?If you?re not busy being born, you?re busy dying,? said folk singer, Bob Dillon.

Everyone knows how much I love Apple shares as an investment. For years now, my report forecasting that the stock would hit $1,000 someday has been circulating inside the company for a sought after weekend read. Just today, my old friend, co-founder Steve Wozniak, was quoting from it in making his own $1,000 prediction.

I know, because they email me all the time with further data to back up my call. I also frequently get asked the same question by these people: all of their net worth is tied up in Apple stock at a cost of $16 a share, so what should they do about it? I reply that they should fall down on their knees and give thanks that there really is a God.

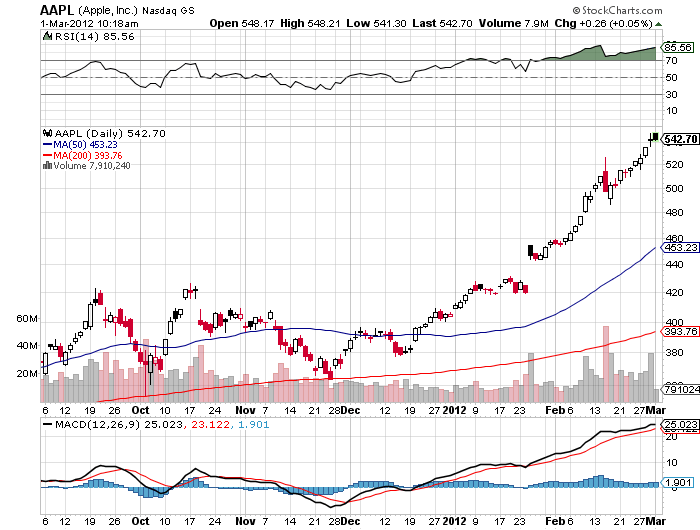

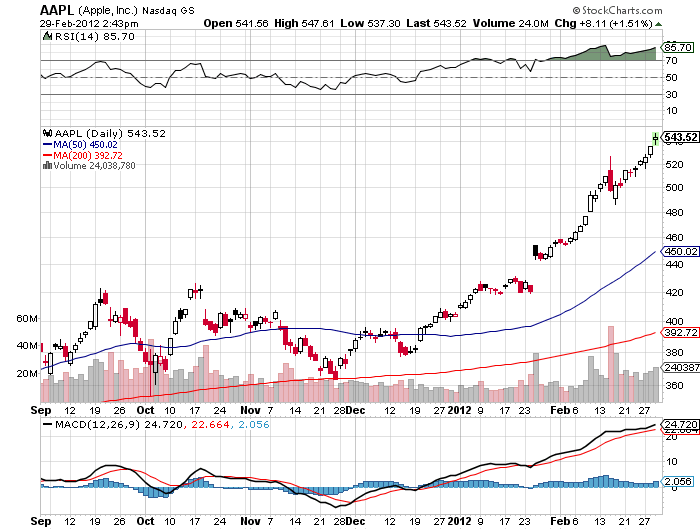

But enough is enough already. Since the beginning of the year, the company has added $124 billion in market capitalization, taking it to $515 billion, making it the largest in the world. To show you how much money this is, that is what the company would have been worth if you combined it with the mega cap, Intel (INTC), on January 1. From here the law of large numbers really has to kick in.

To get the stock up from today?s $540 to $630, it has to add another $88 billion in market cap. I believe this will happen someday. But you won?t see it in the next six weeks.

I am therefore going to sell short the Apple (AAPL) April, 2012 $630 calls for $4.05 or best. This trade makes sense in so many ways. Apple fever has truly gripped the markets, driving the premiums on deep out of the money calls to extraordinary levels. There has never been a better time to sell.

For Apple to get this high in six weeks, the S&P 500 has to soar from 1,375 to 1,470 by then, assuming that the index correlation with (AAPL) remains the same. In other words, the markets have to continue rising at the same 2012 pace until then.

What short term surprises for Apple are left? In recent weeks, we have seen the announcement of a souped up IPad 3, rumors of dividend payments, and blowout Q4, 2011 earnings. Unless we see the resurrection of Steve Jobs to take the CEO post back from Tim Cook, I think the stock is getting ready to take a brief break, or at least slow its rate of ascent.

To prove there is a method to my madness, I have picked the April expiration on April 20, which just so happens to be the day after the Q1, 2012 earnings announcement. Get any break in the markets generally before then, and I should be able to buy these calls back for pennies.

From a risk control point of view, if Apple stock starts to run away to the upside again, I will quickly limit my risk by turning this into a call spread through the buying or a further out of the money call, buying Apple stock as a hedge, or coming out completely for a loss.

This trade requires a level 4 or 5 compliance approval, depending on the house. If your broker won?t let you do it, try selling short the April $630-$670 call spread instead, which will still allow you to keep most of the premium, while defining your risk and greatly reducing your margin requirement.

Those who subscribe to my award winning Global Trading Dispatch received an urgent email alert to execute this trade immediately first thing Thursday morning the prices listed above.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011. The service includes my Trade Alert Service, daily newsletter, real time trading portfolio, an enormous trading idea data base, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Thanks, Woz

I am a notorious seeker of great bargains. I buy sun hats in the winter, umbrellas in the summer, and Christmas ornaments in January when Costco sells them for ten cents on the dollar. I even go into the barrio to buy Japanese sake where no one knows what it is, and it is sometimes ordered by accident.

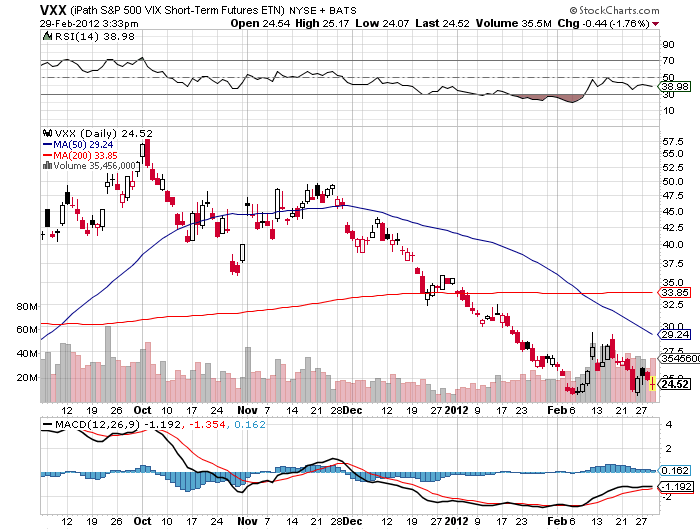

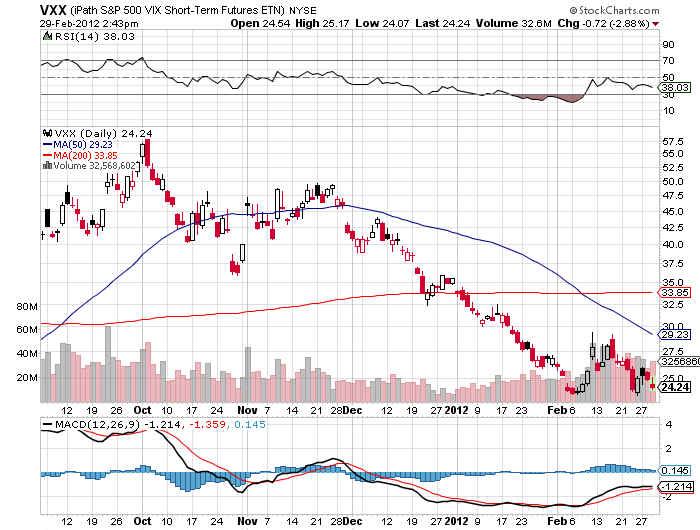

I?ll tell you what I like about the (VXX). It is a bet that someday, somewhere, something bad happens. Since it is not an option, it doesn?t suffer from time decay, and the cost of carry is low. The contango costs are modest. It can be used to hedge the downside risk for a whole range of ?RISK ON? assets, including those garden variety shares in your plain vanilla IRA?s and 401k?s.

If you have a PhD in math from MIT, then you?ll already know that The IPath S&P 500 Vix Short Term Futures ETN (VXX) offers exposure to a daily rolling long position in the first and second month (VIX) futures contracts and reflects the implied volatility (Black Scholes method) of the S&P 500 index at various points along the volatility forward curve. The index futures roll continuously throughout each month from the first month VIX futures contract into the second month VIX futures contract.

If you don?t have such a degree, then this is all you need to know. If the stock market goes up, then the (VXX) goes down. If the stock market goes down, then the (VXX) goes up. The beauty of the (VXX) is that it doesn?t care where the down move starts from, whether it is with the (SPX) here at 1,340, at 1,400, or 1,450. Until then, it will just grind around these levels or go slightly lower.

So if the (SPX) continues to go up, you might lose 10% on the position. If we get the long predicted 5% correction, then it should rise 30% to $32, or back to where it was in January. If we get the summer swoon that I expect, then it will nearly triple to $58, its October high. It is the classic ?heads you win $1, tails, I win $3 type of bet that hedge funds are always looking for.

A direct investment in (VIX) is not possible. The S&P 500 (VIX) Short-Term Futures Index holds (VIX) futures contracts, which could involve roll costs and exhibit different risk and return characteristics. And if your timing is off just a bit, then the time decay will eat you alive if the arbs don?t get to you first.

If you want to learn more about the (VXX), the go to iPath?s page for it at http://www.ipathetn.com/product/VXX/.

Learn to Love Volatility

?If I relied on my customers to tell me what they wanted, they?d ask for faster horses,? said Henry Ford, the founder of Ford Motors.

If you feel like this market has sucked you down a rabbit hole, you have plenty of company.

I have never seen such a profusion of contrary cross market indicators. Traders are running up shares prices while companies are cutting earnings forecasts. Economists are raising GDP forecasts as rising energy prices are taking them the opposite direction. Natural gas is crashing as oil spikes up.

The bond market has gone catatonic, with billions pouring into bond mutual funds to keep them on life support. Dr. Copper, that great leading indicator of global economic activity, has gone to sleep, with investors pouring money into the entire spectrum of risk assets. An increasing share of the buying in equity markets is focusing on a single stock, Apple (AAPL), the world?s largest company.

They say the market climbs a wall of worry. This one is climbing the Great Wall of China. You have to assume that the people buying stocks here are doing so only for the very long term, Warren Buffet style, and are willing to look past any declines we may see this summer. They don?t care if the market drops 5%, 20% (my pick), or 50%.

In my new year Annual Asset Class Review I thought that markets might peak in January. I lied. Thanks to a global quantitative easing program, it is increasingly looking like 2012 will be another ?sell in May and go away? year, the fourth in a row. You might as well book that Mediterranean super yacht, the beach house in the Hamptons, or the bucolic chalet in Switzerland now to beat the rush.

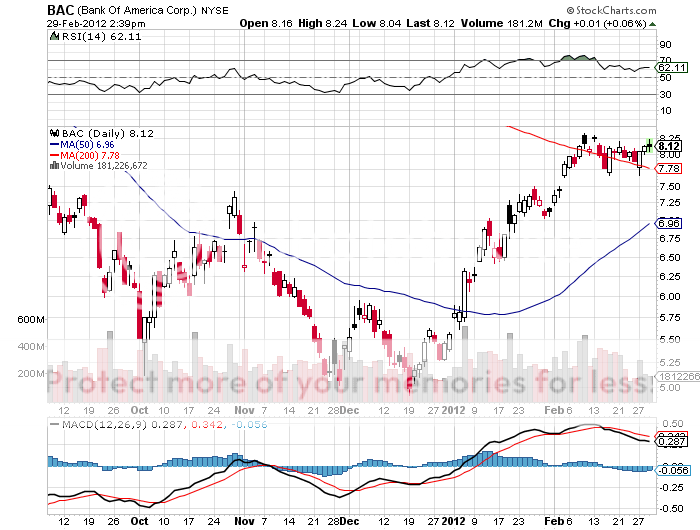

Another ?looking glass? element this year is the extent that last year?s dogs became this year?s divas. Just look no further than Bank of America (BAC), which did a 67% swan dive in 2011, but has soared a blistering 51% this year. This is a stock with a PE multiple of 812 and more investigations underway than Al Capone every saw.

It goes without saying then that those who did terrible in 2011 are looking like stars today. Look no further than hedge fund titan John Paulson, whose flagship fund was down 50% at the low last year, thanks to a big bet on financials. This year it appears his super star status is restored. Other funds that made big bets last year on European stocks and sovereign bonds have been similarly revived. If MF Global had only lasted two more months, John Corzine would be looking like a genius today, instead of a goat.

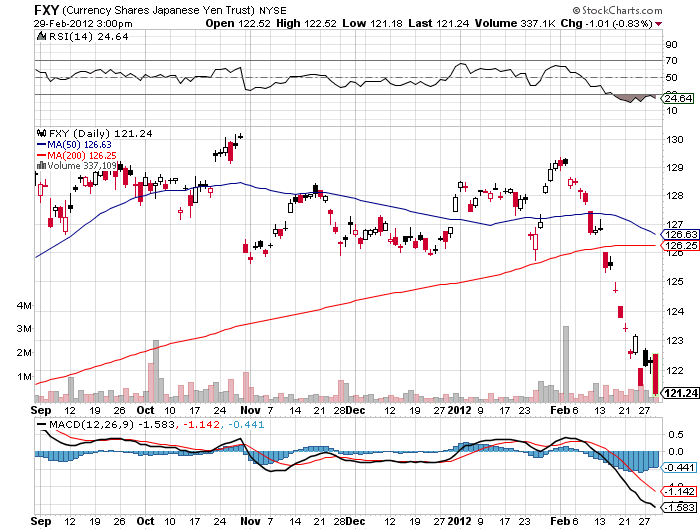

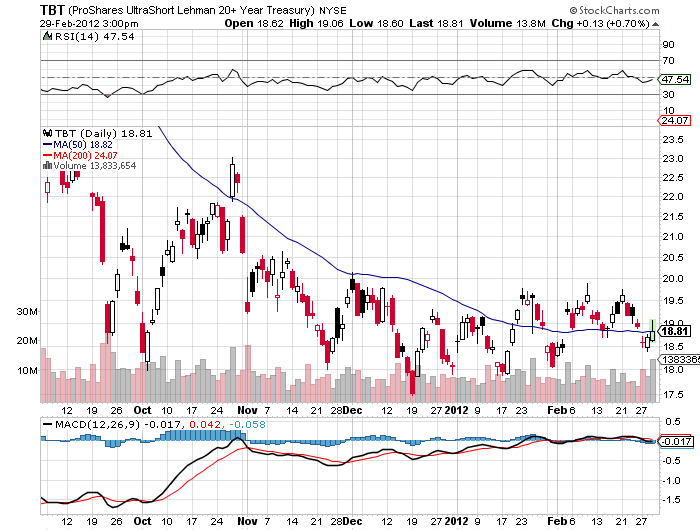

When I realized that this could be a ?dogs of the Dow? year with a turbocharger, I quickly reviewed by own money losing trades in 2011. That prompted be to rush out but puts on the Japanese yen, which doubled in short order, and haven?t looked back since. Now you really have to ask the question, will my other 2011 losers perform similar turnarounds? What?s at the top of the list? The (TBT), my bet that long term Treasury bonds would go down, which inflicted my biggest hickey last year.

By the way, I?m kind of liking the volatility ETF (VXX) here. If the markets keep going up forever you might lose 10%. If they don?t, you will make a quick 30%, and 100% if volatilities return to the highs seen in October. The cost of carry is modest, there is no time decay as with options, and there is no contango. In fact, near month volatility is trading at half the levels of long term volatility. That is the kind of risk/reward ratio that I am constantly looking for.

When I visited the local Safeway over the weekend, I was snared by some uniformed pre-teens, backed by beaming mothers behind a card table selling Girl Scout cookies. I was a pushover. I walked away with a bag of Thin Mints, Lemon Chalet Creams, Do-Si-Dos, and Tagalongs.

I have to confess a lifetime addiction to Girl Scout cookies. During the early eighties, one of the managing directors at Morgan Stanley's equity trading desk had a daughter in this ubiquitous youth organization. One day, she pitched to all 200 traders on the floor, going from desk to desk with sheets of paper taking orders. I used to buy two of everything she offered, as some clients preferred a few boxes of these delectable treats over lunch at the Four Seasons any day. Other's ordered hundreds. I later heard that the girl was the top performing scout in the greater New York area two years running.

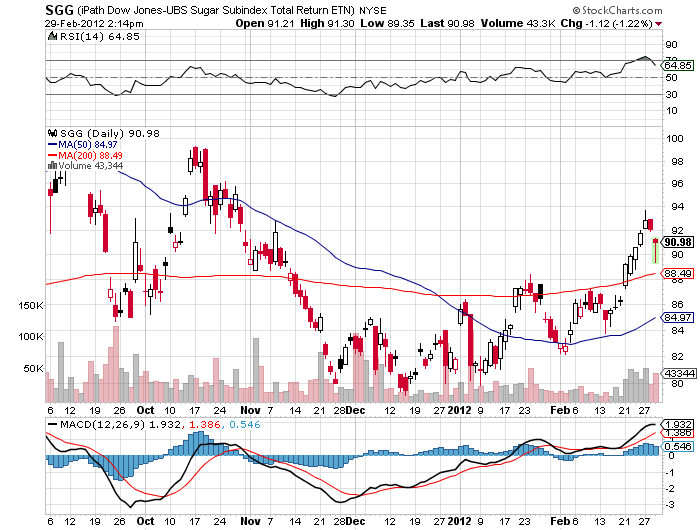

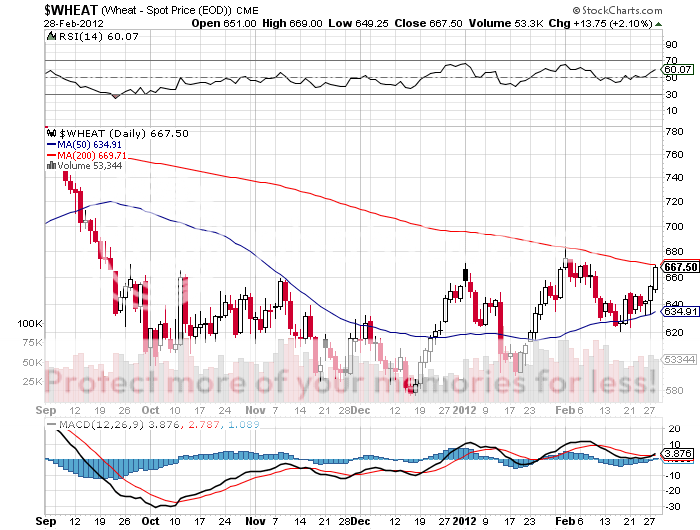

But this year, when I got home and opened the boxes I was shocked. While the price was the same, the number of cookies had shrunk considerably. I knew it was not my waist line the scouts were concerned about. I was seeing the dastardly hand of 'stealth inflation' at work. In this deflationary environment, companies loathe to raise prices. Food companies are especially hard hit, with many commodities like wheat, corn, sugar, soybeans, and coffee up 50%-300% in a year. Any attempt to pass these costs on to consumers is punished severely. So companies cut costs, quantity, and quality, instead, by shrinking the size.

I think you are seeing stealth inflation breaking out everywhere. It is not just in food. Many products seem to be undergoing a miniaturization process while prices remain unchanged. It also extends to services, where a dollar buys you less and less. This is how the consumer prices index is staying in low single digits, despite anecdotal evidence everywhere to the contrary.

Meet the Ugly Face of Stealth Inflation

When I left the Treasury Department, 92% of the American public were against the TARP, but only 60% were against torture. That gives you some idea how much Americans are against bailouts,? said for Treasury Secretary, Hank Paulson.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

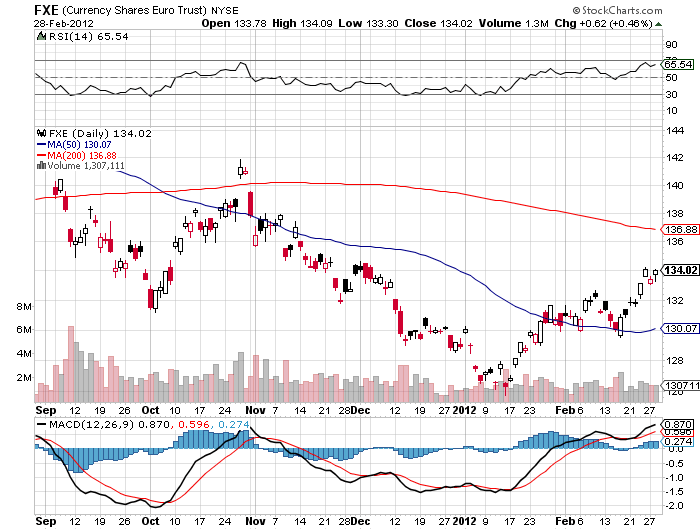

Wednesday will be all about the Euro. That is the day that the European Central Bank announces the result of the next tranche of its quantitative easing program, the LTRO, or Long Term Financial Reorganization policy.

This is the program that allows European banks to borrow unlimited funds at 1% with no questions asked. This is very important for all asset prices worldwide, since the cash pouring out of the continent has been the primary driver of asset prices skyward since December.

It is safe to say that ?500 billion is in the price. That is what the beleaguered currency?s rally from $1.26 to $1.35 has been all about. The unwind of Euro shorts in the sterling and yen crosses have also been a factor. If the ECB delivers ?1 trillion instead, the Euro will pop to $1.37 and risk assets everywhere will rally. If they don?t, expect a low volume bleed off in prices, and the long awaited correction to begin. It is a coin toss which way it will go, so I shall watch from the sidelines.

Anticipation of more sugar infusions from the government has sparked the monster rally in the sovereign debt markets that I predicted last month. Spanish ten year bonds have fallen from 5.8% to 5.5%, while similar Italian yields have made it all the way down from 6.0% to 5.4%. That is quite a long way from the 8.0% peak we saw as recently as December.

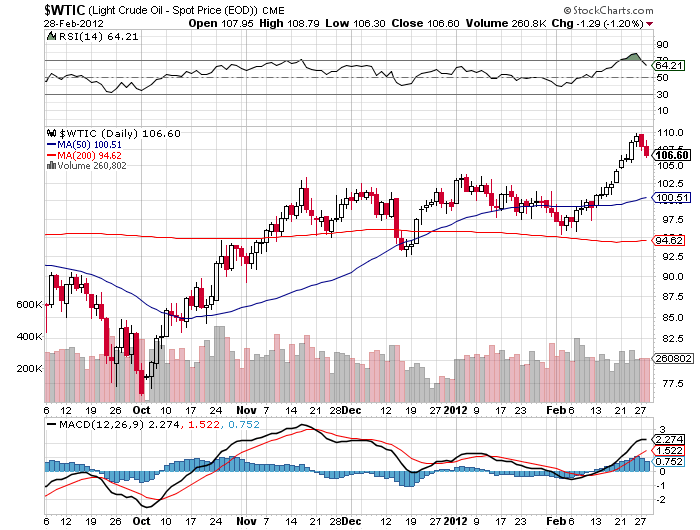

Oil has been another new assist juicing the Euro. If the Euro falls, then the local cost of fuel in Europe would rise sharply, as oil is prices in dollars. This would exacerbate the recession already in progress on the continent. These concerns could prompt ECB president Mario Draghi to delay further interest rates cuts, generating more Euro strength.

If we do get the move to $1.37, that should clean out a big chunk of the remaining shorts, which have dropped recently, but are still huge. Since January 24, total shorts have fallen to 142,000 contracts, down from the all-time high of 171,000 contracts. That works out to $17 billion of underlying remaining on the short side.

Get the Euro back up to $1.37 and it might become an attractive short again. It?s just a matter of time before the market refocuses on Europe?s underlying fundamentals, and those are dramatically worsening by the day.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.