Grab your cowboy hats and enjoy the event.

It’s here.

Ethereum (ETH), the second most important and largest crypto, just ran its final tests before the launch which could turn out to be the most important upgrade in crypto history.

The price of Ether could experience a “buy the rumor and sell the news” reaction, but traders wanting to get into ETH should wait for the dip to buy.

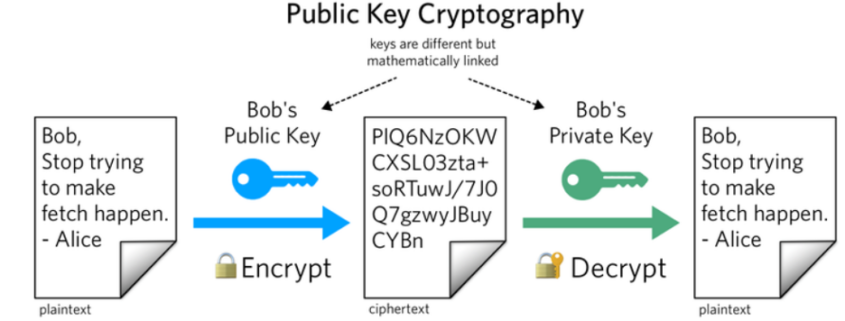

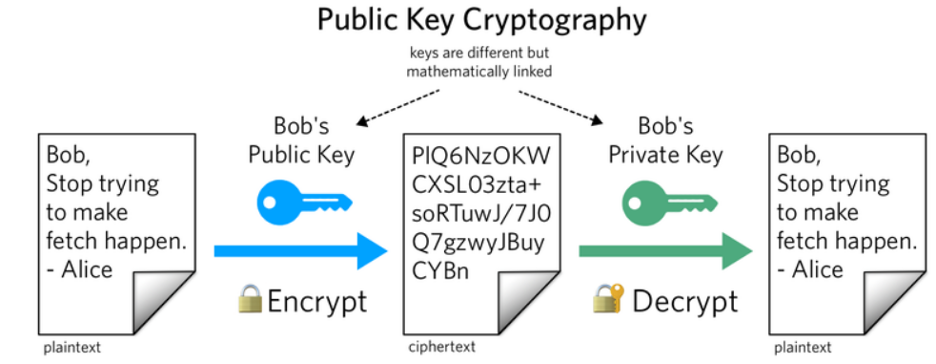

Since its inception, ETH has been mined via a proof-of-work model.

It involves complex math equations that massive numbers of computers race to solve, and it requires plenty of expensive electricity.

Now Ethereum will change to a new model for securing the network called proof of stake.

The method requires users to leverage their existing cache of ether as a means to verify transactions and mint tokens. It uses far less expensive electricity and is expected to translate into faster transactions.

The climate change brigade must be in heaven!

It couldn’t be a better time to change over as electricity bills have soared over 500% in places like London, England, and tripled in places like Munich, Germany.

Ethereum’s transition has been repeatedly stalled for the last several years and testing hasn’t been smooth.

Developers know within seconds whether a test was successful. But they’ll still be looking out for many potential technical issues in the hours and days ahead before the launch.

Another key issue relates to transactions. Ethereum processes transactions in groups known as blocks. One clear indicator that the test went well will be if the blocks have actual transactions in them, and aren’t empty.

The last major check is whether the network is finalizing, meaning that more than two-thirds of validators are online and agree to the same view of the chain history. It takes 15 minutes in normal network conditions.

Since December 2020, programmers have been testing out the proof-of-stake workflow on a chain called beacon, which runs alongside the existing proof-of-work chain. Beacon has solved some key problems.

The upgrade certainly is good news set against a backdrop of an awful last 10 months for the price of ETH.

The price of ETH has also rebounded by 80% recently as the US Central Bank has signaled rate cuts next year.

The transition to a proof-of-stake model means that this will be highly attractive to the incremental ETH miner moving forward.

When ETH miners are in a healthier position, the entire ETH infrastructure benefits and is fortified.

For those playing the long game, as we inch closer to next year’s rate cuts, one must believe that every dip in ETH is a buying opportunity.

We have received strong positive signal lately with meme stocks roaring back to action going to the moon which means liquidity is plentiful and loose.

Liquidity needs to be generous if cryptos are to skyrocket.

Fed Chair Jerome Powell who stated that 2.5% is “neutral” effectively means he is ready to subsidize meme stocks, crypto, and other speculative assets and as the headwinds turn to tailwinds next year, it could prove to be a banner 2023.