?We are witnessing the death of abundance and the birth of austerity for what may be a very, very long time,? said PIMCO managing director, Bill Gross, the world?s largest bond manager.

Troubled Bank of America (BAC) certainly earned its title as the premier Dog of the Dow last year. It managed an appalling 58% decline in 2011, the worst of any of the 30 Index stocks. It only managed to stay above the crucial $5 level by a hair?s breadth, below which many pension funds are barred from owning shares.

Since the beginning of this year, it has been the best performer, soaring 48% from $5.60 to $8.30. Will this eye-popping turnaround continue?

I think it is more likely that the enormous Lake Tahoe outside my window freezes into a gigantic mango smoothie.? Its credentials as a ?zombie? bank are as good as ever, and it will continue to play a leading role in the horror story our financial system has become.

(BAC) has become the poster boy for ?too big to manage?. The bank is still, by many measures, the largest in the US, with $2.3 trillion in assets, 288,000 employees, 5,900 branches, and 18,000 ATM?s. One out of two Americans are said to have an account at the North Carolina based institution. The $84 billion market cap company earned a penny a share last year, giving a price earnings multiple of a mind blowing 802.

The problem is that the company is so gargantuan that by the time information filters up to the top, it has become old, irrelevant, or even dangerous. It seems to want to plunge into every ?flavor of the day? strategy, which is always fatal for any organization that turns with the speed of a supertanker.

It plunged into proprietary trading in the early 2000?s, despite a woeful lack of talent to execute. Its 2007 purchase of Countrywide for $2 billion saddled it with a loan book so toxic that it still may not survive. It paid $50 billion for Merrill Lynch, when, if the positions were marked to market, it would have been worth only $1 or less.

Bank of America is a deer that can?t stay out of the headlights. Any online search about the company reveals a litany of problems, including mortgage fraud, robo signing, SEC sanctions and fines, municipal bond fraud, an ill-fated $5 debit card fee, and litigation up the wazoo. Oh, to be their outside counsel. Kaching!

The company recently announced disappointing earnings driven by falling revenues and rising costs. Their financial statement offered a panoply of special items, with prominent distressed assets sales used to cover losses. It is literally eating its seed corn to keep from starving to death. (BAC) attempted to pay a dividend in 2011, but that was nixed by the Federal Reserve due to its TARP obligations.

The size of the market that can meet their rising credit standards is shrinking dramatically, thanks to a 30 year long squeeze on the middle class. They might as well be a buggy whip manufacturer. The cost of regulation is skyrocketing. This is why I went on national TV last May and pounded the table to get viewers to sell it short at $13.50.

Despite the whopping great rally in the share price, they are trading at a big discount to book value, meaning that investors think the bank is still carrying large, unrealized loan losses on its books. Now Moody?s has threatened to downgrade the bank?s credit rating a couple of notches, which would increase its borrowing costs substantially. They are truly caught between a rock and a hard place.

I am not one of these glum guys who think that Bank of America will go bankrupt. That was a 2008 story. Don?t worry, your deposits are safe. It is far more likely to get broken up. First on the block will be Merrill Lynch, which is worth more today than in the dark days of four years ago. Think of it as (BAC)?s General Motors. Management is also making noises about withdrawing from Texas and other major markets.

There may be a time for a true national bank in the US, but that time is not now. Not when they play at being hedge funds on the side without the slightest idea of how to do so, and then blow up with your money inside, requiring taxpayer assistance. But there is a trade here for the nimble.

This is the really interesting part. Bank of America has become the favorite whipping boy of the high frequency traders. Because of them, its shares frequently accounted for 10% or more of NYSE volume last year. They have increased the volatility of these shares dramatically.? As a result, (BAC) is one of the highest beta large caps in the market.

What does this mean for the average punter working behind a PC (or Mac) at home? That a rapid 50% jump in shares is likely to be followed by a sudden 25% plunge. At this level, it has become the classic ?heads you win, tails I win 5X? situation if positioned appropriately.

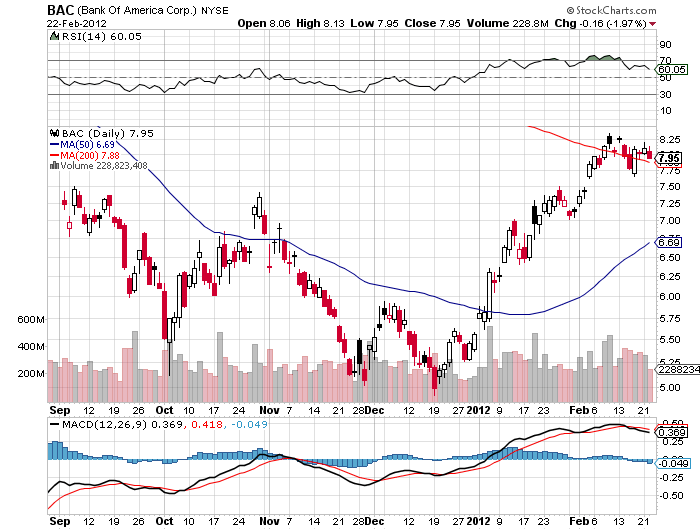

The algorithms are lurking out there just waiting to pounce on this pitiful stock like a hungry leopard. Take a look at the chart below, and the setup is as clear as day. Despite an (SPX) that ground up to new highs nearly every day last week, (BAC) stock has begun rolling over like the Bismarck. Get a serious ?RISK OFF? day in global assets, and this thing could dive like a kamikaze.

No surprise then that (BAC) has become my favorite stock to sell short.

I spent a sad and depressing, but highly instructional evening with Dr. Stephen Greenspan, who had lost most of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky's Tremont feeder fund; receiving convincing trade confirms and rock solid custody statements from the Bank of New York.

This is a particularly bitter pill for Dr. Greenspan to take, because he is an internationally known authority on Ponzi schemes, and just published a book entitled Annals of Gullibility-Why We Get Duped and How to Avoid It. It is a veritable history of scams, starting with Eve's subterfuge to get Adam to eat the apple, to the Trojan horse and the Pied Piper, up to more modern day cons in religion, politics, science, medicine, and yes, personal investments.

Madoff's genius was that the returns he fabricated were small, averaging only 11% a year, making them more believable. In the 1920's, the original Ponzi promised his Boston area Italian immigrant customers a 50% return every 45 days. Madoff also feigned exclusivity, often turning potential investors down, leading them to become even more desirous of joining his club. For a deeper look into Greenspan's fascinating, but expensively learned observations and analysis, go to his website at http://www.stephen-greenspan.com/ .

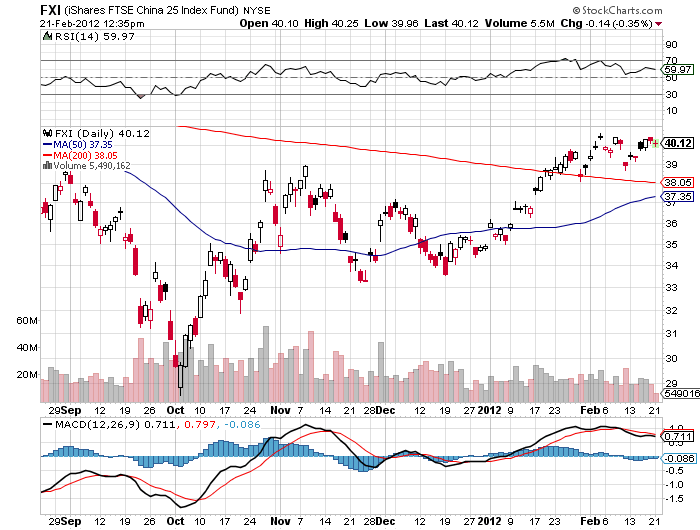

The other shoe has fallen in China, with the People?s Bank of China?s move to cut bank reserve requirements by 50 basis points, the second time since November. The relaxation makes the Middle Kingdom a certified, card carrying member of the international quantitative easing club.? It also confirms the country?s time tested preference for announcing major economic policy changes on American holidays. Watch that calendar!

First, a brief history lesson. China?s central bank uses the reserve rate as a means to control domestic lending without have to resort to changing interest rates. A low reserve rate means that the banks can leverage up and lend with reckless abandon, thus stimulating the economy. A high rate clips lenders? wings and slams on the brakes for the economy.

The authorities stated raising this key benchmark all the way back in 2006, when the reserve rate was only 8% and double digit GDP growth rates ignited inflation fears. The central bank raised the requirement until it reached an all-time high of 21.5% in June, 2011.

This means that banks must retain $21.50 for every $100 in leans they extend, giving them a leverage ratio of 4.6:1, making them the least leveraged banks in the world. By comparison, American banks were leveraged up to 100:1 at the top of the real estate bubble, and are thought to be running 12:1 leverage now, nearly triple China?s current rate.

The important thing to note here is not the absolute 50 basis point change in reserve requirements, but the confirmation of the new direction. The PBC only changes direction in reserve requirements a few times a decade, and when it does, it is a monumental, sea-changing occasion.

It tells us that further cuts are in the works, that Chinese banks are being encouraged to increase and not decrease lending, and that this is good for asset prices everywhere, especially copper.

China Fires the Starting Gun

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

The Bank of Japan renewed its membership in the international quantitative easing club last week, announcing that it was substantially expanding its bond repurchases.

Specifically, it will increase them from ?55 trillion to ?65 trillion, a jump equivalent to $830 billion. To understand how big this is, consider that Japan?s GDP is one third the size of the US. That would be the same as the Federal Reserve announcing a repo program with $2.5 trillion here. Imagine what your asset prices would do if that happened.

For good measure, the Japanese also announced an inflation target of 1%, which is entirely wishful thinking for a country that is entering its 23rd year of deflation. It?s like a man on skid row planning on how to spend his prospective lottery winnings.

The government was prompted to action by the 2011 full year GDP figure, which came in at an appalling -0.9%, compared to a robust growth of 4.5% in 2010. The tsunami reconstruction program has fallen woefully behind schedule due to extreme mismanagement and incompetence by the authorities, despite being more than adequately funded. But after watching the Land of the Rising Sun for the last 20 years, I have come to expect incompetence. Slowdowns in Europe and China, plus the Thai floods and the Fukushima nuclear meltdown have provided additional headwinds.

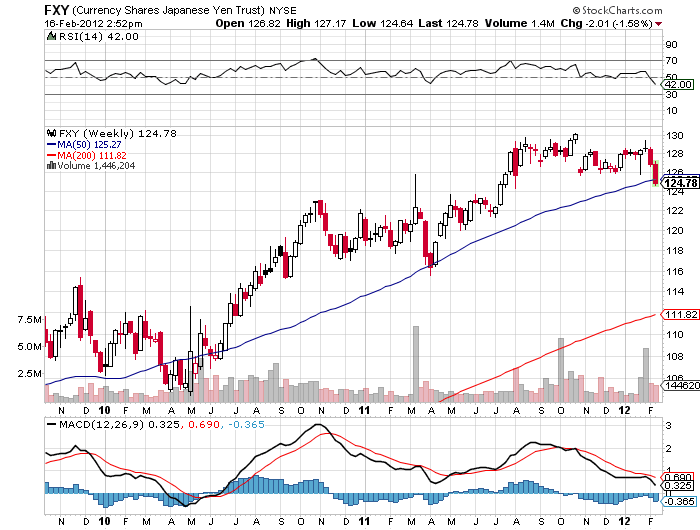

The immediate impact was to trigger a sharp selloff in the yen, delivering an immediate windfall to readers of my Trade Alert Service who were already long yen puts. Traders like myself are always looking for confirming cross market correlations.? You can find one in the movement of the Nikkei stock average, which has been the world?s most despised asset class for the last two decades.

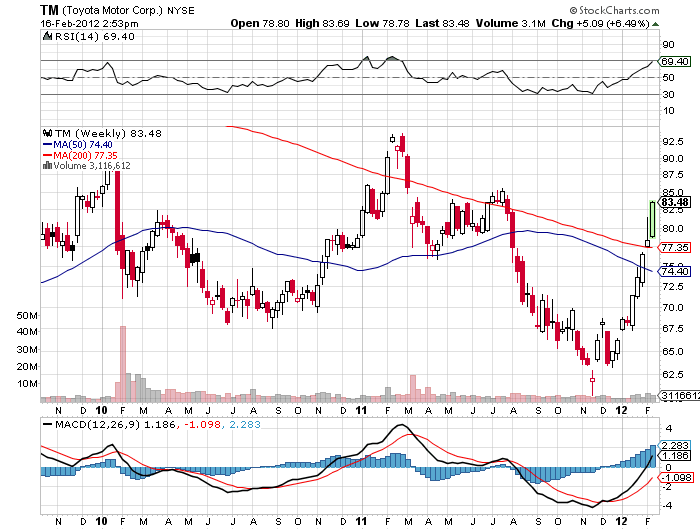

As you can see from the chart below, it is threatening an important multi month breakout to the upside. The reasons for this are simple. A cheaper yen makes Japanese exports more competitive. It also makes the foreign earnings of Japanese multinationals more valuable when translated back into yen. Look no further than the chart of Toyota Motors (TM), which have leapt by a blistering 30% this year.

If you are still unsure about the integrity of the yen collapse, check out the chart for the long dollar basket (UUP). It is setting up for a multiyear head and shoulders breakout to the upside. Uncle Buck has recently taken a steroid shot from the continuing weakness in Europe and the new recession in Japan.

Bottom line: keep selling the yen on rallies, possibly for the next several years.

Those Steroid shots are Definitely Helping Uncle Buck

I never cease to be amazed by the intelligence provided me by the US Defense Department, which after the CIA, has the world?s most impressive and insightful economic research team. There are few places a global strategist like myself can go to get an intelligent, thoughtful forty year views, and this is one.

Of course, they are planning how to commit ever declining resources in future military conflicts. I am just looking for great trading ideas for my readers, which my assorted three star and four star friends have in abundance. I usually have to provide some extra analysis and tweak the data a bit to obtain the precise ticker symbols and entry points, but then that?s what you pay me to do.

An evening with General Douglas Fraser did not disappoint. He is an Air Force? four star who is the commander of US Southern Command (SOUTHCOM), one of nine unified Combatant Commands in the Department of Defense. Its area of responsibility encompasses Central America, South America, and the Caribbean. SOUTHCOM is a joint command comprised of more than 1,200 military and civilian personnel representing the Army, Navy, Air Force, Marine Corps, Coast Guard, and other federal agencies.

The United States is now the second largest Hispanic country in the world, and it will soon become the largest. These industrious people now account for 15% of US GDP, and that figure will grow to 35% by 2050. The Hispanic birthrate in many parts of the US is triple that of any other ethnic group. Because of this, any politicians that pursue anti-immigrant policies are doomed to failure.

Latin America?s GDP is growing at 4% a year, more than double the current US rate. American trade with the region grew by 72% last year, with imports surging an eye popping 112%. It is the source of one third of our foreign energy supplies. It has tremendous wealth in copper, iron ore, and food production that have yet to be exploited. In the last decade, 40 million have risen out of poverty. Yet 13% of the inhabitants earn less than $1 a day.

This poverty has made Latin America fertile ground for the international drug trade, which poses one of the greatest threats to America?s security today.? Profits from the cocaine trade reached $88 billion in 2011, which is more than the GDP of any single Central American country. Some $33 billion worth of this narcotic made it into the US last year. Brazil is the world?s second biggest consumer of cocaine, after the US, with the UK the largest per capita consumer. The farther you move this product from the source, the more expensive it gets. Cocaine costs $2,000 a kilo in Brazil, $40,000 in the US, $80,000 in Europe, and $150,000 in the Middle East.

Technology has made communications, organization and logistics tools once only found in the military available to anyone. This creates a level playing field for international crime organizations of all sorts. The drug business is so profitable that the cartels are now building submarines in the jungles of Columbia at a cost of $4 million each, and sending them under water to the US to make a $100 million profit per voyage.

This illicit wealth is financing the growth of other illegal activities, like money laundering, arms dealing, human trafficking, and even the transportation of exotic animals. This is corrupting the smaller and weaker governments. Key transit point Honduras bas become so violent, with the highest murder rates in the world that the US recently had to withdraw 150 Peace Corps volunteers.

As a result, Fraser has had to modify the mission of SOUTHCOM from a primarily military one to non-traditional crime fighting. His planes are intercepting smugglers at the favored Venezuela-Honduras-US air corridor, as well as craft making it up the Central American west coast.? He is providing military assistance, training, and joint operations where he can, but must balance this with the human rights record in each country.

In additional to his other responsibilities, General Fraser is also keeping close track of China?s rapidly expanding trade relations in the area. They have begun selling inexpensive, low end weapons and military equipment to some of these countries.

The investment opportunities I picked up from General Fraser were legion. It certainly made the ETF?s for Brazil (EWZ), Chile (ECH), and Columbia (GXG) no brainers for a long term portfolio. The Brazilian Real and the Chilean peso are screamers. Copper (CU) and the grains, (CORN), (SOYB), and (WEAT), are probably also good bets.

General Fraser graduated from the Air Force Academy in 1974 and is fluent in Spanish. He has commanded Air Force combat units in Japan, Korea, and Germany. He was later a senior officer in the Space Operations Command. General Fraser joined SOUTHCOM in 2009 after serving as deputy commander of the Pacific Command.

After his briefing, the readers of the Diary of a Mad Hedge Fund Trader who came at my invitation that evening were given the opportunity to ask questions of one of America?s most senior military officers on a one on one basis. In a lighthearted moment, I mentioned to the General that his career total of 2,800 flight hours exceeding my own by only 600 hours. But his rides were vastly more exciting than mine, with most of his time spent in F-16?s and F-15-s, some of the most lethal weapons ever developed.? My log contains an assortment of aircraft that include a lot of more sedentary Cessna?s, a few C-130 Hercules, a P51 Mustang, a De Havilland Tiger Moth, and a few precious hours in a Russian Mig-25 and Mig-29.

Meet my Flight Instructor

?The Fed only knows two speeds; too fast, and too slow,? said Nobel Prize winning economist Milton Friedman to me over lunch one day.

Due to a number of technical difficulties, many potential new subscribers were denied the opportunity to buy my award winning Trade Alert Service at the old price of $1,997 before the price increase. Among other things, the site crashed a few times because of the sheer volume of people attempting to sign up at once.

Since I highly value loyalty, I am therefore offering this price one last time, this weekend only, to give people a chance to get in. On Monday, the price jumps 50%, right back to the now standard price of $3,000, where it will remain for the rest of this year.

It is an old adage in the investment business that you get what you pay for. My Trade Alert Service was the top performing online mentoring service of 2011. Those who closely followed my 56 trade alerts closely, which I shoot out through email and text messages, earned a 40.17% on the year. If my email traffic is anything to go by, many readers did much better than that.

It is looking like 2012 will be just as hot. Check out the returns of my the last few trades that went out over the past three weeks:

Short natural gas - +75%

Short Yen - +64%

Short Bank of America - +30%

My Global Trading Dispatch is a bundled package of services that includes the Trade Alert Service, a daily newsletter offering 3-4 investment ideas a day, a two million word online data base of trading ideas, a daily profit & loss plus risk analysis of my trading book, interviews with investment heavyweights on Hedge Fund Radio, and live customer support to make sure it all works seamlessly and effortlessly. The research explores long and short opportunities in global stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

To subscribe to the Mad Hedge Fund Trader?s Trade Alert Service, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button at the bottom. I look forward to working with you. And thank you for supporting my research.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.