He could spend another $1 trillion before all is said and done. ?If ever an economic theory was pursued to extremes, this is it. ?No doubt future PhD candidates will be writing theses on this move for the next 100 years.

If the QE3 guessing game was driving you nuts this year, you better sign up for frequent flier points with your psychiatrist. ?After the initial commitment, the Fed reserves the right to renew quantitative easing, with the decision to be rendered on the last business day of each month in any size to buy any securities. ?Yikes! ?Will the market now flat line every month and then gap up or down 500 points on the final day when the August decision is announced? ?Double Yikes!

I am not going to sit in my throne at the beach like King Cnut and order the tide not to rise and wet my feet and robes. ?It is not for us to trade the market we want, but the market we have. ?It is interesting listening to the commentary on all of this. The fundamentalists are pissed off because their hard work led to a near universal conclusion that the economy was tanking, only to be met by a stock market surging to a new five year high. ?The technicians are cautiously optimistic trumpeting new upside breakouts. ?The index players (what few are still in the market, anyway) are ecstatic, now that going to sleep is paying off once again.

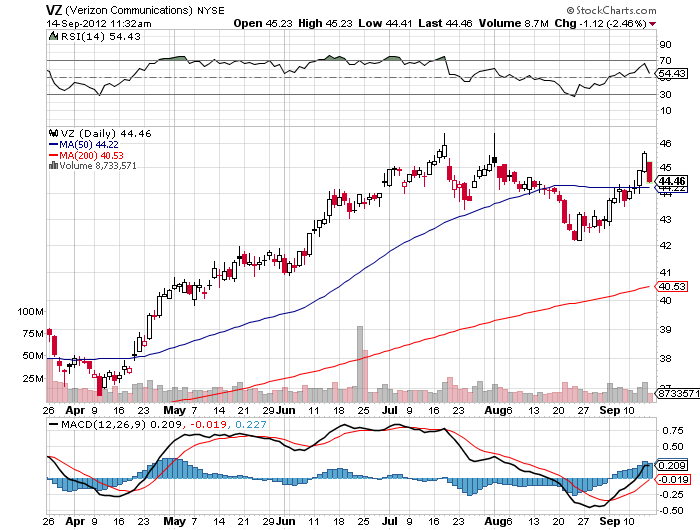

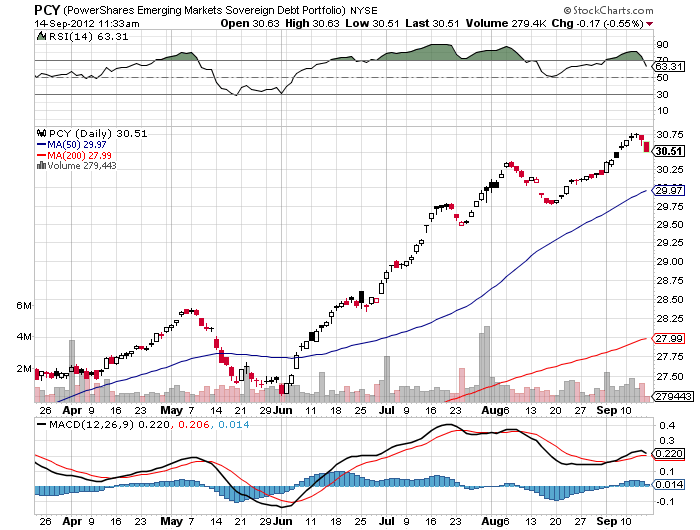

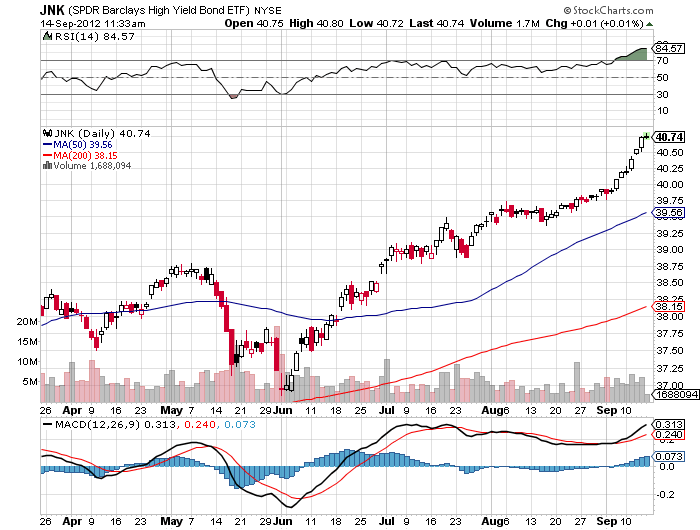

The basic strategy here is to throw risk out the window and gun for yield, which the Fed has put squarely back on the table. ?That means buying junk bonds (JNK), (HYG), at a 7.00% yield, emerging market sovereign debt (PCY) at a 4.72% yield, and high-yield equities like the telecoms, such as Verizon (VZ) and AT&T (T), which both yield around 4.70%. ?At least this way, you get paid for waiting out any heat on the downside.

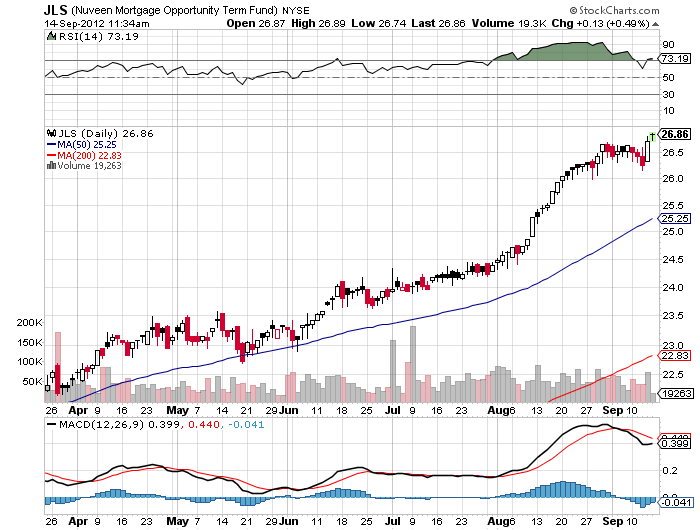

You could even buy exactly what Ben Bernanke is buying: mortgage-backed securities. The central bank will be purchasing half of the $140 billion a month in mortgage backed bonds that Fannie Mae (FNM), Freddie Mac, and Ginnie Mae sell to meet its new commitments. You can easily do that through picking up the Nuveen Mortgage Opportunity Term Fund (JLS), a closed end fund selling at a $2% premium to net asset value. It carries a hefty 7.7% yield, but not for long.

It is 73% invested in residential mortgage-backed securities, 12% in commercial mbs, and 7% in agency collateralized mortgage obligations. ?It does use leverage and hedging strategies to achieve this acrophobic yield, and already had a big gap up in price yesterday. ?But what are the chances that it discounted the next year of Fed bond buying in just one day? ?About zero.