?We?re spending billions in Iraq and Afghanistan. Let?s rebuild America first. If you build us a bridge or a school in West Virginia we won?t blow it up and we won?t burn it down,? said Senator Joe Manchin.

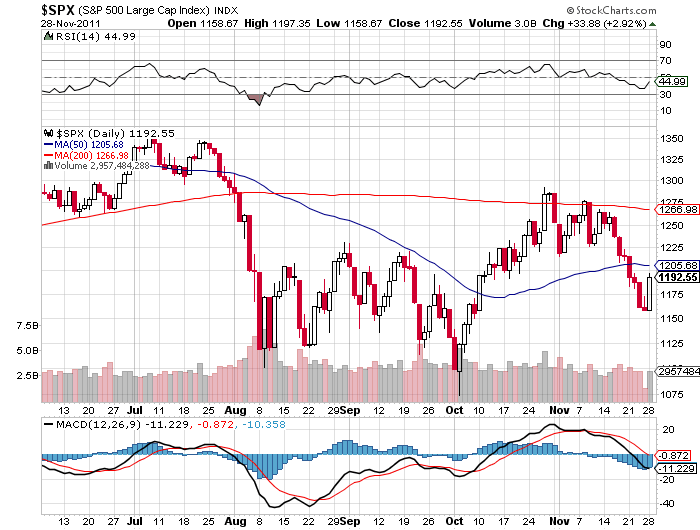

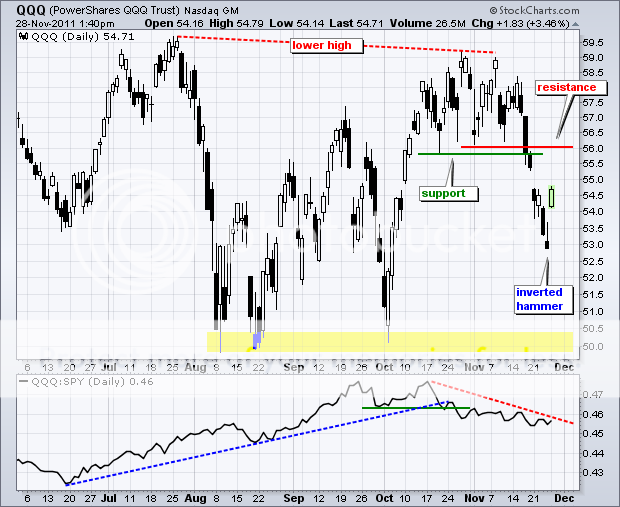

The coming bear trap that I warned about last week sprung this morning on the non-subscribing unwary, triggering panic buying by short sellers in all ?RISK ON? assets. Oil (USO), gold (GLD), silver (SLV), copper (CU), and foreign currencies all moved in lockstep to the upside. The trigger was news that leaked out over the weekend that the International Monetary Fund would make available several hundred billion dollars to bail out the beleaguered European ?PIIGS?.

Never mind that the IMF immediately denied any such moves from multiple offices around the world. The tipoff that something big was coming was the strong performance during Friday?s stock market opening, ostensibly off the back of healthy ?Black Friday? figures, which rapidly faded at the close. I suppose the big money was too busy fighting turkey indigestion to maintain the ephemeral gains. Once the buying started during the Sunday Asian market hours, it was all over but the crying.

With many managers poo-pooing today's move, one has to ask if this is a one day wonder, a much needed 24 hour holiday from the deluge of bad news from the Continent?

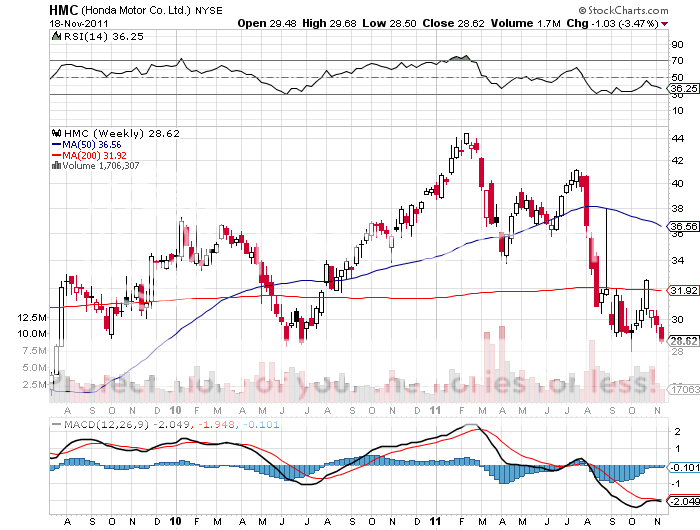

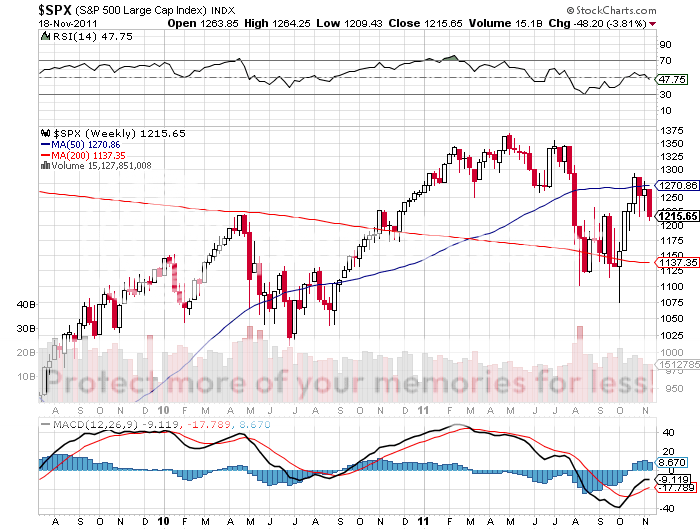

The charts below suggest that this is more than a one day wonder and that there is more juice to go. Certainly breaking the 50 day moving average at 1,205 would be a positive development. At the very least, we should take a run to the old S&P 500 support level at 1,230, which should now pose substantial resistance. Break that, and the 200 day moving average at 1,266 comes into play, close to the three month highs we saw two weeks ago.

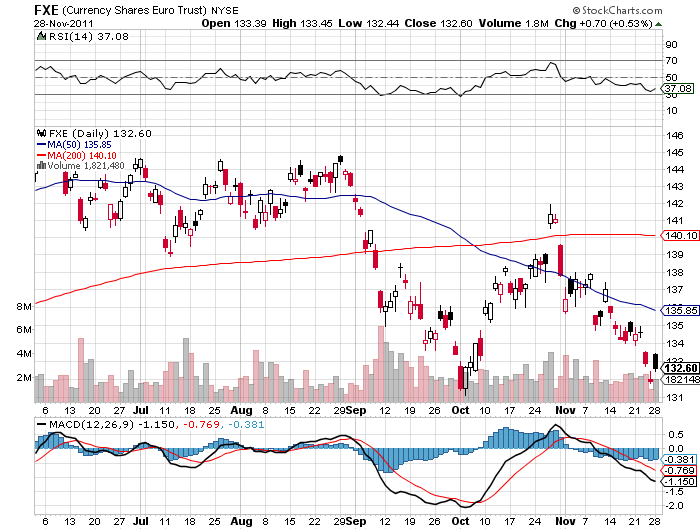

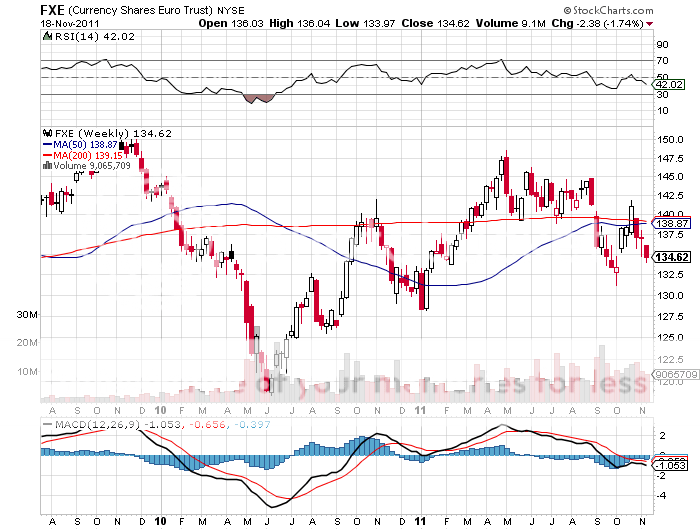

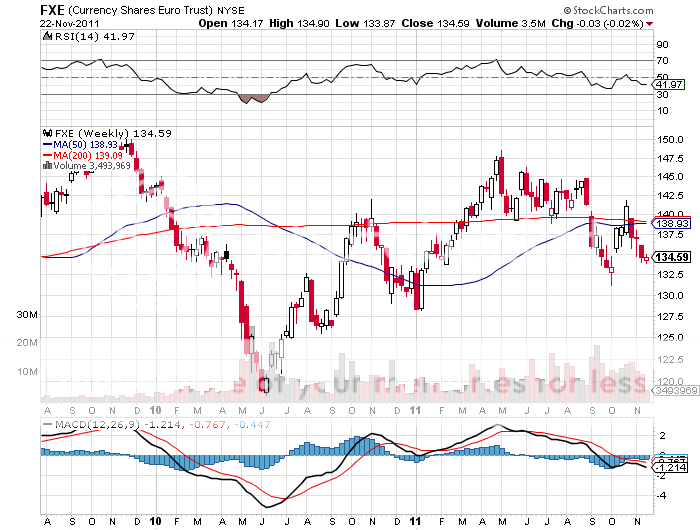

The interesting mover today was the Euro, which hardly moved at all, the ETF (FXE) gained a scant 0.53%. You would think that the troubled European currency would be the primary beneficiary of any rescue attempts. It wasn?t. This feeble response tells me that the Euro is fundamentally flawed, is still the currency that everyone loves to hate, and is looking at more downside than upside. That is why I didn?t join the lemmings this morning scrambling to cover shorts.

Cover Those Shorts!

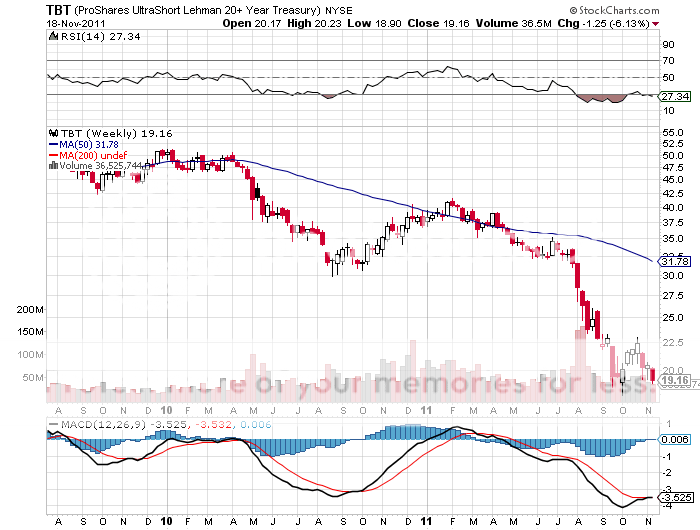

If you want to delve into the case against the long term future of US Treasury bonds in all their darkness, take a look at Foreign Affairs, the establishment bimonthly journal read by academics, intelligence agencies, and politicians alike, which I am sure you all have sitting on your nightstands. In a well-researched and thought out article penned by Roger C. Altman and Richard N. Haas, the road to ruin ahead of us is clearly laid out.

The US has no history of excessive debt, except during WWII, when it briefly exceeded 100% of GDP. That abruptly changed in 2001, when George W. Bush took office. In short order, the new president implemented massive tax cuts, provided expanded Medicare benefits for seniors, and launched two wars, causing budgets deficits to explode at the fastest rate in history. To accomplish this, strict 'pay as you go' rules enforced by the previous Clinton administration were scrapped. The net net was to double the national debt to $10.5 trillion in a mere eight years.

Another $4 trillion in Keynesian reflationary deficit spending by president Obama since then has taken matters from bad to worse. The Congressional Budget Office is now forecasting that, with the current spending trajectory and last year?s tax compromise, total debt will reach $23 trillion by 2020, or some 160% of today's GDP, 1.6 times the WWII peak.

By then, the Treasury will have to pay a staggering $5 trillion a year just to roll over maturing debt. What's more, these figures greatly understate the severity of the problem. They do not include another $9 trillion in debts guaranteed by the federal government, such as bonds issued by home mortgage providers, Fannie Mae and Freddie Mac. State and local governments owe another $3 trillion. Double interest rates, a certainty if commodity price inflation continues unabated, and our debt service burden doubles as well.

It is unlikely that the warring parties in Congress will kiss and make up anytime soon. It is therefore likely that the capital markets will emerge as the sole source of any fiscal discipline, with the return of the 'bond vigilantes.' They have already made their predatory presence known in the profligate nations of Europe, and they are expected to arrive here eventually. Such forces have not been at play in Washington since the early 1980's, when bond yields reached 13%, and homeowners paid 18% for mortgages. Since foreign investors hold 50% of our debt, policy responses will not be dictated by the US, but by the Mandarins in Beijing and Tokyo. They could enforce a cut back in defense spending from the current annual $700 billion. They might even demand a retreat from our $150 billion a year commitments in Iraq and Afghanistan.

Personally, I think the US will never recover from the debt explosions engineered by Bush and by 'deficits don't count' vice president Chaney. The outcome has permanently lowered standards of living for middle class Americans and reduced influence on the global stage. But I'm not going to get mad, I'm going to get even. I am going to make a killing profiting from the coming collapse of the US Treasury market through buying the leveraged short Treasury bond ETF, the (TBT). I am sticking to my short term forecast for this fund to rise from the current $19.16 to $26, then $32, then $40. And that is despite a hefty and rising cost of carry of nearly 0.5% a month.

Looks Like I Can?t Afford the Next War

?Better to have stop and go, than no go at all,? said hedge fund legend, George Soros, about the choppy prospects for the US economy.

The garlic eaters don't want to repay their debts, and the beer drinkers don't want to lend them any more money. That pretty much sums up the financial tensions that exist within Europe right now. The PIIGS countries of Portugal, Ireland, Italy, Greece's, and Spain are lurching from one emergency financing to the next. European interest rates are sky high. Never mind that much of that money was borrowed to buy Mercedes, BMW's and Volkswagens, which enriched Germany's economy mightily.

This is one of many reasons why I think the Euro will continue to fall against the dollar, possibly to as low as the mid $1.10's sometime in 2012. The US is growing, and Europe is not. End of story. American interest rates are rising, while Europe's are not. Another end of story.? This always attracts capital to flow out of the low yielding currency and into the high yielding one, which is creating a rising tide of buyers of greenbacks and sellers of Euro's.

On Friday, Italian, Spanish and Portuguese bonds traded better than expected. Germany's Chancellor Angela Merkel hinted they might bend a little on terms. The? China and Japan have said they would happily take down a chunk of the high yielding European debt. With ten year Japanese Government Bonds yielding a paltry 1%, can you blame them?

Would You Want to Owe Her Money?

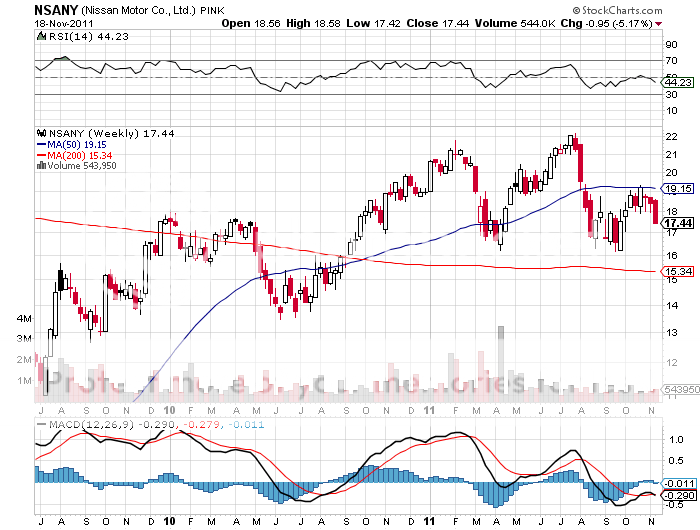

I just flew over one of my favorite leading economic indicators yesterday. Honda (HMC) and Nissan (NSANY) import millions of cars each year through their Benicia, California facilities, where they are loaded on to hundreds of rail cars for shipment to points inland as far as Chicago.

Three years ago, when the US car market shrank to an annualized 8.5 million units, I flew over the site and it was choked with thousands of cars parked bumper to bumper, rusting in the blazing sun, bereft of buyers. Then, 'cash for clunkers' hit. The lots were emptied in a matter of weeks, with mile long trains lumbering inland, only stopping to add extra engines to get over the Sierras at Donner Pass. The stock market took off like a rocket, with the auto companies leading.

I flew over the site last weekend, and guess what? The lots are full again. During the most recent quarter, demand for new cars raced up to an annual 13.5 million car rate. Now what? I'll let you draw your own conclusions. Sorry the photo is a little crooked, but it's tough holding a camera in one hand and a plane's stick with the other while flying through the turbulence of the Carquinez Straight. Air traffic control at nearby Travis Air Force base usually has a heart attack when I conduct my research in this way, with a few joyriding C-130?s having more than one near miss.

I have reported in the past on the value of the Friday-Monday effect, whereby the bulk of the year's performance can be had through buying the Friday close in the stock market and then selling the Monday close. Well, I have discovered a further distillation of this phenomenon. During 2010, the S&P 500 rose by 143 points. Some 134 points of this was racked up on the first trading day of each month, some 12 days in total. That is 94% of the entire return for the year.

If can see where this is coming from. Many pension and mutual funds are completely devoid of any real trading expertise. So they rely on a 'dumb' dollar cost averaging models to commit funds. In a rising market, like we had for most of last year, this produces an ever rising average cost. More than a few hedge funds have figured this out, front run these executions at the expense of the investors of the other institutions. And you wonder why the public has become so disenchanted with their financial advisors.

The possibilities boggle the mind. Imagine strolling into the office on the last trading day of each month and committing you entire capital line. You then spend the night hoping that a giant asteroid doesn't destroy the earth. You return to your desk at the next day's close, unload everything, and take off on a 30 day vacation. Every month, you come back for a reprise. At the end of the year you top the performance leagues, and retire richer than Croesus. It sounds like a nice 12 day work year to me!

Is It Time to Trade Yet?

?Everybody is a day trader now, and a long term hold is three hours,? said noted bank analyst, Dick Bove, of Rochdale Securities.

The Mad Hedge Fund Trader is taking a break for the next few days to take Turkey with the expanded family. A 28 pound bird made the ultimate sacrifice, and will be accompanied with mashed potatoes, gravy, stuffing, potato salad, mince pie, and a fine Yamhill Chardonnay. I ate an entire pumpkin pie last night just to give my digestive system an early warning that some heavy lifting was on its way.

I am the oldest of seven of the most fractious and divided siblings on the planet, so attending these affairs is always a bit of a challenge. I bet many of my readers are faced with the same dilemma, and they all have my sympathy. Suffice it to say, that we'll be talking a lot about the only two safe subjects there are, sports and the weather.

I will learn that my brother who runs a trading desk at Goldman Sachs has put his new Bentley Turbo R into storage. It seems some Occupy Wall Street types have been keying it whenever he parks on the street. There is talk that the firm will go private again to dodge all of the onerous regulation of Dodd-Frank and the Volker rule.

My born again Christian sister is freshly invigorated by the Tea Party wins last year, and is hoping that Michelle Bachman will grab the White House in 2012. I am banned from mentioning President Obama?s name in her house, or I face having to wash the roasting pan by hand. Mitt Romney is also a ?no go?, who she regards as a cult leader.

My gay rights activist sister will be assertively arguing the case for same sex marriage and celebrating the victory in New York. For me, that means conference facilities for my strategy lunches and seminars have suddenly become abundantly available in San Francisco, now that the gay wedding business has decamped for the Big Apple.

A third sister married to a very pleasant fellow in Big Oil will be making the long trip from Borneo, where he is involved in offshore exploration. No doubt I will get a big serving of ?peak oil? theory with my salad, along with arguments on why we should deregulate our way to more offshore energy supplies here. Hopefully, the local headhunters haven?t taken a trophy yet.

Sister no. 4, who is making a killing in commodities in Australia, and is up to her eyeballs in iron ore, will grace us with a rare visit. She has been investing her profits in serial real estate holdings. Every year I tell her to dump everything because a crash is coming, and every year I am proven wrong. But past experience has taught me that the relatives who insist that real estate can never go down eventually end up moving into my basement.

My poor youngest sister, no. 5, took it on the nose in the subprime derivatives market, and is holding on for a comeback. She is the only member of the family I was not able to convince to sell her house in 2005 to duck the coming real estate collapse because she thought the nirvana would last forever. At least that is what her broker told her.

My two Arabic speaking nephews in Army Intelligence will again delight in telling me that they can't talk about their work or they'd have to kill me. They are awaiting orders for forward deployment. I tell them not to forget to cash out after four years, because their language skills will be worth a fortune in the private sector.

Another nephew will be back from his third tour in Iraq with the First Marine Division without a scratch, God willing. I will tell him not to ?re-up? this time around, as there is no future in his business.

My oldest son works for one of the major Wall Street commercial banks. He is bringing a suitcase full of books so he can cram for the series 7 and series 66 exams. Hey dad, what kind of bonds can a Farmers Credit Union issue? Are those triple exempt? How do I calculate the net after tax yield to maturity?

We will all be thankful that my youngest son wasn?t arrested in the latest round of Occupy Wall Street arrests in Manhattan. Until economic growth picks up and Wall Street starts hiring again, he will remain stranded on the fringe, along with half of his recent graduating class.

My oldest daughter?s response to these hard times has been to get a second master?s degree, this time in education. But with the cash starved West coast states continuing to slash budgets, she can only hope for the best, but prepare for the worst.

Reading the riot act to this unruly crowd will be my spritely, but hardnosed mother, who gave up taking any crap from us a long time ago. At 83 can still prop herself up on a cane well enough to knock down 14 out of 15 skeet with a shotgun, although we have had to move her down from a 12 gauge to a 410 because the recoil threatened brittle bones. I am looking forward to my annual Scrabble tournament with her, paging my way through old family photo albums between turns.

My next new research pieces will appear in the Tuesday, November 29 letter. That is, if I survive.

The International Monetary Fund announced a new facility for members to address a short term liquidity crisis. The measure is aimed at beleaguered Europeans girding themselves for a steady worsening of their sovereign debt crisis in the hope of ?breaking the chain of contagion.?? But the measure is more of a squirt gun than a bazooka.

Specifically, the IMF has offered 6 month liquidity of up to 500% of member quotas, and 1-2 year liquidity of 1,000%. This means that governments will have more money to buy back their own bonds to support the credit markets, facilitate interbank lending, or to nationalize banks. The international agency is hoping that this strategy will help halt the decline in European lending and halt the alarming shrinkage of the money supply, all bad for an economy clearly headed into recession.

The problem is that the amounts mentioned, some $345 billion, are a mere drop in the bucket when considering the vast scale of Europe?s problems. You can?t solve a leverage problem with even more leverage. And Europe can?t count on any US participation this time around, as the American mood to bail out anyone these days is greatly diminished.

The news was enough to ignite a one cent pop in the Euro up to $1.352, when it then quickly gave back. That leaves my latest short position in the Euro grinding around slightly profitable levels. Remember, I have been dumping all over this currency since it peaked at $1.60 some 2 1/2 years ago, and again when it topped this year at $1.49.

If we get a nice little post-thanksgiving ?RISK ON? rally, as I expect, then I may have to take some heat on the position, as the Euro will almost certainly rally along with everything else. Those who missed my last trade alert should use this as another opportunity to sell, as the medium term outlook for the continental currency is grim, at best.

It Appears the Bailout is Not Working

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.