Carnage in the Grain Pits

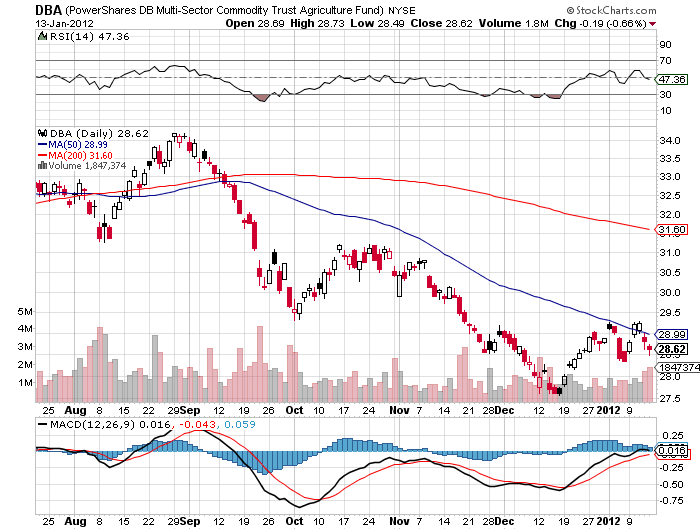

I have been warning readers away from the agriculture space for the past few months, and on Thursday you found out why.

More than 90% of the street was positioned for a bullish report, expecting that the last summer?s blistering drought and ongoing dryness in South American would lead to inevitable shortages.

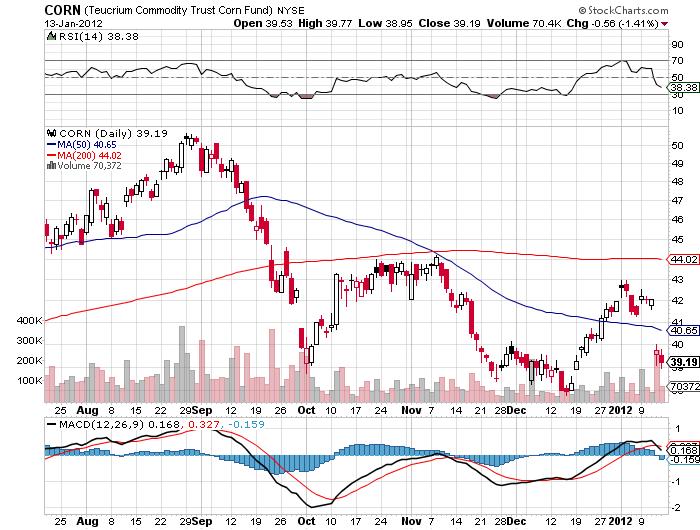

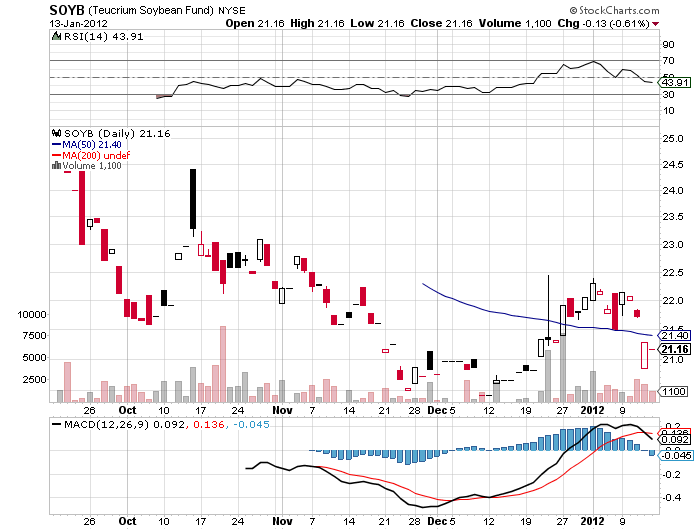

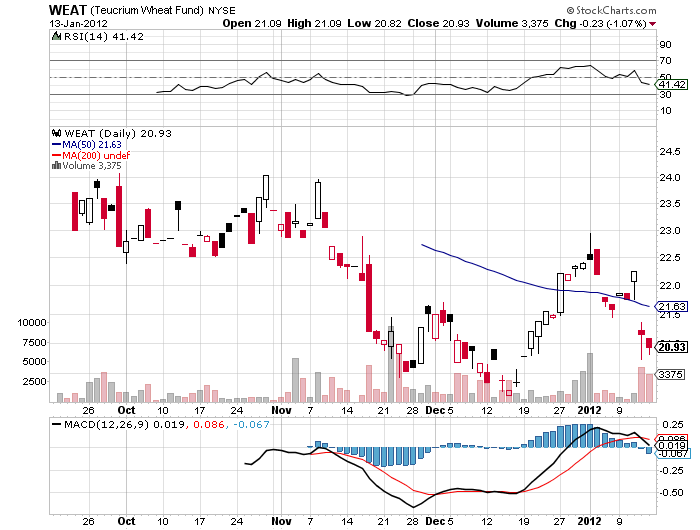

Instead, the US Department of Agriculture dropped a bombshell, predicting in its closely watched crop report that there would be copious oversupplies of every major grain for 2012. Prices utterly collapsed, with corn (CORN) closing limit down on the day.

This is not the first time this has happened. Over the past year, the USDA has lost, and then later found, 100,000 million bushels of corn, twice, sending prices gyrating each time, and putting traders through a meat grinder. Conspiracy theorists suspect political manipulation, insider trading, or just shear incompetence. Budget cuts are a more likely cause. The less money the government agency has to spend, the more volatile and less reliable its numbers are becoming. This is a major reason why I avoid the sector like a plague going into these reports.

I?ll tell you what happens from here. After a few weeks or months, these new developments will get digested by the marketplace. A few bodies will float to the surface, as overleverage by small traders reaps its grim harvest. Liquidation of their positions will give us our final low.

Then the long term bull market in food will resume its inexorable climb, and the grains will begin a slow grind up. The bottom line is that the world is making people faster than the food to feed them. Of the 2 billion souls who will join the global population over the next 40 years, half will come from countries unable to grow enough of their own food, primarily in the Middle East. It is just a matter of time before the weather turns hostile once again. There is the ever present tailwind of global warming. And who knows? The next USDA crop report could surprise to the downside, sending prices soaring.