Having the flu during the holidays is the pits. This weekend, I blew my nose at the Cirque du Soliel so loudly that is perilously distracted some of the high wire acrobats. I coughed and hacked my way through the San Francisco Ballet?s Nutcracker Suite. Even the eggnog is utterly tasteless, no matter how much Myers Rum I pour in it. I am writing this piece with a fever and chills through a haze induced by Robitussin, Dayquil, and Tylenol PM.

Nevertheless, I did manage to get a dozen calls through to an assortment of European bankers, hedge fund managers, central bank officials, and finance ministry staffers this weekend to get a read on the true meaning of the Friday ministers summit agreement.

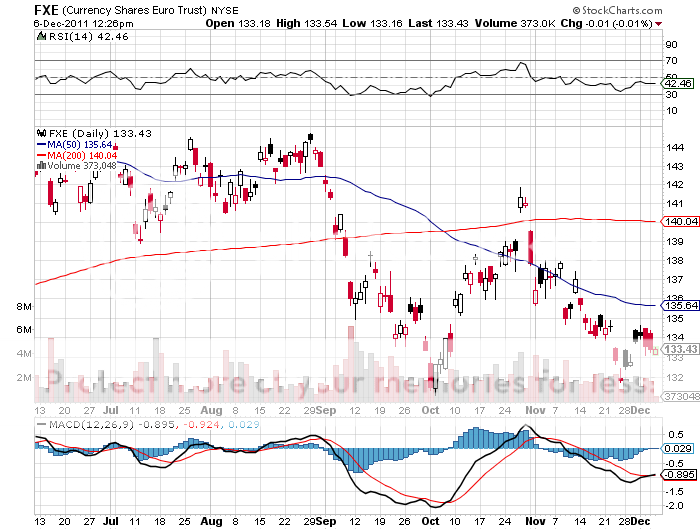

Don?t kid yourself. The deal that they cobbled together with spit, duct tape, and bailing wire was no panacea. It was just enough to keep the Euro (FXE) from collapsing, but lacked the oomph to send it off to the races. And there was some serious kicking of the can forward, with a March deadline set for the most important elements.

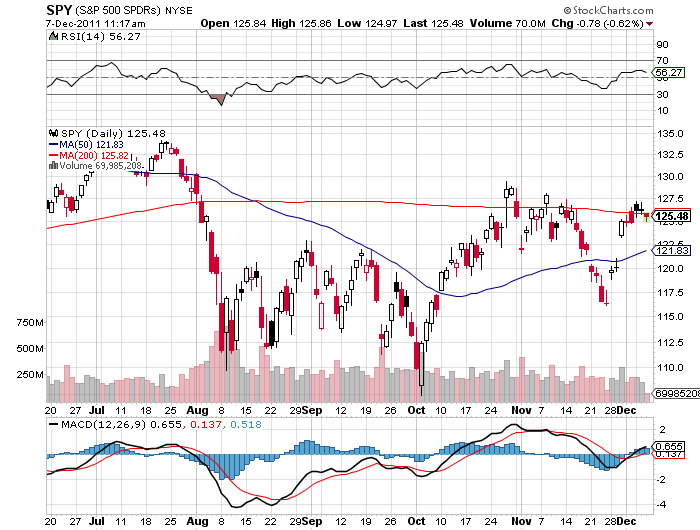

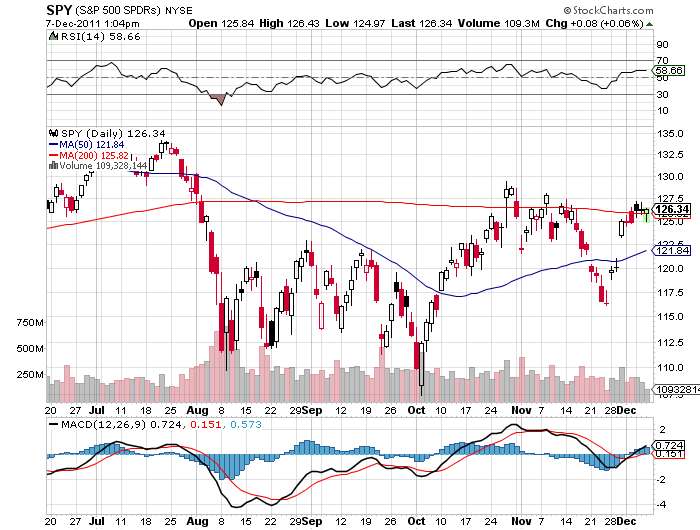

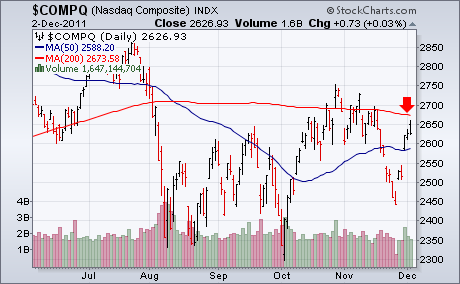

However, it had the juice to send US stocks soaring and European sovereign bond interest rates plunging. After a marathon, ten hour negotiating session that ended at 5:00 am local time, a deal was hammered out that includes:

*Automatic sanctions for violators of the 3% of GDP debt ceiling.

* Brussels (read Berlin) has the power to veto national budgets.

*?200 billion was chipped into the IMF to help troubled countries like Greece.

*Added with other bailout measures, the value of the safety net rises to ?700 billion, or nearly $1 trillion.

While a good start, this is by no means a grand solution. No mention was made of the $100 billion needed to recapitalize European banks, or where it is going to come from. Deleveraging will be decade long process in Europe and be a drag on asset prices worldwide.

Sovereign rating downgrades are a certainty and will trigger a bad day for the markets when they are announced. However, the bond markets won?t crash as yields are already at levels that attract serious buyers. Witness the George Soros move to buy MF Global?s distressed $2 billion portfolio of European paper and the continued purchases by a dollar diversifying Chinese government.

Mario Draghi?s European Central Bank has, in fact, done more on its own to rescue the economy that the political leaders. It cut Euro interest rates by an additional 25 basis points, the second in sext weeks. It eased collateral requirements, extended reserve ratio cuts, and permitted longer term repo agreements

Despite all of this, there was not much of a recovery in the Euro, which ticked as high as $134.20. Maybe it is heavy, or just plain tired. In any case, if we somehow get a rally as high as $1.36, take it as a gift, and sell it short one more time. Parity is still on the long term horizon.