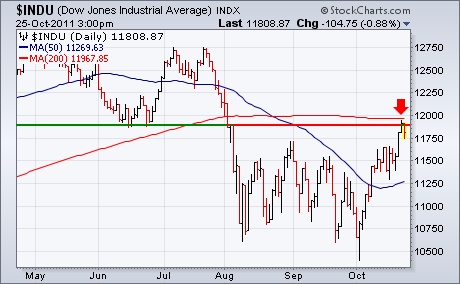

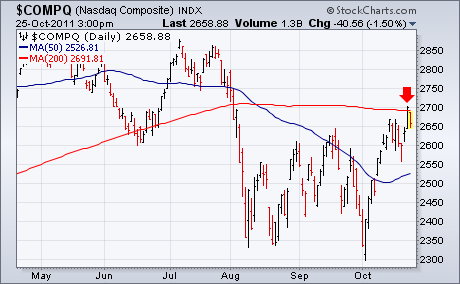

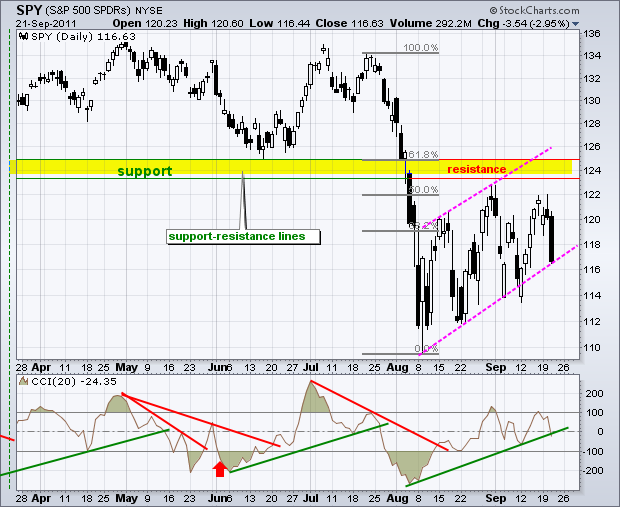

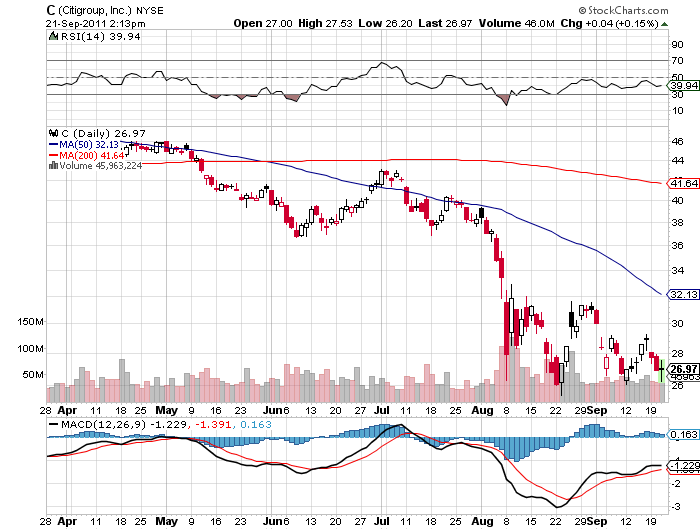

Market observers were stunned, amazed, and gob smacked when trading volumes surged with the 300 point move in the Dow last Thursday. Are retail investors at last making a long awaited return to the stock market? Have they broken with tradition and started buying a bottom, instead of a top?

Not a chance. Much of the volume spike can be traced to the obscure mathematics of credit default swaps. These are in effect insurance policies to guard against a default by individual securities, like Greek, Italian, Spanish, or Portuguese sovereign bonds.

Part of Europe?s triple resolution to its sovereign debt crisis involved an implied guarantee of the value of Greek bonds at 50% of their face value. This means that they will never go to zero, and therefore not meet the contractual definition of ?default?. This renders the value of Credit default swaps on these securities worthless.

The implications of this are huge. For a start, it means that all of the hedge funds that sought to profit from the imminent collapse of Europe through buying credit default swaps have suffered huge losses. We probably won?t hear about these losses until the hedge funds report their year ends in December and January. My bet is that the accounting behind the marks to market will reach new heights of creativity.

More importantly, the banks that issued these swaps have, on paper, just made a ton of money, because their shorts also became worthless. But to realize those windfall profits they have to unwind the risk reducing hedges behind them.

A perfect hedge for a credit default swap on a Greek bond is to sell short the underlying security. But this is easier said than done with illiquid, difficult to borrow paper. Besides, who wants to go short paper with a 30% yield?? The cost of carry would kill you. So the issuing banks crafted a series of clever algorithms based on historic correlations with other lower yielding and more liquid securities, like the bonds of other nearby countries, European equities, and yes, you guessed it, US large cap stocks, far and away the most liquid of these alternatives.

Using the arcane argot of the options world, which is described in ancient Greek letters (no kidding!) the banks had to suddenly adjust for a large change in their gamma, the rate of change on the delta of their positions. And as I?m sure you all know, the delta is the rate of change of an options relative to the underlying stock. For those of you who don?t have a math PhD from MIT, this challenge can only addressed in one way, through buying truckloads of American stocks, and pronto!

So if you client, your boss, or your wife asks you why the market was up, just tell them that hedge funds were rebalancing their gammas to stay delta neutral. If they ask what the hell gamma is, just tell them to look it up on Wikipedia.