Carvana Isn't Nirvana

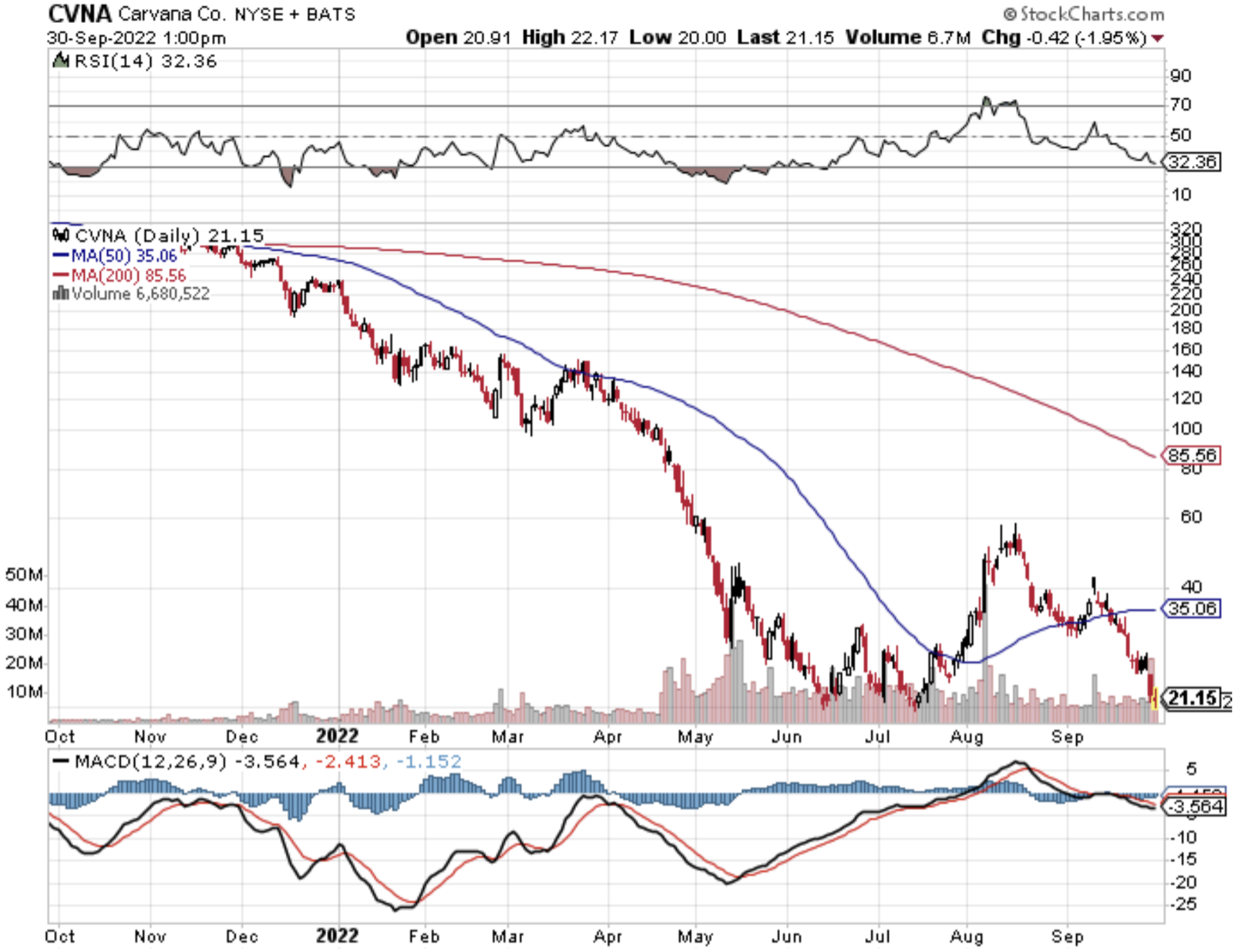

Avoid Carvana (CVNA) stock.

Don’t expect a quick reversal in this digital used-car dealer after the car buying frenzy over the past couple of years.

Why?

We have reached the high water mark in American automobile sales setting up a sharp cliff edge as increasingly, US consumers are either priced out of buying a new used car or have decided to drastically cut back discretionary spending on larger items.

This has sent shockwaves for used car retailer CarMax (KMX) whose stock cratered by 24% and our tech play derivative CVNA who dropped 20% when CarMax’s poor earnings report came out. The price action of these two stocks mirrors each other.

Remember that stocks are forward pricing mechanisms and not backwards to the detriment of these two stocks.

KMX and CVNA are inextricably linked and offer deep insights into the state of each other’s companies.

In a quite damaging earnings report, CarMax was able to increase its gross profit per vehicle by boosting its average vehicle sales price. That’s about all that went right. This appears more like a one-off.

Carvana has a history of overpaying for supply during the boom of used car sales over the past few years.

The numbers are clearly working against CVNA.

Even more worrisome, CVNA is facing an uncertain and rapidly deteriorating macroeconomic environment moving forward.

The data bodes ill for future earnings reports as US consumers abruptly pull back on spending especially at the middle-class to lower income levels.

Just as precarious, many in the middle class to lower echelon prefer to secure automobile loans to finance a new used car purchase.

With interest rate yields exploding to the upside, it sets the stage for not only mass automobile loan delinquency and nonpayment, but it also prices out new car shoppers by making the monthly payment too exorbitant.

There will be few buyers using bank financing to get that new used car they have always wanted. And what non-rich person has a car’s worth of cash lying around these days?

At the ground level, things are bleak.

US consumers are increasingly prioritizing paying the utility and food bills over upgrading, upsizing, or even styling their used cars.

For most US consumers, a brand new car sits in the realm of fantasy as the prices of new cars surge because of high input, logistical, and manufacturing costs. A fresh car from the factory is now a luxury many can’t afford which is why many have turned to the used market.

The worsening consumer sentiment will absolutely negatively impact the volume and nominal price of each individual car sale moving forward.

I believe the data will show up in the last quarter of 2022 and 2023.

As the price of cars falls, CVNA are stuck with a higher cost basis because they snapped up many cars at premium prices and now buyers have vacated. These car dealers’ algorithms haven’t adjusted yet to the paradigm shift.

CVNA will need to consider taking a loss on these automobile units to shed inventory otherwise they are on the hook for high carry costs.

Sadly, the short-term outlook doesn’t provide any silver linings and is getting grimmer by the day.

I fully expect gross margins to crater and nominal sales to fall sharply, causing a severe downgrading in annual revenue.

If the high-end consumer holds up, better to migrate into Tesla (TSLA) stock, but that’s a big if.