Calling the Top in Oil

I?m calling the top in oil right here, but only for this month.

Longer term, we are headed upwards. But that is more of a 2017 story.

If you can?t do options, buy the ProShares Ultra Short Bloomberg Crude Oil ETF (SCO) for a quick trade.

The concept behind this trade is really very simple.

This is a bet that the United States Oil Fund (USO) will not rise above $12.50 by the November 18 expiration date, a new high for 2016.

An agreement to cap production at the Algiers OPEC meeting delivered a monster 20.40% short covering rally in oil. The quotas will be fixed at the next OPEC meeting in Vienna on November 30.

However, not a single person in the industry believes the agreement will be finalized, or if finalized, not honored. Cheating inside OPEC is legendary. The Saudis know this.

Therefore, I think oil will put in a short-term top here, and then trade sideways to down for the next month.

In addition, the current $51/barrel I see on my screen is going to stimulate a ton of new production from US frackers.

Thanks to rapidly accelerating technology, American drillers can turn oil production on and off faster than at any time before in history.

There are now over 1,000 DIP wells in inventory, wells that have been drilled, but not completed, and they can be brought online in months. That alone is worth 1 million barrels a day in new US production.

Also to consider are Iraq?s military victories against ISIS and the outbreak of stability in Libya, both of which will generate substantial new oil supplies.

I think the bear market in oil is over, thanks to a recovering global economy. I intend to write a major research piece as to why in a few days.

I just don?t think we are blasting though to a new yearly high in oil in the next 28 trading days, given the OPEC dynamics.

Hence, the short side (USO) trade alert.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's market, investors need every advantage they can get.

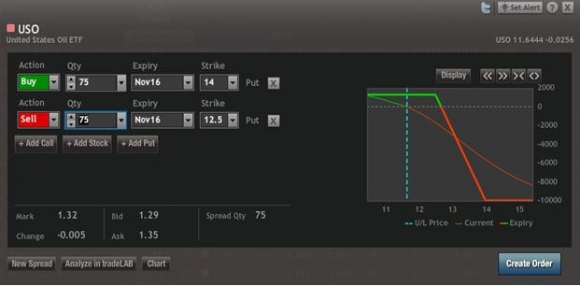

Here are the specific trades you need to execute this position:

Buy 75 November, 2016 (SPY) $14.00 puts at????.?.??$2.41

Sell short 75 October, 2016 (SPY) $12.50 puts at.???.?..$1.09

Net Cost:????????????????????......$1.32

Potential Profit: $1.50 - $1.32 = $0.18

(75 X 100 X $0.18) = $1,350, or 13.64% profit in 28 trading days.